Answered step by step

Verified Expert Solution

Question

1 Approved Answer

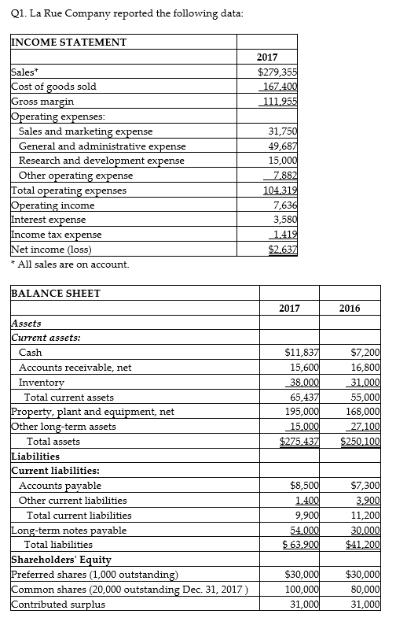

Q1. La Rue Company reported the following data: INCOME STATEMENT Sales* Cost of goods sold Gross margin Operating expenses: Sales and marketing expense General

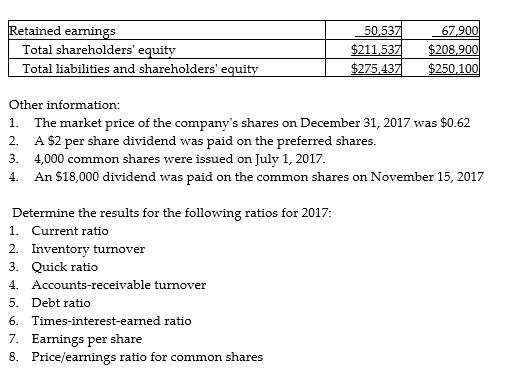

Q1. La Rue Company reported the following data: INCOME STATEMENT Sales* Cost of goods sold Gross margin Operating expenses: Sales and marketing expense General and administrative expense Research and development expense Other operating expense Total operating expenses Operating income Interest expense Income tax expense Net income (loss) All sales are on account. BALANCE SHEET Assets Current assets: Cash Accounts receivable, net Inventory Total current assets Property, plant and equipment, net Other long-term assets Total assets Liabilities Current liabilities: Accounts payable Other current liabilities Total current liabilities Long-term notes payable Total liabilities Shareholders' Equity Preferred shares (1,000 outstanding) Common shares (20,000 outstanding Dec. 31, 2017) Contributed surplus 2017 $279,355 167.400 111.955 31,750 49,687 15,000 7.882 104.319 7,636 3,580 1.419 $2.637 2017 $11,837 15,600 38.000 65,437 195,000 15.000 $275.437 $8,500 1.400 9,900 54.000 $63.900 $30,000 100,000 31,000 2016 $7,200 16,800 31.000 55,000 168,000 27.100 $250,100 $7,300 3,900 11,200 30,000 $41,200 $30,000 80,000 31,000 Retained earnings Total shareholders' equity Total liabilities and shareholders' equity Other information: 1. The market price of the company's shares on December 31, 2017 was $0.62 2. A $2 per share dividend was paid on the preferred shares. Determine the results for the following ratios for 2017: 1. Current ratio 3. 4,000 common shares were issued on July 1, 2017. 4. An $18,000 dividend was paid on the common shares on November 15, 2017 2. Inventory turnover 3. Quick ratio 4. 5. Debt ratio 50,537 $211,537 $275,437 Accounts-receivable turnover 67,900 $208,900 $250,100 6. Times-interest-earned ratio 7. Earnings per share 8. Price/earnings ratio for common shares

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the ratios for 2017 we will use the provided financial data Lets calculate each ratio step by step 1Current ratio Current Ratio Current A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started