Answered step by step

Verified Expert Solution

Question

1 Approved Answer

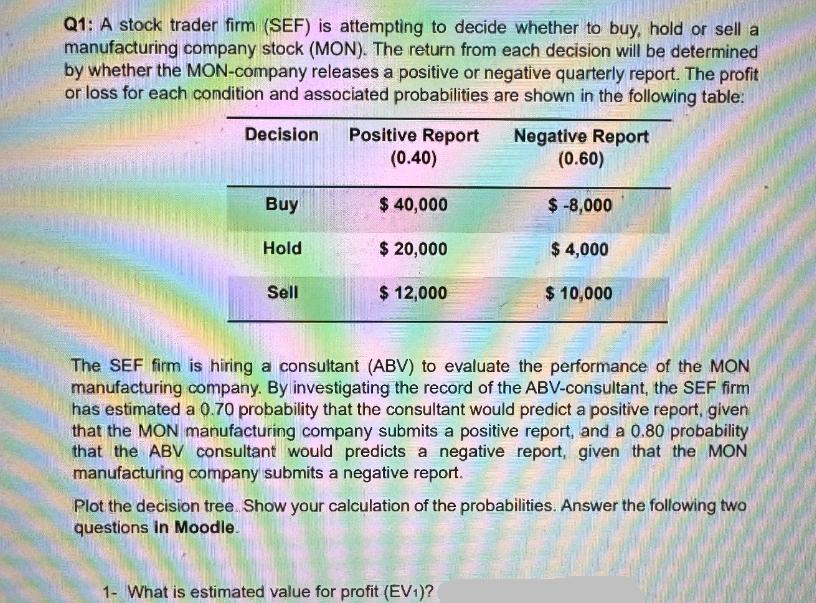

Q1: A stock trader firm (SEF) is attempting to decide whether to buy, hold or sell a manufacturing company stock (MON). The return from

Q1: A stock trader firm (SEF) is attempting to decide whether to buy, hold or sell a manufacturing company stock (MON). The return from each decision will be determined by whether the MON-company releases a positive or negative quarterly report. The profit or loss for each condition and associated probabilities are shown in the following table: Decision Positive Report (0.40) Buy $40,000 Hold $ 20,000 Sell $ 12,000 Negative Report (0.60) $ -8,000 $ 4,000 $10,000 The SEF firm is hiring a consultant (ABV) to evaluate the performance of the MON manufacturing company. By investigating the record of the ABV-consultant, the SEF firm has estimated a 0.70 probability that the consultant would predict a positive report, given that the MON manufacturing company submits a positive report, and a 0.80 probability that the ABV consultant would predicts a negative report, given that the MON manufacturing company submits a negative report. Plot the decision tree. Show your calculation of the probabilities. Answer the following two questions in Moodle. 1- What is estimated value for profit (EV1)? 2- What do you recommend to the SEF firm if the ABV consultant predicts a negative report?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started