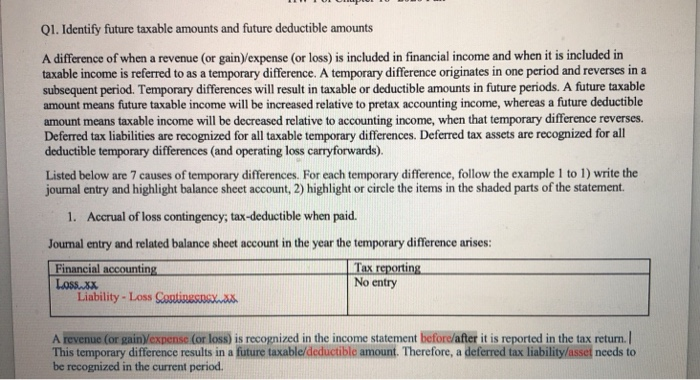

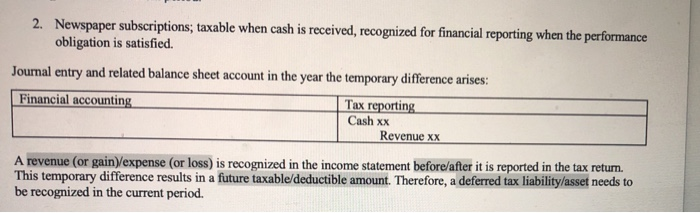

Q1. Identify future taxable amounts and future deductible amounts A difference of when a revenue (or gain)/expense (or loss) is included in financial income and when it is included in taxable income is referred to as a temporary difference. A temporary difference originates in one period and reverses in a subsequent period. Temporary differences will result in taxable or deductible amounts in future periods. A future taxable amount means future taxable income will be increased relative to pretax accounting income, whereas a future deductible amount means taxable income will be decreased relative to accounting income, when that temporary difference reverses. Deferred tax liabilities are recognized for all taxable temporary differences. Deferred tax assets are recognized for all deductible temporary differences and operating loss carryforwards). Listed below are 7 causes of temporary differences. For each temporary difference, follow the example 1 to 1) write the journal entry and highlight balance sheet account, 2) highlight or circle the items in the shaded parts of the statement 1. Accrual of loss contingency, tax-deductible when paid. Journal entry and related balance sheet account in the year the temporary difference arises: Financial accounting Tax reporting Loss.XX No entry Liability - Loss Costinesuusas A revenue (or gain)/expense (or loss) is recognized in the income statement before/after it is reported in the tax return. This temporary difference results in a future taxable/deductible amount. Therefore, a deferred tax liability/asset needs to be recognized in the current period. 2. Newspaper subscriptions; taxable when cash is received, recognized for financial reporting when the performance obligation is satisfied. Journal entry and related balance sheet account in the year the temporary difference arises: Financial accounting Tax reporting Cash xx Revenue xx A revenue (or gain)/expense (or loss) is recognized in the income statement before/after it is reported in the tax retum. This temporary difference results in a future taxable/deductible amount. Therefore, a deferred tax liability/asset needs to be recognized in the current period