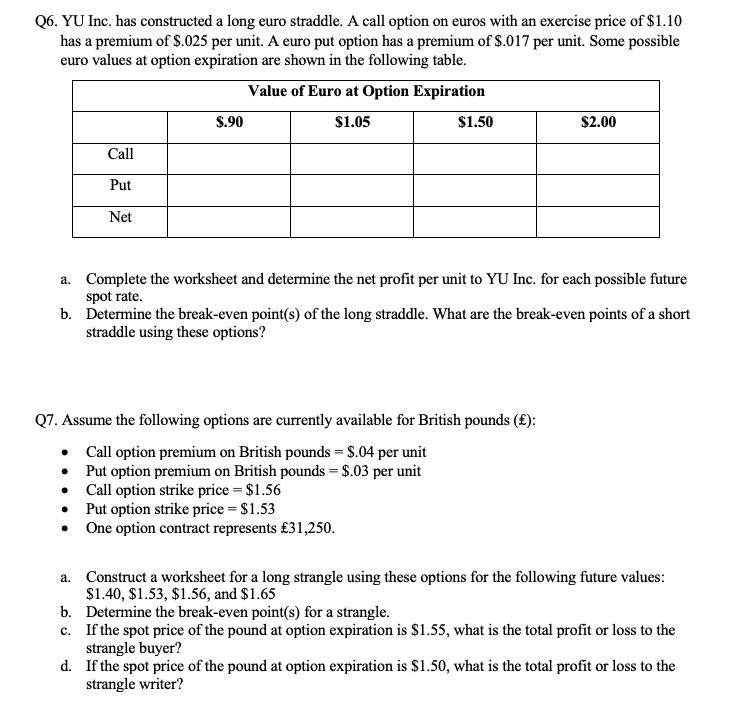

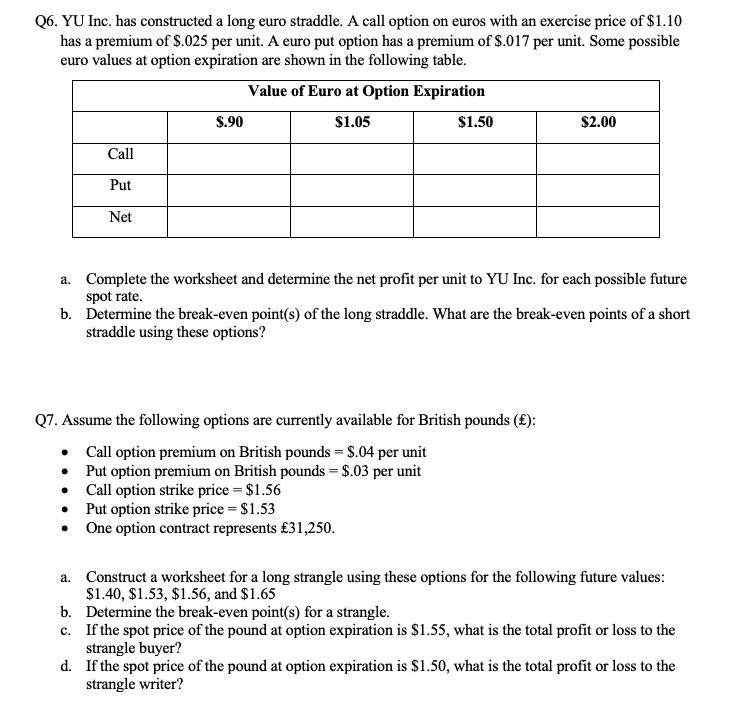

Q1. Compute the forward discount or premium for the Mexican peso whose 90-day forward rate is $.102 and spot rate is $.10. State whether your answer is a discount or premium. Q2. Ghaleb purchased a call option on British pounds for $.02 per unit. The strike price was $1.45 and the spot rate at the time the option was exercised was $1.46. Assume there are 31,250 units in a British pound option. What was ghalebs's net profit on this option? Q3. Hessah purchased a put option on British pounds for $.04 per unit. The strike price was $1.80 and the spot rate at the time the pound option was exercised was $1.59. Assume there are 31,250 units in a British pound option. What was Heesah's net profit on the option? Q4. Faisal sold a call option on Canadian dollars for $.01 per unit. The strike price was $.76, and the spot rate at the time the option was exercised was $.82. Assume Faisal did not obtain Canadian dollars until the option was exercised. Also assume that there are 50,000 units in a Canadian dollar option. What was Faisal's net profit on the call option? Q5. Ahmed sold a put option on Canadian dollars for $.03 per unit. The strike price was $.75, and the spot rate at the time the option was exercised was $.72. Assume Ahmed immediately sold off the Canadian dollars received when the option was exercised. Also assume that there are 50,000 units in a Canadian dollar option. What was Ahmed's net profit on the put option? Q6. YU Inc. has constructed a long euro straddle. A call option on euros with an exercise price of $1.10 has a premium of $.025 per unit. A euro put option has a premium of $.017 per unit. Some possible euro values at option expiration are shown in the following table. Value of Euro at Option Expiration $.90 $1.05 $1.50 $2.00 Call Put Net a. Complete the worksheet and determine the net profit per unit to YU Inc. for each possible future spot rate. b. Determine the break-even point(s) of the long straddle. What are the break-even points of a short straddle using these options? Q7. Assume the following options are currently available for British pounds (): Call option premium on British pounds = $.04 per unit Put option premium on British pounds = $.03 per unit Call option strike price = $1.56 Put option strike price = $1.53 One option contract represents 31,250. a. Construct a worksheet for a long strangle using these options for the following future values: $1.40, $1.53, $1.56, and $1.65 b. Determine the break-even point(s) for a strangle. c. If the spot price of the pound at option expiration is $1.55, what is the total profit or loss to the strangle buyer? d. If the spot price of the pound at option expiration is $1.50, what is the total profit or loss to the strangle writer