Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q.1) (BKM Qu. 2): Two bonds have identical times to maturity and coupon rates. One is callable at 105, the other at 110. Which should

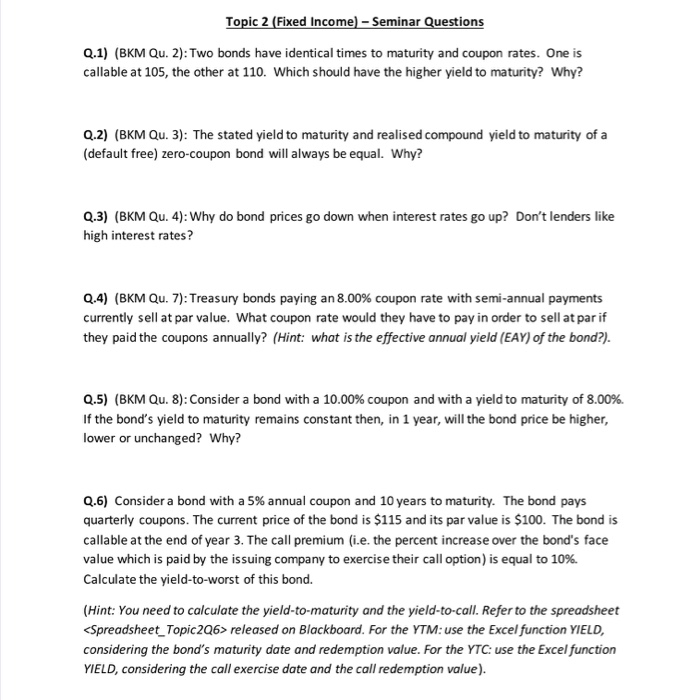

Q.1) (BKM Qu. 2): Two bonds have identical times to maturity and coupon rates. One is callable at 105, the other at 110. Which should have the higher yield to maturity? Why?

Q.2) (BKM Qu. 3): The stated yield to maturity and realised compound yield to maturity of a (default free) zero-coupon bond will always be equal. Why?

Q.3) (BKM Qu. 4): Why do bond prices go down when interest rates go up? Dont lenders like high interest rates?

Q.4) (BKM Qu. 7): Treasury bonds paying an 8.00% coupon rate with semi -annual payments currently sell at par value. What coupon rate would they have to pay in order to sell at par if they paid the coupons annually? (Hint: what is the effective annual yield (EAY) of the bond?).

Q.5) (BKM Qu. 8): Consider a bond with a 10.00% coupon and with a yield to maturity of 8.00%. If the bonds yield to maturity remains constant then, in 1 year, will the bond price be higher, lower or unchanged? Why?

Q.6) Consider a bond with a 5% annual coupon and 10 years to maturity. The bond pays quarterly coupons. The current price of the bond is $115 and its par value is $100. The bond is callable at the end of year 3. The call premium (i.e. the percent increase over the bond's face value which is paid by the issuing company to exercise their call option) is equal to 10%. Calculate the yield-to-worst of this bond.

(Hint: You need to calculate the yield-to-maturity and the yield-to-call. Refer to the spreadsheet released on Blackboard. For the YTM: use the Excel function YIELD, considering the bonds maturity date and redemption value. For the YTC: use the Excel function YIELD, considering the call exercise date and the call redemption value ).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started