Question

Q1. (a) You hold a portfolio with the following securities: Security % of Portfolio Beta Return X Corporation 20% 1.35 14% Y Corporation 35% 0.95

Q1. (a) You hold a portfolio with the following securities:

Security % of Portfolio Beta Return

X Corporation 20% 1.35 14%

Y Corporation 35% 0.95 10%

Z Corporation 45% 0.75 8%

(i) Compute the expected return and beta for the portfolio.

(ii) Interpret the value of the portfolio beta in part (i).

(b) Consider the following expected scenario: There is an 18% probability of a recession with a 2.0% return; there is a 65% probability of a moderate economy with a 9.5% return; there is a 17% probability of a strong economy with a 14.2% return. What is the standard deviation of the investment under this scenario?

(c) The risk free rate of return is currently 5%. The stock of a company, say ABC, has a beta of 1.69 and a required (expected) rate of return of 15.4%. According to CAPM, what is the return on the market portfolio?

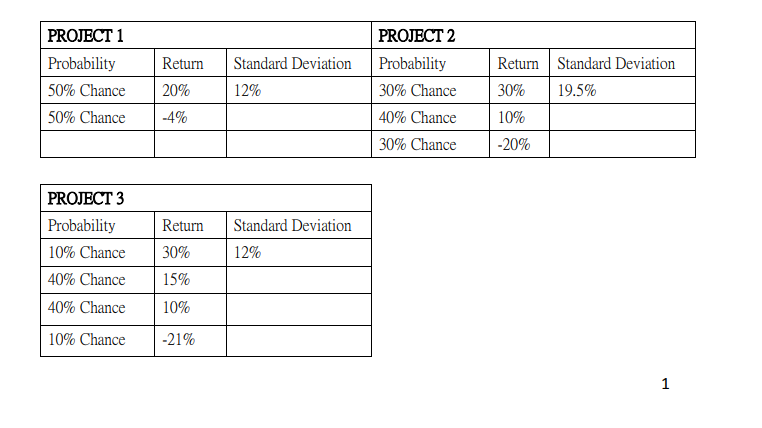

(d) You are going to invest all of your funds in one of three projects with the following distribution of possible returns:

If you are a risk-averse investor, which one should you choose? Explain your answer.

PROJECT 2 PROJECT1 ProbabilityReturn Standard Deviation Probability 50% Chance | 20% 50% Chance | -4% Return Standard Deviation | 30% | 10% |-20% 12% 30% Chance 40% Chance 30% Chance | 19.5% PROJECT3 Probability Return 10% Chance | 30% 40% Chance | 15% 40% Chance | 10% 10% Chance 1-21% Standard Deviation |12%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started