Answered step by step

Verified Expert Solution

Question

1 Approved Answer

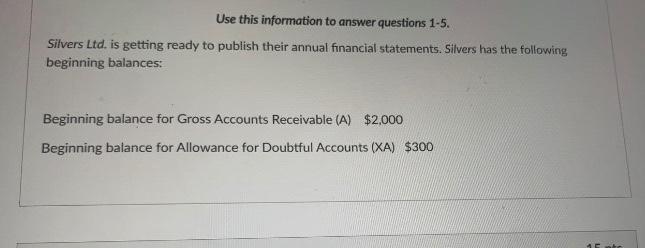

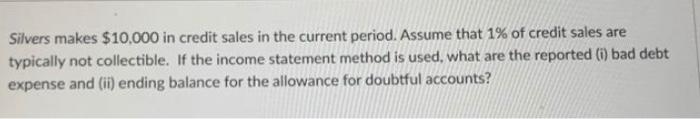

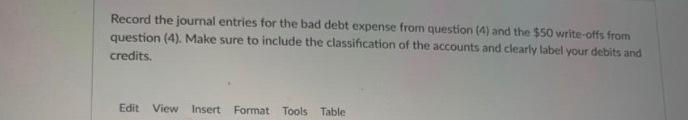

Q1. Q2. **answer question 2** Q4 Use this information to answer questions 1-5. Silvers Ltd. is getting ready to publish their annual financial statements. Silvers

Q1.

Q2.

**answer question 2**

Q4

Use this information to answer questions 1-5. Silvers Ltd. is getting ready to publish their annual financial statements. Silvers has the following beginning balances: Beginning balance for Gross Accounts Receivable (A) $2,000 Beginning balance for Allowance for Doubtful Accounts (XA) $300 Silvers makes $10,000 in credit sales in the current period. Assume that 1% of credit sales are typically not collectible. If the income statement method is used, what are the reported (1) bad debt expense and (ii) ending balance for the allowance for doubtful accounts? Record the journal entries for the bad debt expense from question (4) and the $50 write-offs from question (4). Make sure to include the classification of the accounts and clearly label your debits and credits. Edit View Insert Format Tools Table Question 4 5 pts Now suppose that Silvers recorded 550 in write-offs for the current accounting period. What is the bad debt expense from question (1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started