Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1. Mike smart founded Dubbo canoe Pty Ltd and later purchased Current Designs Pty Ltd, a company that designs and Manufactures kayaks. The kayak

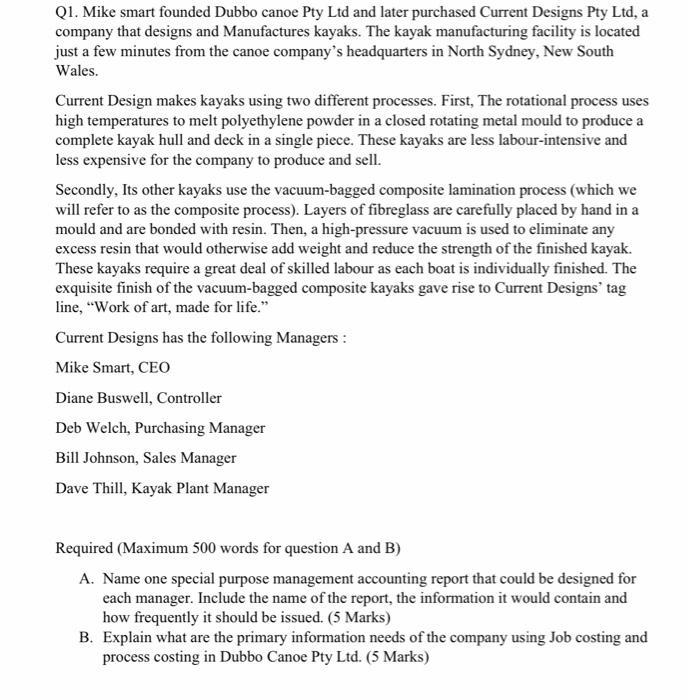

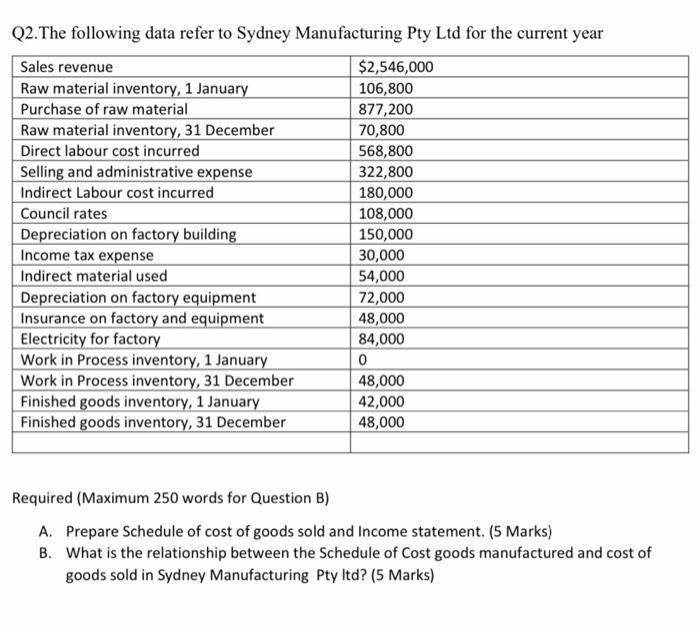

Q1. Mike smart founded Dubbo canoe Pty Ltd and later purchased Current Designs Pty Ltd, a company that designs and Manufactures kayaks. The kayak manufacturing facility is located just a few minutes from the canoe company's headquarters in North Sydney, New South Wales. Current Design makes kayaks using two different processes. First, The rotational process uses high temperatures to melt polyethylene powder in a closed rotating metal mould to produce a complete kayak hull and deck in a single piece. These kayaks are less labour-intensive and less expensive for the company to produce and sell. Secondly, Its other kayaks use the vacuum-bagged composite lamination process (which we will refer to as the composite process). Layers of fibreglass are carefully placed by hand in a mould and are bonded with resin. Then, a high-pressure vacuum is used to eliminate any excess resin that would otherwise add weight and reduce the strength of the finished kayak. These kayaks require a great deal of skilled labour as each boat is individually finished. The exquisite finish of the vacuum-bagged composite kayaks gave rise to Current Designs' tag line, "Work of art, made for life." Current Designs has the following Managers : Mike Smart, CEO Diane Buswell, Controller Deb Welch, Purchasing Manager Bill Johnson, Sales Manager Dave Thill, Kayak Plant Manager Required (Maximum 500 words for question A and B) A. Name one special purpose management accounting report that could be designed for each manager. Include the name of the report, the information it would contain and how frequently it should be issued. (5 Marks) B. Explain what are the primary information needs of the company using Job costing and process costing in Dubbo Canoe Pty Ltd. (5 Marks) Q2.The following data refer to Sydney Manufacturing Pty Ltd for the current year Sales revenue Raw material inventory, 1 January Purchase of raw material Raw material inventory, 31 December $2,546,000 106,800 877,200 70,800 Direct labour cost incurred 568,800 322,800 Selling and administrative expense Indirect Labour cost incurred 180,000 108,000 150,000 30,000 Council rates Depreciation on factory building Income tax expense Indirect material used 54,000 Depreciation on factory equipment Insurance on factory and equipment Electricity for factory Work in Process inventory, 1 January Work in Process inventory, 31 December Finished goods inventory, 1 January Finished goods inventory, 31 December 72,000 48,000 84,000 48,000 42,000 48,000 Required (Maximum 250 words for Question B) A. Prepare Schedule of cost of goods sold and Income statement. (5 Marks) B. What is the relationship between the Schedule of Cost goods manufactured and cost of goods sold in Sydney Manufacturing Pty Itd? (5 Marks)

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Answer A A OfficerinCharge Management Report Mike Smart CEO Performance Report Diane Buswell Fina...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started