Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 https://www.chegg.com/homework-help/questions-and-answers/applying-dividend-discount-model-determine-relevance-ril-s-dividend-policy-investors-behav-q65504502 Q2 https://www.chegg.com/homework-help/questions-and-answers/question-1-analyze-dividend-policy-ril-shareholders-wealth-maximization-advise-optimal-div-q65174039 Link as well as screenshots are provided.. Please solve these. Question: Applying the dividend discount model, determine the relev... Applying the

Q1

https://www.chegg.com/homework-help/questions-and-answers/applying-dividend-discount-model-determine-relevance-ril-s-dividend-policy-investors-behav-q65504502

Q2

https://www.chegg.com/homework-help/questions-and-answers/question-1-analyze-dividend-policy-ril-shareholders-wealth-maximization-advise-optimal-div-q65174039

Link as well as screenshots are provided.. Please solve these.

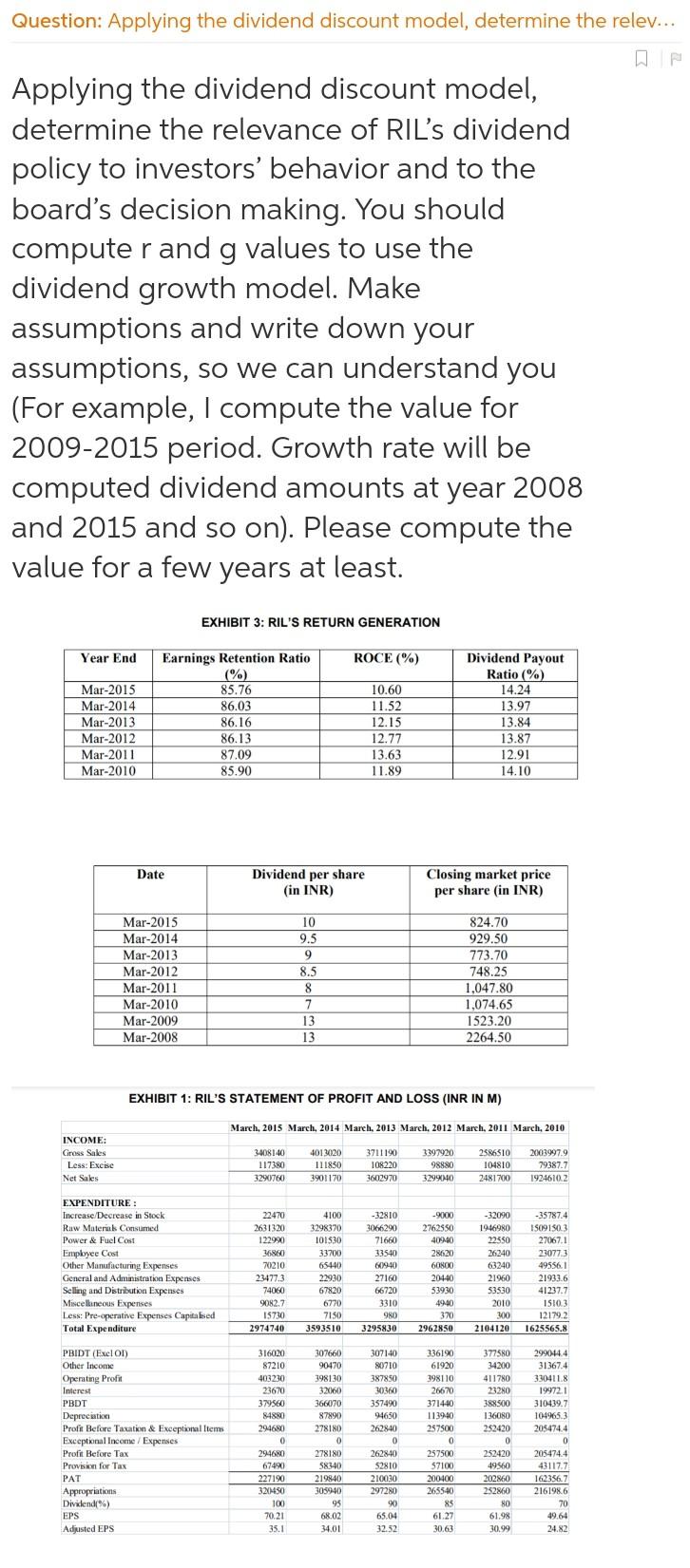

Question: Applying the dividend discount model, determine the relev... Applying the dividend discount model, determine the relevance of RIL's dividend policy to investors' behavior and to the board's decision making. You should computer and g values to use the lg dividend growth model. Make assumptions and write down your assumptions, so we can understand you (For example, I compute the value for 2009-2015 period. Growth rate will be computed dividend amounts at year 2008 and 2015 and so on). Please compute the value for a few years at least. EXHIBIT 3: RIL'S RETURN GENERATION Year End ROCE (%) Mar-2015 Mar-2014 Mar-2013 Mar-2012 Mar-2011 Mar-2010 Earnings Retention Ratio (%) 85.76 86.03 86.16 86.13 87.09 85.90 10.60 11.52 12.15 12.77 13.63 11.89 Dividend Payout Ratio (%) 14.24 13.97 13.84 13.87 12.91 14.10 Date Dividend per share (in INR) Closing market price per share (in INR) Mar-2015 Mar-2014 Mar-2013 Mar-2012 Mar-2011 Mar-2010 Mar-2009 Mar-2008 10 9.5 9 8.5 8 7 13 13 824.70 929.50 773.70 748.25 1,047.80 1,074.65 1523,20 2264.50 EXHIBIT 1: RIL'S STATEMENT OF PROFIT AND LOSS (INR IN M) March, 2015 March, 2014 March, 2013 March, 2012 March, 2011 March, 2010 , INCOME: Gross Sales Less: Excise Net Sales 3408140 117380 3290760 4012020 111830 3901170 3711190 108220 3602970 3397920 98880 329940 2526510 104810 2481700 2003997,9 79387.7 1924610.2 EXPENDITURE : Increase/Decrease in Stock Raw Materik Consumed Power & Fuel Cost Employee Cost Other Manufacturing Expenses General and Administration Expenses Selling and Distribution Expenses Miscellaneous Expenses Less: Pre-operative Expenses Capitalised Total Expenditure 22470 2631320 122990 36860 70210 23477.3 74060 9082.7 15730 2974740 4100 3298370 101530 33700 6540 22930 67820 6770 71 SO 3593510 -32810 3066290 71660 33540 0940 27160 66720 3310 980 3295830 -9000 2762550 40940 28620 60800 20440 53930 4940 370 2962850 -32090 1946980 22350 26240 63240 21960 53530 2010 200 2104120 -35787.4 1509150.3 27067.1 230773 49556.1 21933.6 41237.7 15103 121792 1625565.8 PBIDT (Exel Ol) Other Income Operating Profil Interest PBDT Deprecat Profit Before Taxation & Exceptional Items Exceptional Income / Expenses Profit Before Tax Provision for Tax PAT Appropriations Dividend%) EPS Adjusted EPS 316020 87210 403230 23670 379560 84880 294680 0 29460 67490 227190 321450 100 70,21 35.1 307660 90470 398130 320/60 366070 87890 278180 0 278180 58340 219840 305910 95 307140 80710 387850 30360 357490 94650 262840 0 262840 52810 210030 297280 90 65.04 32.52 336190 61920 398110 26670 371440 113940 257500 0 257500 57100 200400 2655-40 85 61.27 30.63 377580 34200 411780 23280 388500 136080 2$2420 0 252420 49560 202860 252860 80 61.98 30.99 29914.4 31367.4 330411.8 19972.1 310439.7 104965.3 2054744 0 2054744 43117.7 162356.7 2161986 70 49.64 24.82 68.02 34.01 ptimal dividend policy to ensure shareholde Ith is maximized. Please discuss following stions in your response: - What type of divide cy has RIL been following? (Constant payout stant dividend per share, or long-run residua cy?) The constant payout approach is a divid tegy in which a company determines a level dend payout and applies this to net income. e, a certain percentage of profits is paid to th eholders every year. But when profits declin eholders may become concerned, as the stant dividend payouts may affect the stock e. Companies prefer the constant payout pol ause it indicates their ability to pay dividends as "smooth their dividend payments over tim y to maintain a stable dividend payout ratio. long-run residual policy is intended to build t in shareholders by offering to pay a regular increasing, dividend; hence it signals to eholders that the company looks out for the ncial well-being. Companies first anticipate t licable factors on the dividend size for a give od, typically five years, and then decide on th but ratio. Dividends over the years may vary, as the target payout ratio is in line with the plute income over the same period. This poli t suitable for companies experiencing uated earnings. In the constant dividend pe ce strategy, companies pay a steady dividenc share regardless of their earnings per share, change in their net profit will not influence th dend paid to shareholders. Companies that mal development potential and are expectin le earnings in the future adopt this type of cy. - Does RIL look after its shareholder' rests? How? - What factors should a compar - Question 1: Analyze the dividend policy of RIL for shareholders' wealth maximization and advise on an optimal dividend policy to ensure shareholders' wealth is maximized. Please discuss following questions in your response: - What type of dividend policy has RIL been following? (Constant payout, constant dividend per share, or long-run residual policy?) The constant payout approach is a dividend strategy in which a company determines a level of dividend payout and applies this to net income. Here, a certain percentage of profits is paid to the shareholders every year. But when profits decline, shareholders may become concerned, as the constant dividend payouts may affect the stock price. Companies prefer the constant payout policy because it indicates their ability to pay dividends. Firms "smooth their dividend payments over time to try to maintain a stable dividend payout ratio. The long-run residual policy is intended to build trust in shareholders by offering to pay a regular, or even increasing, dividend; hence it signals to shareholders that the company looks out for their financial well-being. Companies first anticipate the applicable factors on the dividend size for a given period, typically five years, and then decide on the payout ratio. Dividends over the years may vary, as long as the target payout ratio is in line with the absolute income over the same period. This policy is most suitable for companies experiencing fluctuated earnings. In the constant dividend per share strategy, companies pay a steady dividend per share regardless of their earnings per share, i.e., any change in their net profit will not influence the dividend paid to shareholders. Companies that have minimal development potential and are expecting stable earnings in the future adopt this type of policy. - Does RIL look after its shareholder' interests? How? - What factors should a company consider when planning its investment budget? Question 2: Study the impact of RILs dividend policy on its share price performance and discuss the relevance of dividend theory for RIL. Please discuss following questions in your response: - What factors affect the market price of a company? - Is RIL's market performance guided by its dividend policy or by other factors as well? - In the long run, what quantum effect does a dividend policy have on a company's share price? Do you think "dividend irrelevance theory" is evident in RIL's case? Question 3: Evaluate the retention policy of RIL for investments and its return on capital employed and determine their impact on RIL's shareholders' investment behavior. Please discuss following questions in your response: - How does a company decide its capital retention policy? What factors does it consider? - Is a higher capital retention rate a motivation for investors? - Does capital return generation affect stock pricing? Question 4: Applying the dividend discount model, determine the relevance of RIL's dividend policy to investors' behavior and to the board's decision making. Question: Applying the dividend discount model, determine the relev... Applying the dividend discount model, determine the relevance of RIL's dividend policy to investors' behavior and to the board's decision making. You should computer and g values to use the lg dividend growth model. Make assumptions and write down your assumptions, so we can understand you (For example, I compute the value for 2009-2015 period. Growth rate will be computed dividend amounts at year 2008 and 2015 and so on). Please compute the value for a few years at least. EXHIBIT 3: RIL'S RETURN GENERATION Year End ROCE (%) Mar-2015 Mar-2014 Mar-2013 Mar-2012 Mar-2011 Mar-2010 Earnings Retention Ratio (%) 85.76 86.03 86.16 86.13 87.09 85.90 10.60 11.52 12.15 12.77 13.63 11.89 Dividend Payout Ratio (%) 14.24 13.97 13.84 13.87 12.91 14.10 Date Dividend per share (in INR) Closing market price per share (in INR) Mar-2015 Mar-2014 Mar-2013 Mar-2012 Mar-2011 Mar-2010 Mar-2009 Mar-2008 10 9.5 9 8.5 8 7 13 13 824.70 929.50 773.70 748.25 1,047.80 1,074.65 1523,20 2264.50 EXHIBIT 1: RIL'S STATEMENT OF PROFIT AND LOSS (INR IN M) March, 2015 March, 2014 March, 2013 March, 2012 March, 2011 March, 2010 , INCOME: Gross Sales Less: Excise Net Sales 3408140 117380 3290760 4012020 111830 3901170 3711190 108220 3602970 3397920 98880 329940 2526510 104810 2481700 2003997,9 79387.7 1924610.2 EXPENDITURE : Increase/Decrease in Stock Raw Materik Consumed Power & Fuel Cost Employee Cost Other Manufacturing Expenses General and Administration Expenses Selling and Distribution Expenses Miscellaneous Expenses Less: Pre-operative Expenses Capitalised Total Expenditure 22470 2631320 122990 36860 70210 23477.3 74060 9082.7 15730 2974740 4100 3298370 101530 33700 6540 22930 67820 6770 71 SO 3593510 -32810 3066290 71660 33540 0940 27160 66720 3310 980 3295830 -9000 2762550 40940 28620 60800 20440 53930 4940 370 2962850 -32090 1946980 22350 26240 63240 21960 53530 2010 200 2104120 -35787.4 1509150.3 27067.1 230773 49556.1 21933.6 41237.7 15103 121792 1625565.8 PBIDT (Exel Ol) Other Income Operating Profil Interest PBDT Deprecat Profit Before Taxation & Exceptional Items Exceptional Income / Expenses Profit Before Tax Provision for Tax PAT Appropriations Dividend%) EPS Adjusted EPS 316020 87210 403230 23670 379560 84880 294680 0 29460 67490 227190 321450 100 70,21 35.1 307660 90470 398130 320/60 366070 87890 278180 0 278180 58340 219840 305910 95 307140 80710 387850 30360 357490 94650 262840 0 262840 52810 210030 297280 90 65.04 32.52 336190 61920 398110 26670 371440 113940 257500 0 257500 57100 200400 2655-40 85 61.27 30.63 377580 34200 411780 23280 388500 136080 2$2420 0 252420 49560 202860 252860 80 61.98 30.99 29914.4 31367.4 330411.8 19972.1 310439.7 104965.3 2054744 0 2054744 43117.7 162356.7 2161986 70 49.64 24.82 68.02 34.01 ptimal dividend policy to ensure shareholde Ith is maximized. Please discuss following stions in your response: - What type of divide cy has RIL been following? (Constant payout stant dividend per share, or long-run residua cy?) The constant payout approach is a divid tegy in which a company determines a level dend payout and applies this to net income. e, a certain percentage of profits is paid to th eholders every year. But when profits declin eholders may become concerned, as the stant dividend payouts may affect the stock e. Companies prefer the constant payout pol ause it indicates their ability to pay dividends as "smooth their dividend payments over tim y to maintain a stable dividend payout ratio. long-run residual policy is intended to build t in shareholders by offering to pay a regular increasing, dividend; hence it signals to eholders that the company looks out for the ncial well-being. Companies first anticipate t licable factors on the dividend size for a give od, typically five years, and then decide on th but ratio. Dividends over the years may vary, as the target payout ratio is in line with the plute income over the same period. This poli t suitable for companies experiencing uated earnings. In the constant dividend pe ce strategy, companies pay a steady dividenc share regardless of their earnings per share, change in their net profit will not influence th dend paid to shareholders. Companies that mal development potential and are expectin le earnings in the future adopt this type of cy. - Does RIL look after its shareholder' rests? How? - What factors should a compar - Question 1: Analyze the dividend policy of RIL for shareholders' wealth maximization and advise on an optimal dividend policy to ensure shareholders' wealth is maximized. Please discuss following questions in your response: - What type of dividend policy has RIL been following? (Constant payout, constant dividend per share, or long-run residual policy?) The constant payout approach is a dividend strategy in which a company determines a level of dividend payout and applies this to net income. Here, a certain percentage of profits is paid to the shareholders every year. But when profits decline, shareholders may become concerned, as the constant dividend payouts may affect the stock price. Companies prefer the constant payout policy because it indicates their ability to pay dividends. Firms "smooth their dividend payments over time to try to maintain a stable dividend payout ratio. The long-run residual policy is intended to build trust in shareholders by offering to pay a regular, or even increasing, dividend; hence it signals to shareholders that the company looks out for their financial well-being. Companies first anticipate the applicable factors on the dividend size for a given period, typically five years, and then decide on the payout ratio. Dividends over the years may vary, as long as the target payout ratio is in line with the absolute income over the same period. This policy is most suitable for companies experiencing fluctuated earnings. In the constant dividend per share strategy, companies pay a steady dividend per share regardless of their earnings per share, i.e., any change in their net profit will not influence the dividend paid to shareholders. Companies that have minimal development potential and are expecting stable earnings in the future adopt this type of policy. - Does RIL look after its shareholder' interests? How? - What factors should a company consider when planning its investment budget? Question 2: Study the impact of RILs dividend policy on its share price performance and discuss the relevance of dividend theory for RIL. Please discuss following questions in your response: - What factors affect the market price of a company? - Is RIL's market performance guided by its dividend policy or by other factors as well? - In the long run, what quantum effect does a dividend policy have on a company's share price? Do you think "dividend irrelevance theory" is evident in RIL's case? Question 3: Evaluate the retention policy of RIL for investments and its return on capital employed and determine their impact on RIL's shareholders' investment behavior. Please discuss following questions in your response: - How does a company decide its capital retention policy? What factors does it consider? - Is a higher capital retention rate a motivation for investors? - Does capital return generation affect stock pricing? Question 4: Applying the dividend discount model, determine the relevance of RIL's dividend policy to investors' behavior and to the board's decision makingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started