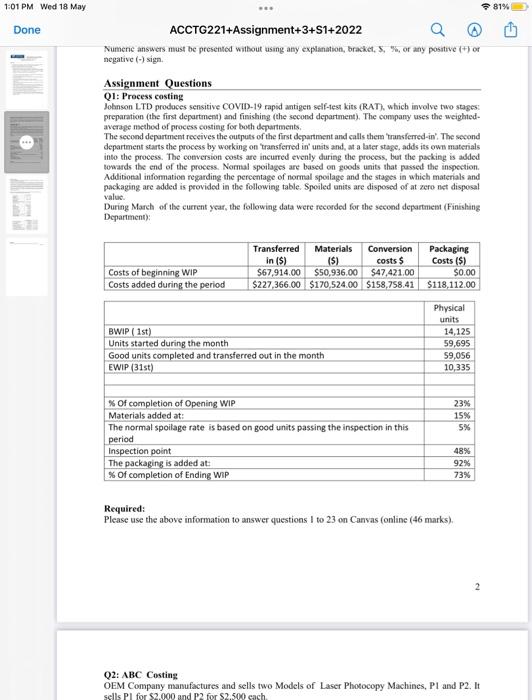

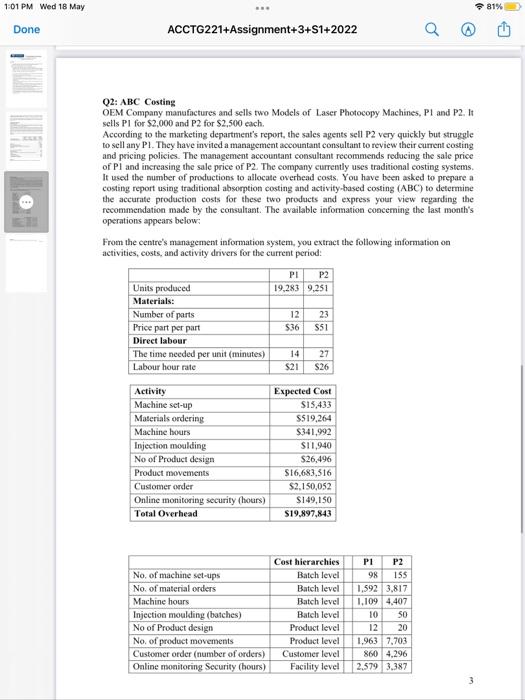

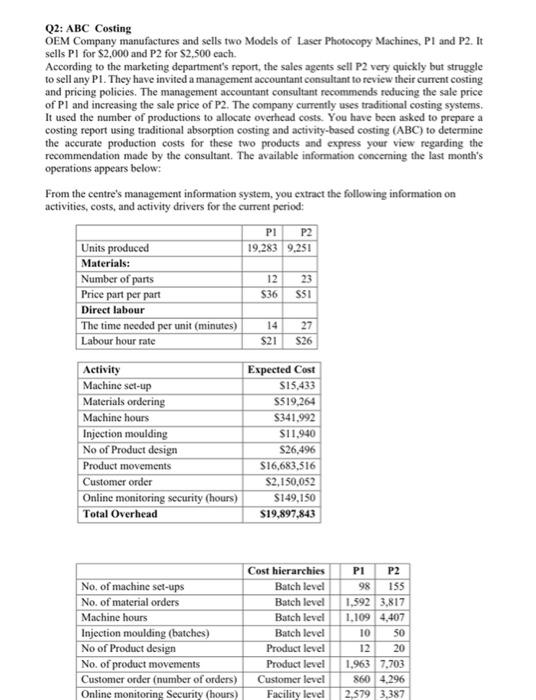

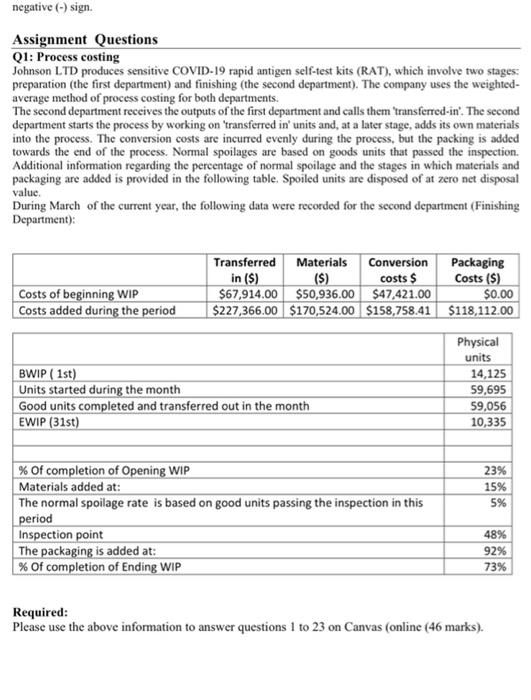

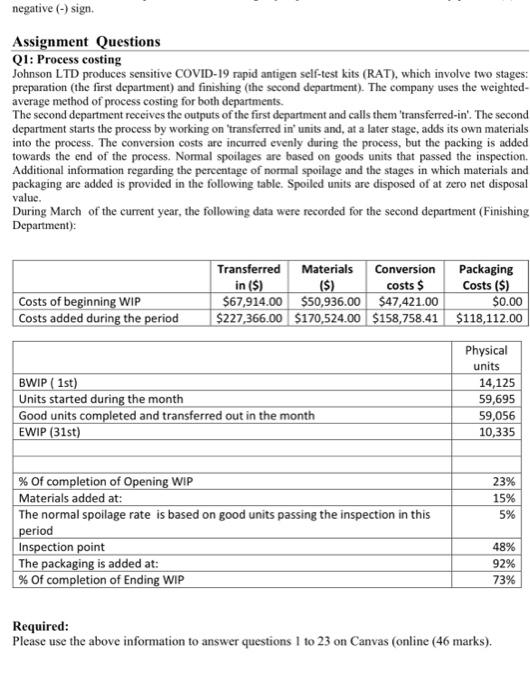

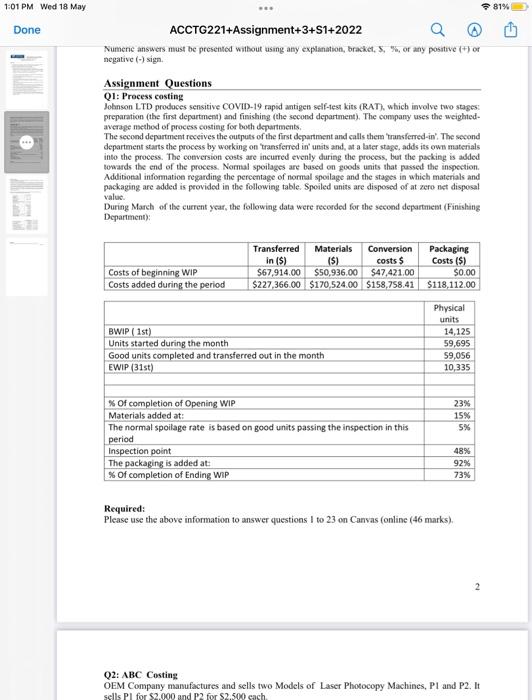

Q1: Process costing

Johnson LTD produces sensitive COVID-19 rapid antigen self-test kits (RAT), which involve two stages: preparation (the first department) and finishing (the second department). The company uses the weighted- average method of process costing for both departments.

The second department receives the outputs of the first department and calls them 'transferred-in'. The second department starts the process by working on 'transferred in' units and, at a later stage, adds its own materials into the process. The conversion costs are incurred evenly during the process, but the packing is added towards the end of the process. Normal spoilages are based on goods units that passed the inspection. Additional information regarding the percentage of normal spoilage and the stages in which materials and packaging are added is provided in the following table. Spoiled units are disposed of at zero net disposal value.

During March of the current year, the following data were recorded for the second department (Finishing Department):

This is the assigment that was given. Do you need worshop examples and answers that were given

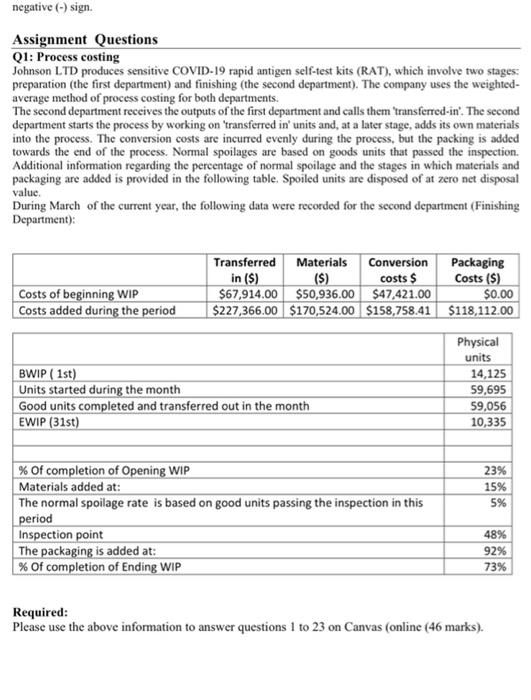

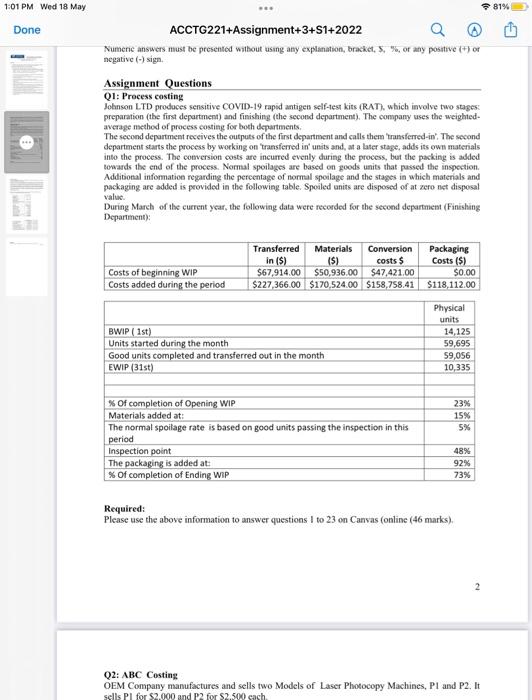

Q1: Process costing

Johnson LTD produces sensitive COVID-19 rapid antigen self-test kits (RAT), which involve two stages: preparation (the first department) and finishing (the second department). The company uses the weighted- average method of process costing for both departments.

The second department receives the outputs of the first department and calls them 'transferred-in'. The second department starts the process by working on 'transferred in' units and, at a later stage, adds its own materials into the process. The conversion costs are incurred evenly during the process, but the packing is added towards the end of the process. Normal spoilages are based on goods units that passed the inspection. Additional information regarding the percentage of normal spoilage and the stages in which materials and packaging are added is provided in the following table. Spoiled units are disposed of at zero net disposal value.

During March of the current year, the following data were recorded for the second department (Finishing Department):

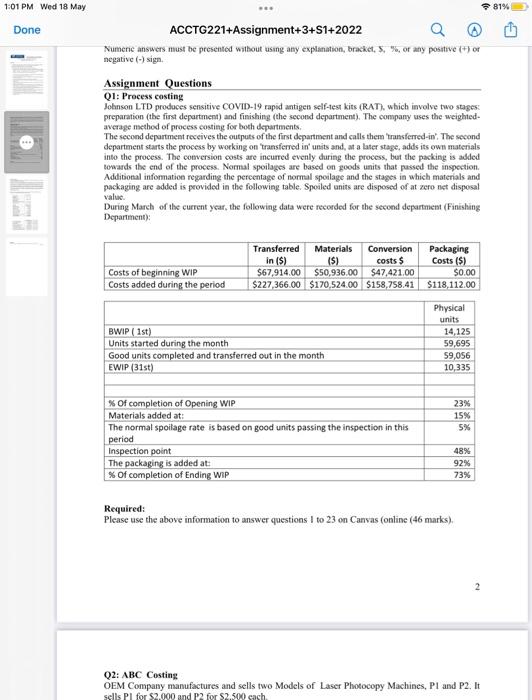

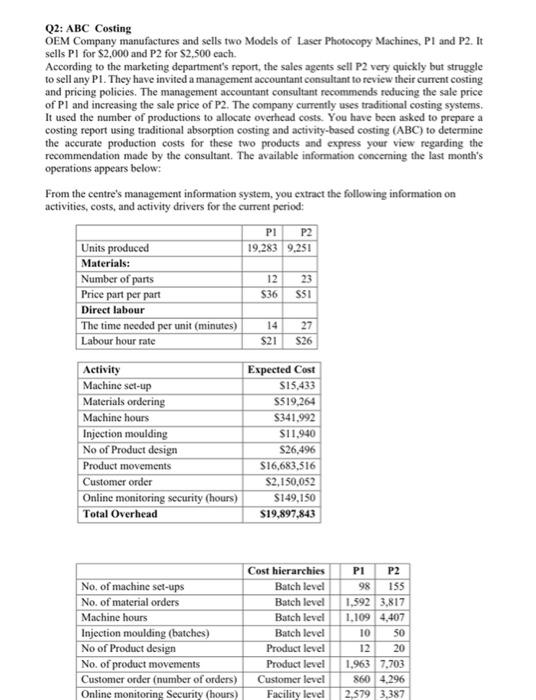

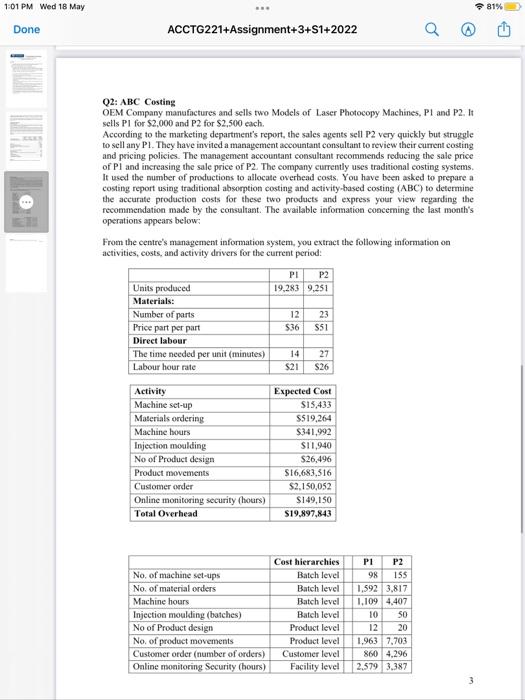

1:01 PM Wed 18 May Done 81% ACCTG221+Assignment+3+S1+2022 Numeric answers must be presented without using any explanation, bracket, S, %, or any positive (+) or negative (-) sign. Assignment Questions Q1: Process costing Johnson LTD produces sensitive COVID-19 rapid antigen self-test kits (RAT), which involve two stages: preparation (the first department) and finishing (the second department). The company uses the weighted- average method of process costing for both departments. The second department receives the outputs of the first department and calls them transferred-in". The second department starts the process by working on transferred in' units and, at a later stage, adds its own materials into the process. The conversion costs are incurred evenly during the process, but the packing is added towards the end of the process. Normal spoilages are based on goods units that passed the inspection. Additional information regarding the percentage of normal spoilage and the stages in which materials and packaging are added is provided in the following table. Spoiled units are disposed of at zero net disposal value. During March of the current year, the following data were recorded for the second department (Finishing Department): Transferred in (5) $67,914.00 Materials Conversion (S) costs $ $50,936.00 $47,421.00 Packaging Costs ($) Costs of beginning WIP $0.00 Costs added during the period $227,366.00 $170,524.00 $158,758.41 $118,112.00 Physical units BWIP (1st) 14,125 Units started during the month 59,695 59,056 Good units completed and transferred out in the month EWIP (31st) 10,335 % Of completion of Opening WIP 23% Materials added at: 15% 5% The normal spoilage rate is based on good units passing the inspection in this period Inspection point 48% The packaging is added at: 92% % Of completion of Ending WIP 73% Required: Please use the above information to answer questions I to 23 on Canvas (online (46 marks). 2 Q2: ABC Costing OEM Company manufactures and sells two Models of Laser Photocopy Machines, Pl and P2. It sells Pl for $2.000 and P2 for $2.500 each. 1:01 PM Wed 18 May Done 81% ACCTG221+Assignment+3+S1+2022 Q2: ABC Costing OEM Company manufactures and sells two Models of Laser Photocopy Machines, Pl and P2. It sells PI for $2,000 and P2 for $2,500 each. According to the marketing department's report, the sales agents sell P2 very quickly but struggle to sell any Pl. They have invited a management accountant consultant to review their current costing and pricing policies. The management accountant consultant recommends reducing the sale price of PI and increasing the sale price of P2. The company currently uses traditional costing systems. It used the number of productions to allocate overhead costs. You have been asked to prepare a costing report using traditional absorption costing and activity-based costing (ABC) to determine the accurate production costs for these two products and express your view regarding the recommendation made by the consultant. The available information concerning the last month's operations appears below: From the centre's management information system, you extract the following information on activities, costs, and activity drivers for the current period: PI P2 19,283 9,251 Units produced Materials: Number of parts 12 23 Price part per part $36 $51 Direct labour 14 27 The time needed per unit (minutes) Labour hour rate $21 $26 Activity Expected Cost Machine set-up $15,433 Materials ordering $519,264 Machine hours $341,992 Injection moulding $11,940 No of Product design $26,496 Product movements $16,683,516 Customer order $2,150,052 Online monitoring security (hours) $149,150 Total Overhead $19,897,843 Cost hierarchies No. of machine set-ups No. of material orders Machine hours Batch level Batch level Batch level Batch level Product level Injection moulding (batches) No of Product design No. of product movements Product level Customer order (number of orders) Customer level Online monitoring Security (hours) Facility level PI P2 98 155 1,592 3,817 1,109 4,407 10 50 12 20 1,963 7,703 860 4,296 2,579 3.387 3 negative (-) sign. Assignment Questions Q1: Process costing Johnson LTD produces sensitive COVID-19 rapid antigen self-test kits (RAT), which involve two stages: preparation (the first department) and finishing (the second department). The company uses the weighted- average method of process costing for both departments. The second department receives the outputs of the first department and calls them 'transferred-in'. The second department starts the process by working on 'transferred in' units and, at a later stage, adds its own materials into the process. The conversion costs are incurred evenly during the process, but the packing is added towards the end of the process. Normal spoilages are based on goods units that passed the inspection. Additional information regarding the percentage of normal spoilage and the stages in which materials and packaging are added is provided in the following table. Spoiled units are disposed of at zero net disposal value. During March of the current year, the following data were recorded for the second department (Finishing Department): Transferred in (5) $67,914.00 Materials Conversion costs $ Packaging Costs (5) (S) $50,936.00 $47,421.00 Costs of beginning WIP $0.00 Costs added during the period $227,366.00 $170,524.00 $158,758.41 $118,112.00 Physical units BWIP (1st) 14,125 Units started during the month 59,695 59,056 Good units completed and transferred out in the month EWIP (31st) 10,335 % Of completion of Opening WIP 23% Materials added at: 15% 5% The normal spoilage rate is based on good units passing the inspection in this period Inspection point 48% The packaging is added at: 92% % Of completion of Ending WIP 73% Required: Please use the above information to answer questions 1 to 23 on Canvas (online (46 marks). 1:01 PM Wed 18 May Done whak 81% ACCTG221+Assignment+3+S1+2022 Numeric answers must be presented without using any explanation, bracket, S, %, or any positive (+) or negative (-) sign. Assignment Questions Q1: Process costing Johnson LTD produces sensitive COVID-19 rapid antigen self-test kits (RAT), which involve two stages: preparation (the first department) and finishing (the second department). The company uses the weighted- average method of process costing for both departments. The second department receives the outputs of the first department and calls them transferred-in". The second department starts the process by working on transferred in' units and, at a later stage, adds its own materials into the process. The conversion costs are incurred evenly during the process, but the packing is added towards the end of the process. Normal spoilages are based on goods units that passed the inspection. Additional information regarding the percentage of normal spoilage and the stages in which materials and packaging are added is provided in the following table. Spoiled units are disposed of at zero net disposal value. During March of the current year, the following data were recorded for the second department (Finishing Department): Transferred in (5) $67,914.00 Materials Conversion (S) costs $ $50,936.00 $47,421.00 Packaging Costs ($) Costs of beginning WIP $0.00 Costs added during the period $227,366.00 $170,524.00 $158,758.41 $118,112.00 Physical units BWIP (1st) 14,125 Units started during the month 59,695 59,056 Good units completed and transferred out in the month EWIP (31st) 10,335 % Of completion of Opening WIP 23% Materials added at: 15% 5% The normal spoilage rate is based on good units passing the inspection in this period Inspection point 48% The packaging is added at: 92% % Of completion of Ending WIP 73% Required: Please use the above information to answer questions I to 23 on Canvas (online (46 marks). 2 Q2: ABC Costing OEM Company manufactures and sells two Models of Laser Photocopy Machines, Pl and P2. It sells Pl for $2.000 and P2 for $2.500 each. Q2: ABC Costing OEM Company manufactures and sells two Models of Laser Photocopy Machines, PI and P2. It sells Pl for $2,000 and P2 for $2,500 each. According to the marketing department's report, the sales agents sell P2 very quickly but struggle to sell any P1. They have invited a management accountant consultant to review their current costing and pricing policies. The management accountant consultant recommends reducing the sale price of PI and increasing the sale price of P2. The company currently uses traditional costing systems. It used the number of productions to allocate overhead costs. You have been asked to prepare a costing report using traditional absorption costing and activity-based costing (ABC) to determine the accurate production costs for these two products and express your view regarding the recommendation made by the consultant. The available information concerning the last month's operations appears below: From the centre's management information system, you extract the following information on activities, costs, and activity drivers for the current period: Pl P2 19,283 9,251 Units produced Materials: Number of parts 12 23 Price part per part $51 Direct labour The time needed per unit (minutes) 14 27 Labour hour rate $21 $26 Activity Expected Cost Machine set-up $15,433 $519,264 Materials ordering Machine hours Injection moulding $341,992 $11,940 No of Product design $26,496 Product movements $16,683,516 Customer order $2,150,052 Online monitoring security (hours) $149,150 Total Overhead $19,897,843 Cost hierarchies No. of machine set-ups Batch level Batch level No. of material orders Machine hours Batch level Batch level Injection moulding (batches) No of Product design Product level No. of product movements Product level Customer order (number of orders) Customer level Online monitoring Security (hours) Facility level $36 PI P2 155 98 1,592 3,817 1,109 4,407 10 50 12 20 1,963 7,703 860 4,296 2,579 3,387 negative (-) sign. Assignment Questions Q1: Process costing Johnson LTD produces sensitive COVID-19 rapid antigen self-test kits (RAT), which involve two stages: preparation (the first department) and finishing (the second department). The company uses the weighted- average method of process costing for both departments. The second department receives the outputs of the first department and calls them 'transferred-in'. The second department starts the process by working on 'transferred in' units and, at a later stage, adds its own materials into the process. The conversion costs are incurred evenly during the process, but the packing is added. towards the end of the process. Normal spoilages are based on goods units that passed the inspection. Additional information regarding the percentage of normal spoilage and the stages in which materials and packaging are added is provided in the following table. Spoiled units are disposed of at zero net disposal value. During March of the current year, the following data were recorded for the second department (Finishing Department): Packaging Transferred in (S) $67,914.00 Materials Conversion costs $ Costs ($) (S) $50,936.00 $47,421.00 Costs of beginning WIP Costs added during the period $0.00 $227,366.00 $170,524.00 $158,758.41 $118,112.00 Physical units BWIP (1st) 14,125 Units started during the month 59,695 59,056 Good units completed and transferred out in the month EWIP (31st) 10,335 % Of completion of Opening WIP 23% Materials added at: 15% 5% The normal spoilage rate is based on good units passing the inspection in this period Inspection point 48% The packaging is added at: 92% % Of completion of Ending WIP 73% Required: Please use the above information to answer questions 1 to 23 on Canvas (online (46 marks). 1:01 PM Wed 18 May Done 81% ACCTG221+Assignment+3+S1+2022 Numeric answers must be presented without using any explanation, bracket, S, %, or any positive (+) or negative (-) sign. Assignment Questions Q1: Process costing Johnson LTD produces sensitive COVID-19 rapid antigen self-test kits (RAT), which involve two stages: preparation (the first department) and finishing (the second department). The company uses the weighted- average method of process costing for both departments. The second department receives the outputs of the first department and calls them transferred-in". The second department starts the process by working on transferred in' units and, at a later stage, adds its own materials into the process. The conversion costs are incurred evenly during the process, but the packing is added towards the end of the process. Normal spoilages are based on goods units that passed the inspection. Additional information regarding the percentage of normal spoilage and the stages in which materials and packaging are added is provided in the following table. Spoiled units are disposed of at zero net disposal value. During March of the current year, the following data were recorded for the second department (Finishing Department): Transferred in (5) $67,914.00 Materials Conversion (S) costs $ $50,936.00 $47,421.00 Packaging Costs ($) Costs of beginning WIP $0.00 Costs added during the period $227,366.00 $170,524.00 $158,758.41 $118,112.00 Physical units BWIP (1st) 14,125 Units started during the month 59,695 59,056 Good units completed and transferred out in the month EWIP (31st) 10,335 % Of completion of Opening WIP 23% Materials added at: 15% 5% The normal spoilage rate is based on good units passing the inspection in this period Inspection point 48% The packaging is added at: 92% % Of completion of Ending WIP 73% Required: Please use the above information to answer questions I to 23 on Canvas (online (46 marks). 2 Q2: ABC Costing OEM Company manufactures and sells two Models of Laser Photocopy Machines, Pl and P2. It sells Pl for $2.000 and P2 for $2.500 each. 1:01 PM Wed 18 May Done 81% ACCTG221+Assignment+3+S1+2022 Q2: ABC Costing OEM Company manufactures and sells two Models of Laser Photocopy Machines, Pl and P2. It sells PI for $2,000 and P2 for $2,500 each. According to the marketing department's report, the sales agents sell P2 very quickly but struggle to sell any Pl. They have invited a management accountant consultant to review their current costing and pricing policies. The management accountant consultant recommends reducing the sale price of PI and increasing the sale price of P2. The company currently uses traditional costing systems. It used the number of productions to allocate overhead costs. You have been asked to prepare a costing report using traditional absorption costing and activity-based costing (ABC) to determine the accurate production costs for these two products and express your view regarding the recommendation made by the consultant. The available information concerning the last month's operations appears below: From the centre's management information system, you extract the following information on activities, costs, and activity drivers for the current period: PI P2 19,283 9,251 Units produced Materials: Number of parts 12 23 Price part per part $36 $51 Direct labour 14 27 The time needed per unit (minutes) Labour hour rate $21 $26 Activity Expected Cost Machine set-up $15,433 Materials ordering $519,264 Machine hours $341,992 Injection moulding $11,940 No of Product design $26,496 Product movements $16,683,516 Customer order $2,150,052 Online monitoring security (hours) $149,150 Total Overhead $19,897,843 Cost hierarchies No. of machine set-ups No. of material orders Machine hours Batch level Batch level Batch level Batch level Product level Injection moulding (batches) No of Product design No. of product movements Product level Customer order (number of orders) Customer level Online monitoring Security (hours) Facility level PI P2 98 155 1,592 3,817 1,109 4,407 10 50 12 20 1,963 7,703 860 4,296 2,579 3.387 3 negative (-) sign. Assignment Questions Q1: Process costing Johnson LTD produces sensitive COVID-19 rapid antigen self-test kits (RAT), which involve two stages: preparation (the first department) and finishing (the second department). The company uses the weighted- average method of process costing for both departments. The second department receives the outputs of the first department and calls them 'transferred-in'. The second department starts the process by working on 'transferred in' units and, at a later stage, adds its own materials into the process. The conversion costs are incurred evenly during the process, but the packing is added towards the end of the process. Normal spoilages are based on goods units that passed the inspection. Additional information regarding the percentage of normal spoilage and the stages in which materials and packaging are added is provided in the following table. Spoiled units are disposed of at zero net disposal value. During March of the current year, the following data were recorded for the second department (Finishing Department): Transferred in (5) $67,914.00 Materials Conversion costs $ Packaging Costs (5) (S) $50,936.00 $47,421.00 Costs of beginning WIP $0.00 Costs added during the period $227,366.00 $170,524.00 $158,758.41 $118,112.00 Physical units BWIP (1st) 14,125 Units started during the month 59,695 59,056 Good units completed and transferred out in the month EWIP (31st) 10,335 % Of completion of Opening WIP 23% Materials added at: 15% 5% The normal spoilage rate is based on good units passing the inspection in this period Inspection point 48% The packaging is added at: 92% % Of completion of Ending WIP 73% Required: Please use the above information to answer questions 1 to 23 on Canvas (online (46 marks). 1:01 PM Wed 18 May Done whak 81% ACCTG221+Assignment+3+S1+2022 Numeric answers must be presented without using any explanation, bracket, S, %, or any positive (+) or negative (-) sign. Assignment Questions Q1: Process costing Johnson LTD produces sensitive COVID-19 rapid antigen self-test kits (RAT), which involve two stages: preparation (the first department) and finishing (the second department). The company uses the weighted- average method of process costing for both departments. The second department receives the outputs of the first department and calls them transferred-in". The second department starts the process by working on transferred in' units and, at a later stage, adds its own materials into the process. The conversion costs are incurred evenly during the process, but the packing is added towards the end of the process. Normal spoilages are based on goods units that passed the inspection. Additional information regarding the percentage of normal spoilage and the stages in which materials and packaging are added is provided in the following table. Spoiled units are disposed of at zero net disposal value. During March of the current year, the following data were recorded for the second department (Finishing Department): Transferred in (5) $67,914.00 Materials Conversion (S) costs $ $50,936.00 $47,421.00 Packaging Costs ($) Costs of beginning WIP $0.00 Costs added during the period $227,366.00 $170,524.00 $158,758.41 $118,112.00 Physical units BWIP (1st) 14,125 Units started during the month 59,695 59,056 Good units completed and transferred out in the month EWIP (31st) 10,335 % Of completion of Opening WIP 23% Materials added at: 15% 5% The normal spoilage rate is based on good units passing the inspection in this period Inspection point 48% The packaging is added at: 92% % Of completion of Ending WIP 73% Required: Please use the above information to answer questions I to 23 on Canvas (online (46 marks). 2 Q2: ABC Costing OEM Company manufactures and sells two Models of Laser Photocopy Machines, Pl and P2. It sells Pl for $2.000 and P2 for $2.500 each. Q2: ABC Costing OEM Company manufactures and sells two Models of Laser Photocopy Machines, PI and P2. It sells Pl for $2,000 and P2 for $2,500 each. According to the marketing department's report, the sales agents sell P2 very quickly but struggle to sell any P1. They have invited a management accountant consultant to review their current costing and pricing policies. The management accountant consultant recommends reducing the sale price of PI and increasing the sale price of P2. The company currently uses traditional costing systems. It used the number of productions to allocate overhead costs. You have been asked to prepare a costing report using traditional absorption costing and activity-based costing (ABC) to determine the accurate production costs for these two products and express your view regarding the recommendation made by the consultant. The available information concerning the last month's operations appears below: From the centre's management information system, you extract the following information on activities, costs, and activity drivers for the current period: Pl P2 19,283 9,251 Units produced Materials: Number of parts 12 23 Price part per part $51 Direct labour The time needed per unit (minutes) 14 27 Labour hour rate $21 $26 Activity Expected Cost Machine set-up $15,433 $519,264 Materials ordering Machine hours Injection moulding $341,992 $11,940 No of Product design $26,496 Product movements $16,683,516 Customer order $2,150,052 Online monitoring security (hours) $149,150 Total Overhead $19,897,843 Cost hierarchies No. of machine set-ups Batch level Batch level No. of material orders Machine hours Batch level Batch level Injection moulding (batches) No of Product design Product level No. of product movements Product level Customer order (number of orders) Customer level Online monitoring Security (hours) Facility level $36 PI P2 155 98 1,592 3,817 1,109 4,407 10 50 12 20 1,963 7,703 860 4,296 2,579 3,387 negative (-) sign. Assignment Questions Q1: Process costing Johnson LTD produces sensitive COVID-19 rapid antigen self-test kits (RAT), which involve two stages: preparation (the first department) and finishing (the second department). The company uses the weighted- average method of process costing for both departments. The second department receives the outputs of the first department and calls them 'transferred-in'. The second department starts the process by working on 'transferred in' units and, at a later stage, adds its own materials into the process. The conversion costs are incurred evenly during the process, but the packing is added. towards the end of the process. Normal spoilages are based on goods units that passed the inspection. Additional information regarding the percentage of normal spoilage and the stages in which materials and packaging are added is provided in the following table. Spoiled units are disposed of at zero net disposal value. During March of the current year, the following data were recorded for the second department (Finishing Department): Packaging Transferred in (S) $67,914.00 Materials Conversion costs $ Costs ($) (S) $50,936.00 $47,421.00 Costs of beginning WIP Costs added during the period $0.00 $227,366.00 $170,524.00 $158,758.41 $118,112.00 Physical units BWIP (1st) 14,125 Units started during the month 59,695 59,056 Good units completed and transferred out in the month EWIP (31st) 10,335 % Of completion of Opening WIP 23% Materials added at: 15% 5% The normal spoilage rate is based on good units passing the inspection in this period Inspection point 48% The packaging is added at: 92% % Of completion of Ending WIP 73% Required: Please use the above information to answer questions 1 to 23 on Canvas (online (46 marks)