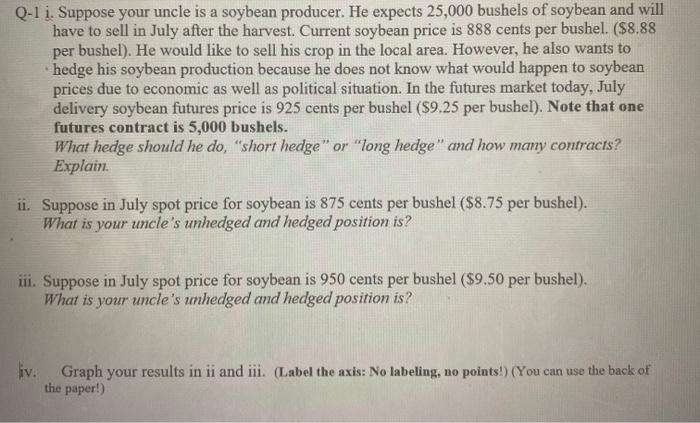

Q-1 i. Suppose your uncle is a soybean producer. He expects 25,000 bushels of soybean and will have to sell in July after the harvest. Current soybean price is 888 cents per bushel. ($8.88 per bushel). He would like to sell his crop in the local area. However, he also wants to hedge his soybean production because he does not know what would happen to soybean prices due to economic as well as political situation. In the futures market today, July delivery soybean futures price is 925 cents per bushel ($9.25 per bushel). Note that one futures contract is 5,000 bushels. What hedge should he do, "short hedge" or "long hedge" and how many contracts? Explain ii. Suppose in July spot price for soybean is 875 cents per bushel ($8.75 per bushel). What is your uncle's unhedged and hedged position is? iii. Suppose in July spot price for soybean is 950 cents per bushel ($9.50 per bushel). What is your uncle's unhedged and hedged position is? iv. Graph your results in ii and iii. (Label the axis: No labeling, no points!) (You can use the back of the paper!) Q-1 i. Suppose your uncle is a soybean producer. He expects 25,000 bushels of soybean and will have to sell in July after the harvest. Current soybean price is 888 cents per bushel. ($8.88 per bushel). He would like to sell his crop in the local area. However, he also wants to hedge his soybean production because he does not know what would happen to soybean prices due to economic as well as political situation. In the futures market today, July delivery soybean futures price is 925 cents per bushel ($9.25 per bushel). Note that one futures contract is 5,000 bushels. What hedge should he do, "short hedge" or "long hedge" and how many contracts? Explain ii. Suppose in July spot price for soybean is 875 cents per bushel ($8.75 per bushel). What is your uncle's unhedged and hedged position is? iii. Suppose in July spot price for soybean is 950 cents per bushel ($9.50 per bushel). What is your uncle's unhedged and hedged position is? iv. Graph your results in ii and iii. (Label the axis: No labeling, no points!) (You can use the back of the paper!)