Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1. Following are the current details of Ruby Ltd. Financial Leverage Operating Leverage Variable cost to Sales ratio The Tax rate applicable to the

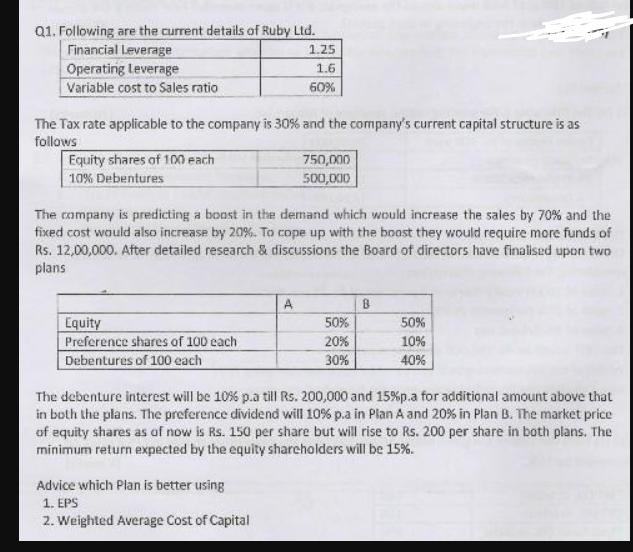

Q1. Following are the current details of Ruby Ltd. Financial Leverage Operating Leverage Variable cost to Sales ratio The Tax rate applicable to the company is 30% and the company's current capital structure is as follows Equity shares of 100 each 10% Debentures Equity Preference shares of 100 each Debentures of 100 each 1.25 1.6 60% The company is predicting a boost in the demand which would increase the sales by 70% and the fixed cost would also increase by 20%. To cope up with the boost they would require more funds of Rs. 12,00,000. After detailed research & discussions the Board of directors have finalised upon two plans A Advice which Plan is better using 1. EPS 2. Weighted Average Cost of Capital 750,000 500,000 50% 20% 30% B 50% 10% 40% The debenture interest will be 10% p.a till Rs. 200,000 and 15% p.a for additional amount above that in both the plans. The preference dividend will 10% p.a in Plan A and 20% in Plan B. The market price of equity shares as of now is Rs. 150 per share but will rise to Rs. 200 per share in both plans. The minimum return expected by the equity shareholders will be 15%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

it is not possible to definitively say which plan is better using EPS and Weighted Average Cost of C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started