Question

Q1. ? ? ? ? On NOV 1, 03 a firm agrees to borrow $20 million from DEC 1 2003 through DEC 1 2004 at

Q1. ? ? ? ? On NOV 1, 03 a firm agrees to borrow $20 million from DEC 1 2003 through DEC 1 2004 at LIBOR + 70bps. Interest will be paid quarterly on MAR 1; JUN 1; SEP 1 and DEC 1, 2004.

1.1 On NOV 1, 03: LIBOR = 6.50% and the Eurodollar IMM index levels are: 90.02 for DEC 2003; 90.50 for MAR 2004; 91.11 for JUN 2004 and 91.54 for SEP 2004.

? ? ? ? ? ? ? ? Using a time table, describe the hedge the firm will open on NOV 1.

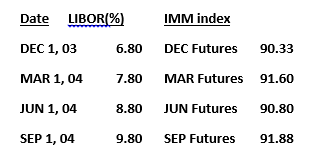

The following are LIBOR rates and IMM indexes that have materialized during the ? ? ? ? year:

Use the same time table you used in 1.1 in order to show the activities and cash flows in the spot and futures markets during the year. Show the interest payments as well as the gain/loss from the futures trading. Compare the Average loan rate with and without the hedge?

Date LIBOR (%) DEC 1, 03 MAR 1, 04 JUN 1, 04 SEP 1, 04 6.80 7.80 8.80 9.80 IMM index DEC Futures MAR Futures JUN Futures SEP Futures 90.33 91.60 90.80 91.88

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Solution Important things to know before getting into the answer 1 Eurodollar futures are expressed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started