Answered step by step

Verified Expert Solution

Question

1 Approved Answer

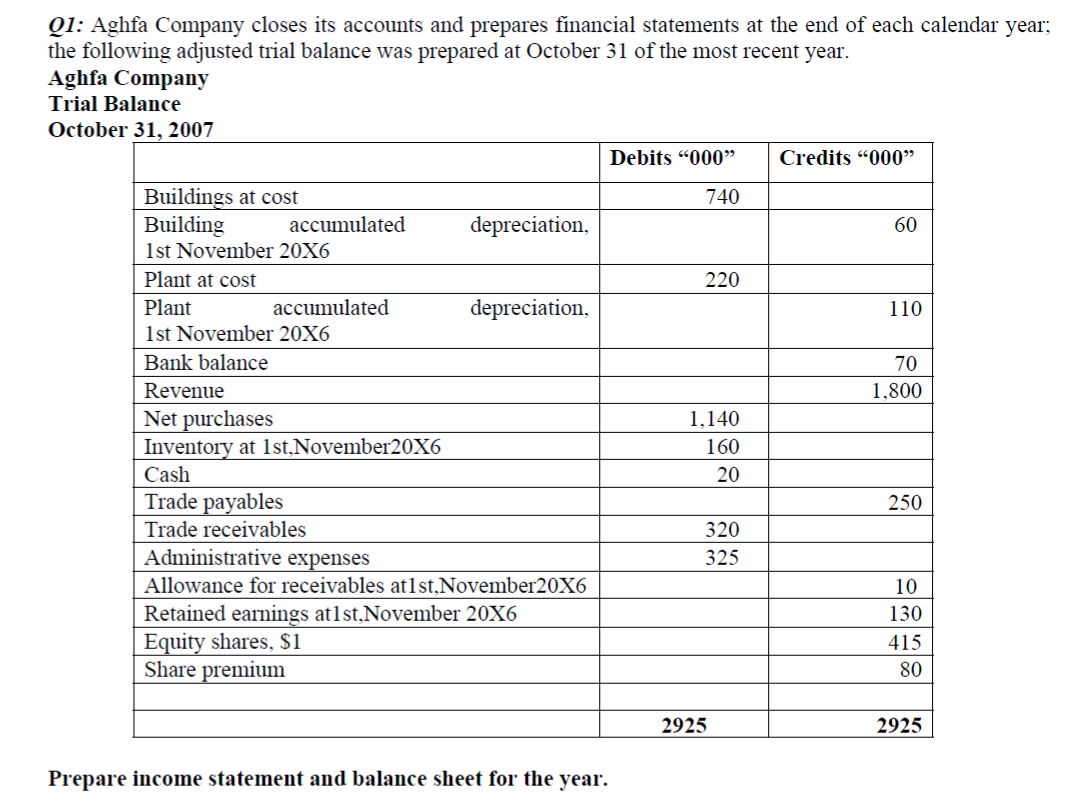

Q1: Aghfa Company closes its accounts and prepares financial statements at the end of each calendar year; the following adjusted trial balance was prepared

Q1: Aghfa Company closes its accounts and prepares financial statements at the end of each calendar year; the following adjusted trial balance was prepared at October 31 of the most recent year. Aghfa Company Trial Balance October 31, 2007 Debits "000" Credits "000" Buildings at cost 740 Building accumulated depreciation, 60 1st November 20X6 Plant at cost 220 Plant accumulated depreciation, 110 1st November 20X6 Bank balance 70 Revenue 1,800 Net purchases 1,140 Inventory at 1st, November 20X6 160 Cash 20 Trade payables 250 Trade receivables 320 Administrative expenses 325 Allowance for receivables at1 st, November20X6 10 Retained earnings at1st,November 20X6 130 Equity shares, $1 415 Share premium 80 2925 Prepare income statement and balance sheet for the year. 2925

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Trading and profit Loss dle of Aghla co for the ended Octob...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started