Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1. On July 1st, 2021, Verrecchia Manufacturing exchanged machinery A to machinery B with Demski Corp. Verrecchia Manfacturing paid $100,000 additionally to Demski Corp.

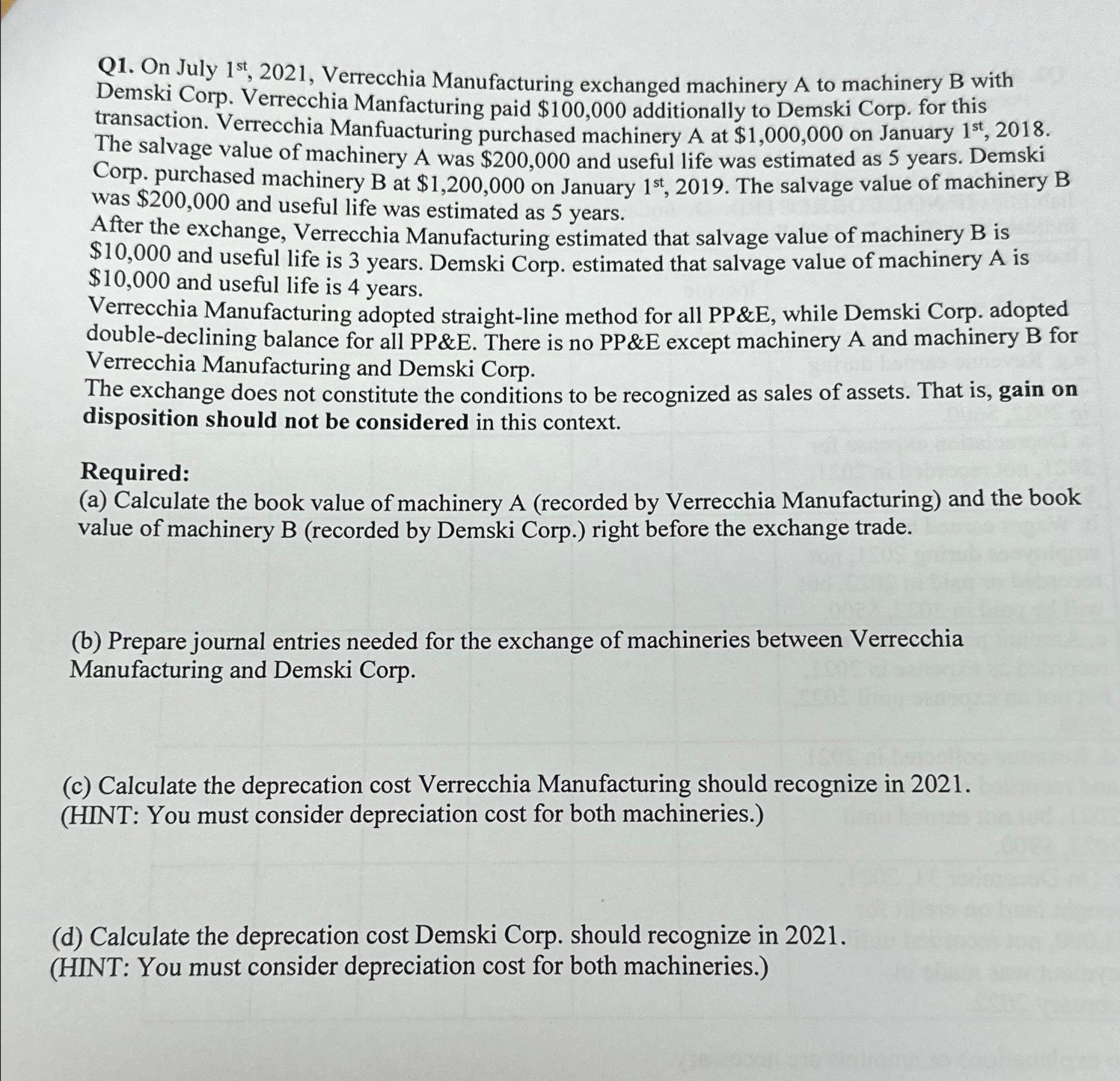

Q1. On July 1st, 2021, Verrecchia Manufacturing exchanged machinery A to machinery B with Demski Corp. Verrecchia Manfacturing paid $100,000 additionally to Demski Corp. for this transaction. Verrecchia Manfuacturing purchased machinery A at $1,000,000 on January 1st, 2018. The salvage value of machinery A was $200,000 and useful life was estimated as 5 years. Demski Corp. purchased machinery B at $1,200,000 on January 1st, 2019. The salvage value of machinery B was $200,000 and useful life was estimated as 5 years. After the exchange, Verrecchia Manufacturing estimated that salvage value of machinery B is $10,000 and useful life is 3 years. Demski Corp. estimated that salvage value of machinery A is $10,000 and useful life is 4 years. Verrecchia Manufacturing adopted straight-line method for all PP&E, while Demski Corp. adopted double-declining balance for all PP&E. There is no PP&E except machinery A and machinery B for Verrecchia Manufacturing and Demski Corp. The exchange does not constitute the conditions to be recognized as sales of assets. That is, gain on disposition should not be considered in this context. Required: (a) Calculate the book value of machinery A (recorded by Verrecchia Manufacturing) and the book value of machinery B (recorded by Demski Corp.) right before the exchange trade. (b) Prepare journal entries needed for the exchange of machineries between Verrecchia Manufacturing and Demski Corp. (c) Calculate the deprecation cost Verrecchia Manufacturing should recognize in 2021. (HINT: You must consider depreciation cost for both machineries.) (d) Calculate the deprecation cost Demski Corp. should recognize in 2021. (HINT: You must consider depreciation cost for both machineries.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculation of book value of machinery A recorded by Verrecchia Manufacturing and machinery B reco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started