Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q1 Regarding #1, top row possible answers can be: Cost Depreciable Cost Estimated Life Salvage Value Paper Printing Company purchased a copy machine for $65,000

q1

q1

Regarding #1, top row possible answers can be:

Cost

Depreciable Cost

Estimated Life

Salvage Value

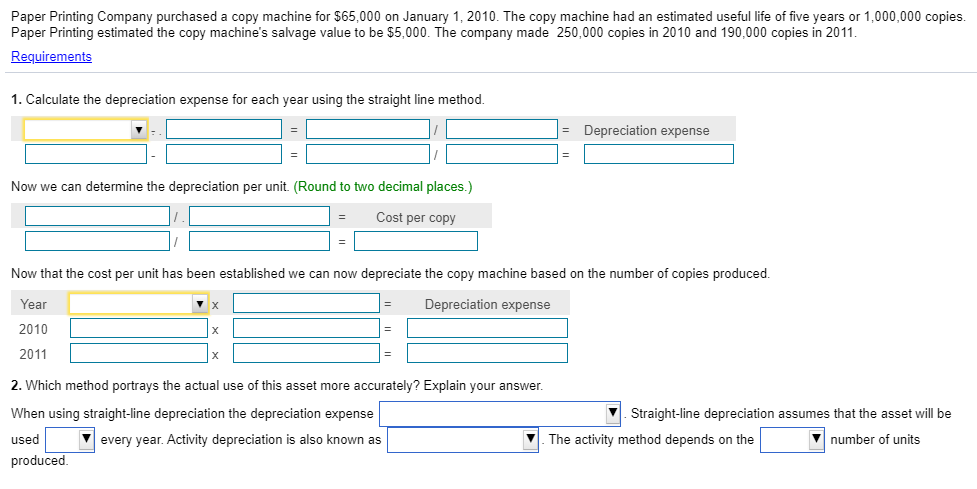

Paper Printing Company purchased a copy machine for $65,000 on January 1, 2010. The copy machine had an estimated useful life of five years or 1,000,000 copies. Paper Printing estimated the copy machine's salvage value to be $5,000. The company made 250,000 copies in 2010 and 190,000 copies in 2011. Requirements 1. Calculate the depreciation expense for each year using the straight line method. = Depreciation expense Now we can determine the depreciation per unit. (Round to two decimal places.) = Cost per copy Now that the cost per unit has been established we can now depreciate the copy machine based on the number of copies produced. = Depreciation expense Year 2010 2011 2. Which method portrays the actual use of this asset more accurately? Explain your answer. When using straight-line depreciation the depreciation expense . Straight-line depreciation assumes that the asset will be used every year. Activity depreciation is also known as V. The activity method depends on the V number of units produced

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started