Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1: Bond Corp. pays a 9.5 per cent annual coupon; Bond Inc. pays a 7.5 per cent annual coupon; and Bond LLC. pays no coupons.

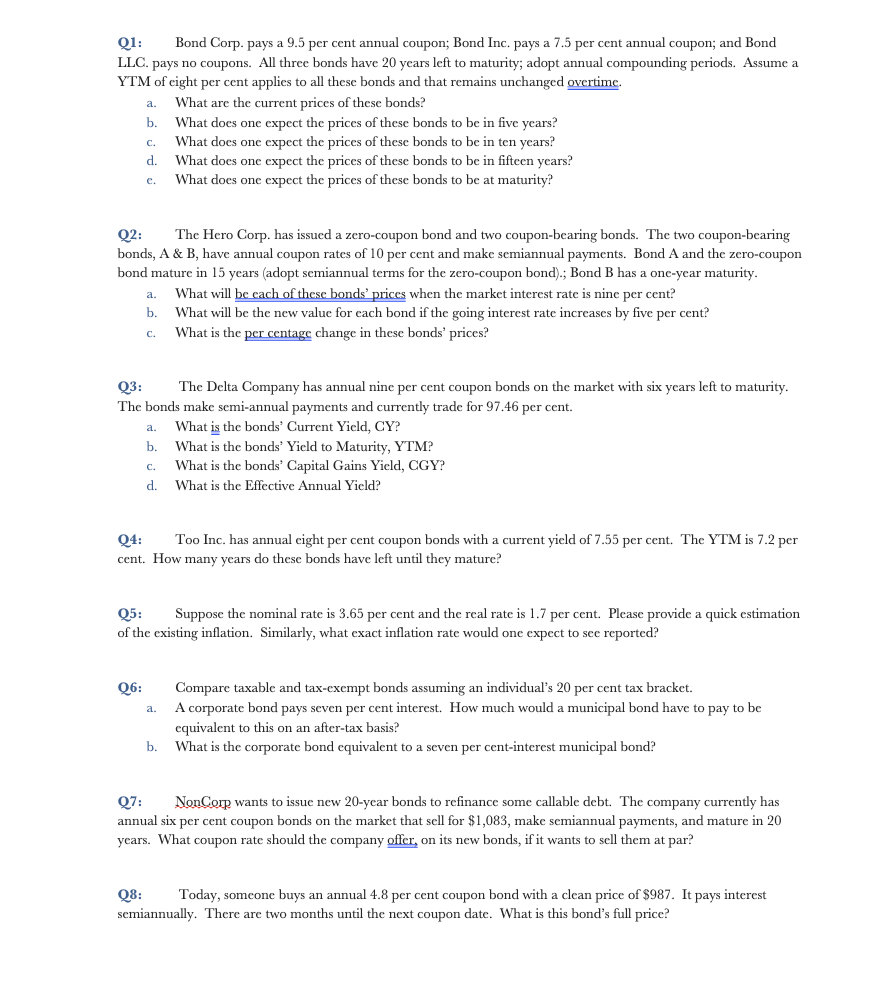

Q1: Bond Corp. pays a 9.5 per cent annual coupon; Bond Inc. pays a 7.5 per cent annual coupon; and Bond LLC. pays no coupons. All three bonds have 20 years left to maturity; adopt annual compounding periods. Assume a YTM of eight per cent applies to all these bonds and that remains unchanged overtime. a. What are the current prices of these bonds? b. What does one expect the prices of these bonds to be in five years? c. What does one expect the prices of these bonds to be in ten years? d. What does one expect the prices of these bonds to be in fifteen years? e. What does one expect the prices of these bonds to be at maturity? Q2: The Hero Corp. has issued a zero-coupon bond and two coupon-bearing bonds. The two coupon-bearing bonds, A \& B, have annual coupon rates of 10 per cent and make semiannual payments. Bond A and the zero-coupon bond mature in 15 years (adopt semiannual terms for the zero-coupon bond).; Bond B has a one-year maturity. a. What will be each of these bonds' prices when the market interest rate is nine per cent? b. What will be the new value for each bond if the going interest rate increases by five per cent? c. What is the per centage change in these bonds' prices? Q3: The Delta Company has annual nine per cent coupon bonds on the market with six years left to maturity. The bonds make semi-annual payments and currently trade for 97.46 per cent. a. What is the bonds' Current Yield, CY? b. What is the bonds' Yield to Maturity, YTM? c. What is the bonds' Capital Gains Yield, CGY? d. What is the Effective Annual Yield? Q4: Too Inc. has annual eight per cent coupon bonds with a current yield of 7.55 per cent. The YTM is 7.2 per cent. How many years do these bonds have left until they mature? Q5: Suppose the nominal rate is 3.65 per cent and the real rate is 1.7 per cent. Please provide a quick estimation of the existing inflation. Similarly, what exact inflation rate would one expect to see reported? Q6: Compare taxable and tax-exempt bonds assuming an individual's 20 per cent tax bracket. a. A corporate bond pays seven per cent interest. How much would a municipal bond have to pay to be equivalent to this on an after-tax basis? b. What is the corporate bond equivalent to a seven per cent-interest municipal bond? Q7: NonCorp wants to issue new 20-year bonds to refinance some callable debt. The company currently has annual six per cent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company offer, on its new bonds, if it wants to sell them at par? Q8: Today, someone buys an annual 4.8 per cent coupon bond with a clean price of $987. It pays interest semiannually. There are two months until the next coupon date. What is this bond's full price

Q1: Bond Corp. pays a 9.5 per cent annual coupon; Bond Inc. pays a 7.5 per cent annual coupon; and Bond LLC. pays no coupons. All three bonds have 20 years left to maturity; adopt annual compounding periods. Assume a YTM of eight per cent applies to all these bonds and that remains unchanged overtime. a. What are the current prices of these bonds? b. What does one expect the prices of these bonds to be in five years? c. What does one expect the prices of these bonds to be in ten years? d. What does one expect the prices of these bonds to be in fifteen years? e. What does one expect the prices of these bonds to be at maturity? Q2: The Hero Corp. has issued a zero-coupon bond and two coupon-bearing bonds. The two coupon-bearing bonds, A \& B, have annual coupon rates of 10 per cent and make semiannual payments. Bond A and the zero-coupon bond mature in 15 years (adopt semiannual terms for the zero-coupon bond).; Bond B has a one-year maturity. a. What will be each of these bonds' prices when the market interest rate is nine per cent? b. What will be the new value for each bond if the going interest rate increases by five per cent? c. What is the per centage change in these bonds' prices? Q3: The Delta Company has annual nine per cent coupon bonds on the market with six years left to maturity. The bonds make semi-annual payments and currently trade for 97.46 per cent. a. What is the bonds' Current Yield, CY? b. What is the bonds' Yield to Maturity, YTM? c. What is the bonds' Capital Gains Yield, CGY? d. What is the Effective Annual Yield? Q4: Too Inc. has annual eight per cent coupon bonds with a current yield of 7.55 per cent. The YTM is 7.2 per cent. How many years do these bonds have left until they mature? Q5: Suppose the nominal rate is 3.65 per cent and the real rate is 1.7 per cent. Please provide a quick estimation of the existing inflation. Similarly, what exact inflation rate would one expect to see reported? Q6: Compare taxable and tax-exempt bonds assuming an individual's 20 per cent tax bracket. a. A corporate bond pays seven per cent interest. How much would a municipal bond have to pay to be equivalent to this on an after-tax basis? b. What is the corporate bond equivalent to a seven per cent-interest municipal bond? Q7: NonCorp wants to issue new 20-year bonds to refinance some callable debt. The company currently has annual six per cent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company offer, on its new bonds, if it wants to sell them at par? Q8: Today, someone buys an annual 4.8 per cent coupon bond with a clean price of $987. It pays interest semiannually. There are two months until the next coupon date. What is this bond's full price Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started