Question

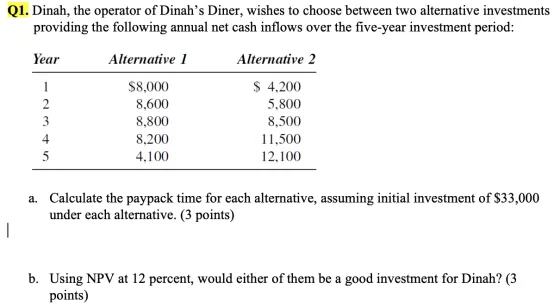

Q1. Dinah, the operator of Dinah's Diner, wishes to choose between two alternative investments providing the following annual net cash inflows over the five-year

Q1. Dinah, the operator of Dinah's Diner, wishes to choose between two alternative investments providing the following annual net cash inflows over the five-year investment period: Year Alternative 2 $ 4,200 5,800 8,500 11,500 12,100 12 3 4 5 Alternative 1 $8,000 8,600 8,800 8,200 4,100 a. Calculate the paypack time for each alternative, assuming initial investment of $33,000 under each alternative. (3 points) b. Using NPV at 12 percent, would either of them be a good investment for Dinah? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainly To calculate the NPV for each alternative using a discount rate of 12 percent ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial economics applications strategy and tactics

Authors: James r. mcguigan, R. Charles Moyer, frederick h. deb harris

12th Edition

9781133008071, 1439079234, 1133008070, 978-1439079232

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App