Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 Saturn PLC Saturn PLC is considering a capital investment of 2,500,000 in new, state of the art equipment, with a resale value of

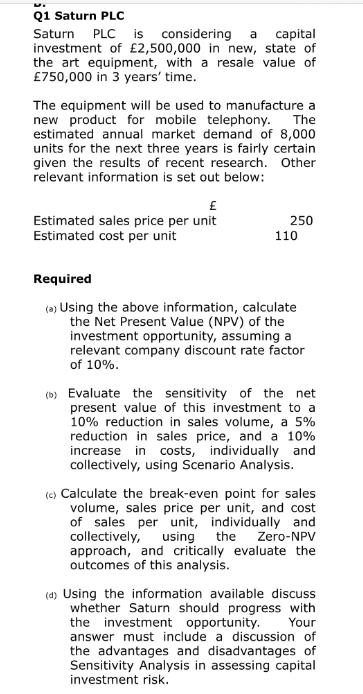

Q1 Saturn PLC Saturn PLC is considering a capital investment of 2,500,000 in new, state of the art equipment, with a resale value of 750,000 in 3 years' time. The equipment will be used to manufacture a new product for mobile telephony. The estimated annual market demand of 8,000 units for the next three years is fairly certain given the results of recent research. Other relevant information is set out below: 250 110 Estimated sales price per unit Estimated cost per unit Required (a) Using the above information, calculate the Net Present Value (NPV) of the investment opportunity, assuming a relevant company discount rate factor of 10%. (b) Evaluate the sensitivity of the net present value of this investment to a 10% reduction in sales volume, a 5% reduction in sales price, and a 10% increase in costs, individually and collectively, using Scenario Analysis. (c) Calculate the break-even point for sales volume, sales price per unit, and cost of sales per unit, individually and collectively, using the Zero-NPV approach, and critically evaluate the outcomes of this analysis. (d) Using the information available discuss whether Saturn should progress with the investment opportunity. Your answer must include a discussion of the advantages and disadvantages of Sensitivity Analysis in assessing capital investment risk.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Saturn PLC Investment Analysis Assumptions Project life 3 years Units sold per year 8000 Discount rate 10 a Net Present Value NPV Calculation A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started