Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 Fast Solution John Wise, a sole trader and computer science graduate, wants to expand his IT consultancy business called Fast Solutions. John operates

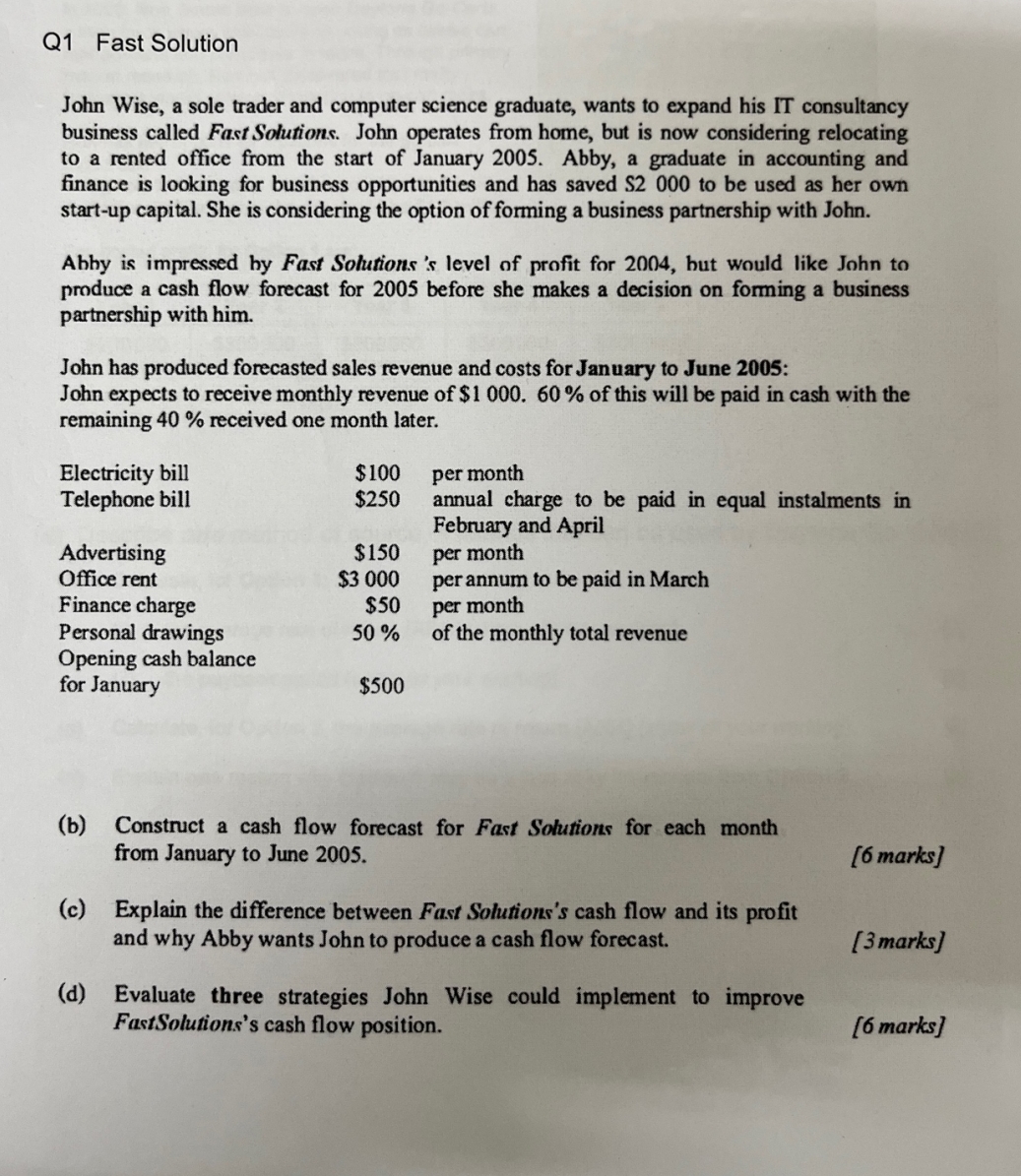

Q1 Fast Solution John Wise, a sole trader and computer science graduate, wants to expand his IT consultancy business called Fast Solutions. John operates from home, but is now considering relocating to a rented office from the start of January 2005. Abby, a graduate in accounting and finance is looking for business opportunities and has saved S2 000 to be used as her own start-up capital. She is considering the option of forming a business partnership with John. Abby is impressed by Fast Solutions 's level of profit for 2004, but would like John to produce a cash flow forecast for 2005 before she makes a decision on forming a business partnership with him. John has produced forecasted sales revenue and costs for January to June 2005: John expects to receive monthly revenue of $1000. 60% of this will be paid in cash with the remaining 40 % received one month later. Electricity bill $100 per month Telephone bill $250 Advertising $150 per month Office rent $3.000 annual charge to be paid in equal instalments in February and April per annum to be paid in March Finance charge $50 per month Personal drawings 50% of the monthly total revenue Opening cash balance for January $500 (b) Construct a cash flow forecast for Fast Solutions for each month from January to June 2005. [6 marks] (c) Explain the difference between Fast Solutions's cash flow and its profit and why Abby wants John to produce a cash flow forecast. [3 marks] (d) Evaluate three strategies John Wise could implement to improve FastSolutions's cash flow position. [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started