Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1) Cash operations in 2021 was a) 116,500 b) 117,000 c) 115500 d) 114500 Q2) The change in current assets in 2021 was a) Decrease

Q1) Cash operations in 2021 was

a) 116,500

b) 117,000

c) 115500

d) 114500

Q2) The change in current assets in 2021 was

a) Decrease of 2000$

b) Decrease of 61000$

c) Increase of 13000$

d) increase of 2000$

e) None of the above

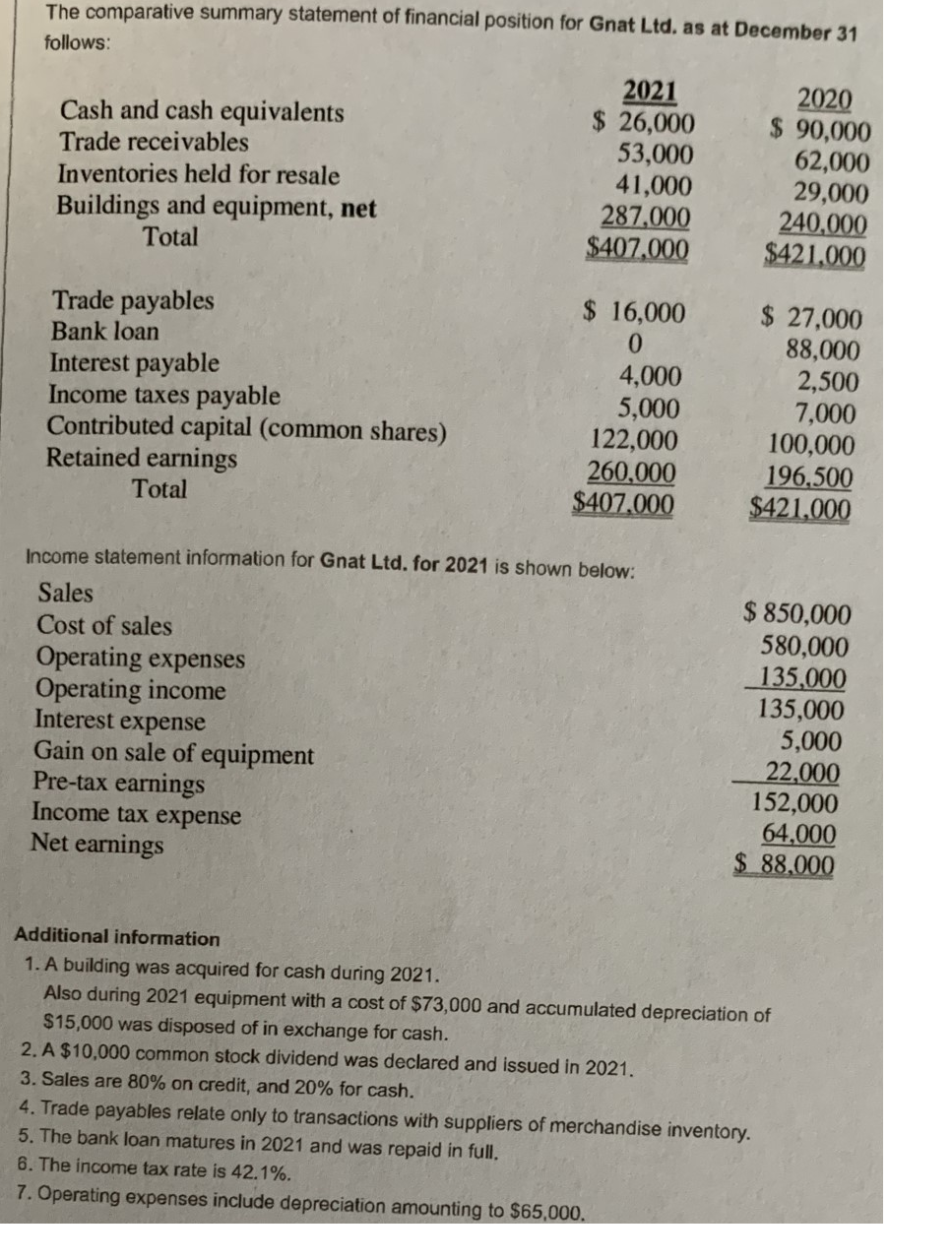

The comparative summary statement of financial position for Gnat Ltd. as at December 31 follows: 2021 2020 Cash and cash equivalents $ 26,000 $ 90,000 Trade receivables 53,000 62,000 Inventories held for resale 41,000 29,000 Buildings and equipment, net 287,000 240,000 Total $407,000 $421.000 Trade payables Bank loan Interest payable Income taxes payable Contributed capital (common shares) Retained earnings Total $ 16,000 0 4,000 5,000 122,000 260,000 $407,000 $ 27,000 88,000 2,500 7,000 100,000 196,500 $421,000 Income statement information for Gnat Ltd. for 2021 is shown below: Sales Cost of sales Operating expenses Operating income Interest expense Gain on sale of equipment Pre-tax earnings Income tax expense Net earnings $ 850,000 580,000 135,000 135,000 5,000 22,000 152,000 64,000 $ 88,000 Additional information 1. A building was acquired for cash during 2021. Also during 2021 equipment with a cost of $73,000 and accumulated depreciation of $15,000 was disposed of in exchange for cash. 2. A $10,000 common stock dividend was declared and issued in 2021. 3. Sales are 80% on credit, and 20% for cash. 4. Trade payables relate only to transactions with suppliers of merchandise inventory. 5. The bank loan matures in 2021 and was repaid in full, 6. The income tax rate is 42.1%. 7. Operating expenses include depreciation amounting to $65,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started