Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 Question 1 24 Points For each of the following statements clearly indicate whether the statement is true or false and provide a brief explanation

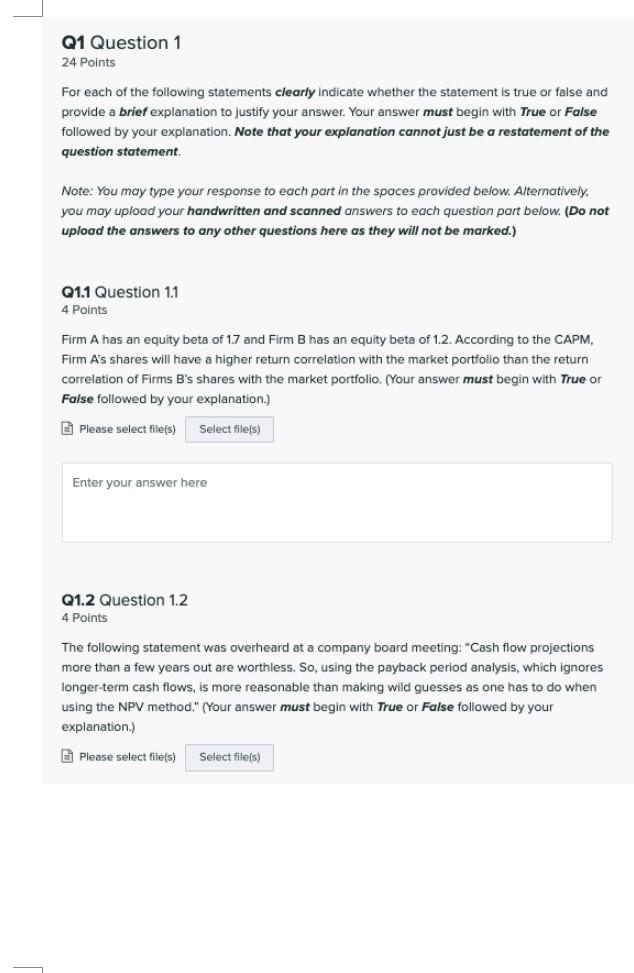

Q1 Question 1 24 Points For each of the following statements clearly indicate whether the statement is true or false and provide a brief explanation to justify your answer. Your answer must begin with True or False followed by your explanation. Note that your explanation cannot just be a restatement of the question statement. Note: You may type your response to each part in the spaces provided below. Alternatively, you may upload your handwritten and scanned answers to each question part below. (Do not upload the answers to any other questions here as they will not be marked.) Q1.1 Question 1.1 4 Points Firm A has an equity beta of 1.7 and Firm B has an equity beta of 1.2. According to the CAPM, Firm A's shares will have a higher return correlation with the market portfolio than the return correlation of Firms B's shares with the market portfolio. (Your answer must begin with True or False followed by your explanation.) Please select file(s) Select file(s) Enter your answer here Q1.2 Question 1.2 4 Points The following statement was overheard at a company board meeting: "Cash flow projections more than a few years out are worthless. So, using the payback period analysis, which ignores longer-term cash flows, is more reasonable than making wild guesses as one has to do when using the NPV method." (Your answer must begin with True or False followed by your explanation.) Please select file(s) Select file(s)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started