Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1) Suppose Nabisco Corporation just issued a dividend of $2.25 per share yesterday. Subsequent dividends will grow at a constant rate of 5.87% indefinitely.

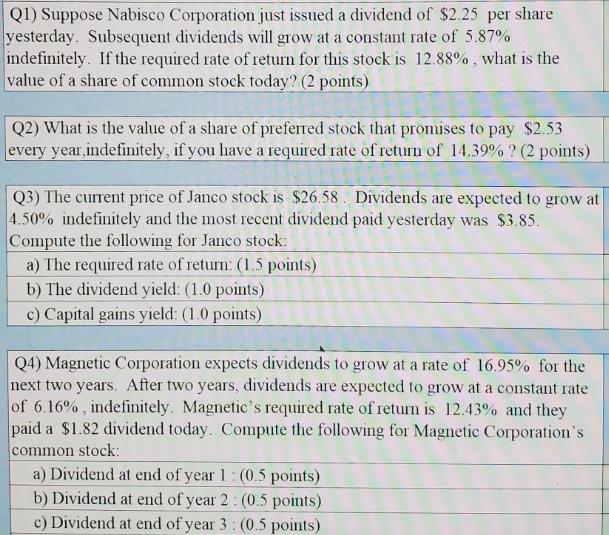

Q1) Suppose Nabisco Corporation just issued a dividend of $2.25 per share yesterday. Subsequent dividends will grow at a constant rate of 5.87% indefinitely. If the required rate of return for this stock is 12.88%, what is the value of a share of common stock today? (2 points) Q2) What is the value of a share of preferred stock that promises to pay $2.53 every year,indefinitely, if you have a required rate of return of 14.39% ? (2 points) Q3) The current price of Janco stock is $26.58. Dividends are expected to grow at 4.50% indefinitely and the most recent dividend paid yesterday was $3.85. Compute the following for Janco stock: a) The required rate of return: (1.5 points) b) The dividend yield: (1.0 points) c) Capital gains yield: (1.0 points) Q4) Magnetic Corporation expects dividends to grow at a rate of 16.95% for the next two years. After two years, dividends are expected to grow at a constant rate of 6.16%, indefinitely. Magnetic's required rate of return is 12.43% and they paid a $1.82 dividend today. Compute the following for Magnetic Corporation's common stock: a) Dividend at end of year 1: (0.5 points) b) Dividend at end of year 2: (0.5 points) c) Dividend at end of year 3: (0.5 points) Q1) Suppose Nabisco Corporation just issued a dividend of $2.25 per share yesterday. Subsequent dividends will grow at a constant rate of 5.87% indefinitely. If the required rate of return for this stock is 12.88%, what is the value of a share of common stock today? (2 points) Q2) What is the value of a share of preferred stock that promises to pay $2.53 every year,indefinitely, if you have a required rate of return of 14.39% ? (2 points) Q3) The current price of Janco stock is $26.58. Dividends are expected to grow at 4.50% indefinitely and the most recent dividend paid yesterday was $3.85. Compute the following for Janco stock: a) The required rate of return: (1.5 points) b) The dividend yield: (1.0 points) c) Capital gains yield: (1.0 points) Q4) Magnetic Corporation expects dividends to grow at a rate of 16.95% for the next two years. After two years, dividends are expected to grow at a constant rate of 6.16%, indefinitely. Magnetic's required rate of return is 12.43% and they paid a $1.82 dividend today. Compute the following for Magnetic Corporation's common stock: a) Dividend at end of year 1: (0.5 points) b) Dividend at end of year 2: (0.5 points) c) Dividend at end of year 3 (0.5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Stock Valuation and Analysis Q1 Nabisco Corporation Present Value of Growing Perpetuity P D1 r g 225 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started