Answered step by step

Verified Expert Solution

Question

1 Approved Answer

= Q.1. (Ambiguity and Trade) People do not participate in the stock market to the extent that standard theory implies. In this problem you

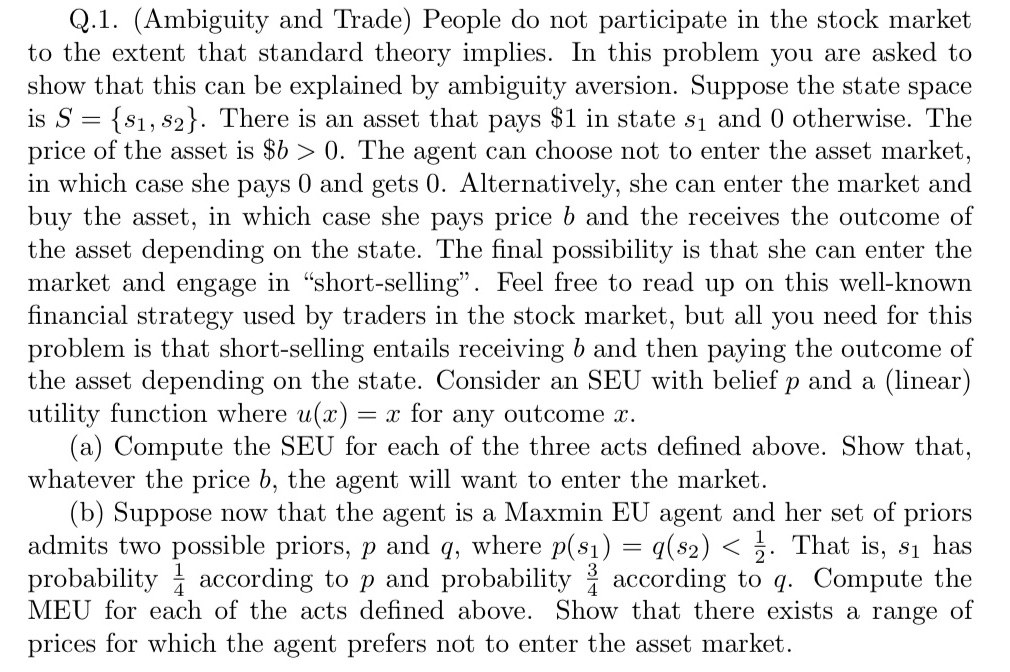

= Q.1. (Ambiguity and Trade) People do not participate in the stock market to the extent that standard theory implies. In this problem you are asked to show that this can be explained by ambiguity aversion. Suppose the state space is S {81, 82}. There is an asset that pays $1 in state s and 0 otherwise. The price of the asset is $b > 0. The agent can choose not to enter the asset market, in which case she pays 0 and gets 0. Alternatively, she can enter the market and buy the asset, in which case she pays price b and the receives the outcome of the asset depending on the state. The final possibility is that she can enter the market and engage in "short-selling". Feel free to read up on this well-known financial strategy used by traders in the stock market, but all you need for this problem is that short-selling entails receiving b and then paying the outcome of the asset depending on the state. Consider an SEU with belief p and a (linear) utility function where u(x) = x for any outcome x. (a) Compute the SEU for each of the three acts defined above. Show that, whatever the price b, the agent will want to enter the market. (b) Suppose now that the agent is a Maxmin EU agent and her set of priors admits two possible priors, p and q, where p(s) = q(82) < 1. That is, 8 has probability according to p and probability according to q. Compute the MEU for each of the acts defined above. Show that there exists a range of prices for which the agent prefers not to enter the asset market.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Ambiguity Aversion and Trade a SEU Agent Act 1 Not Enter SEU u0 1 0 Act 2 Enter and Buy SEU u1 p u0 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started