Answered step by step

Verified Expert Solution

Question

1 Approved Answer

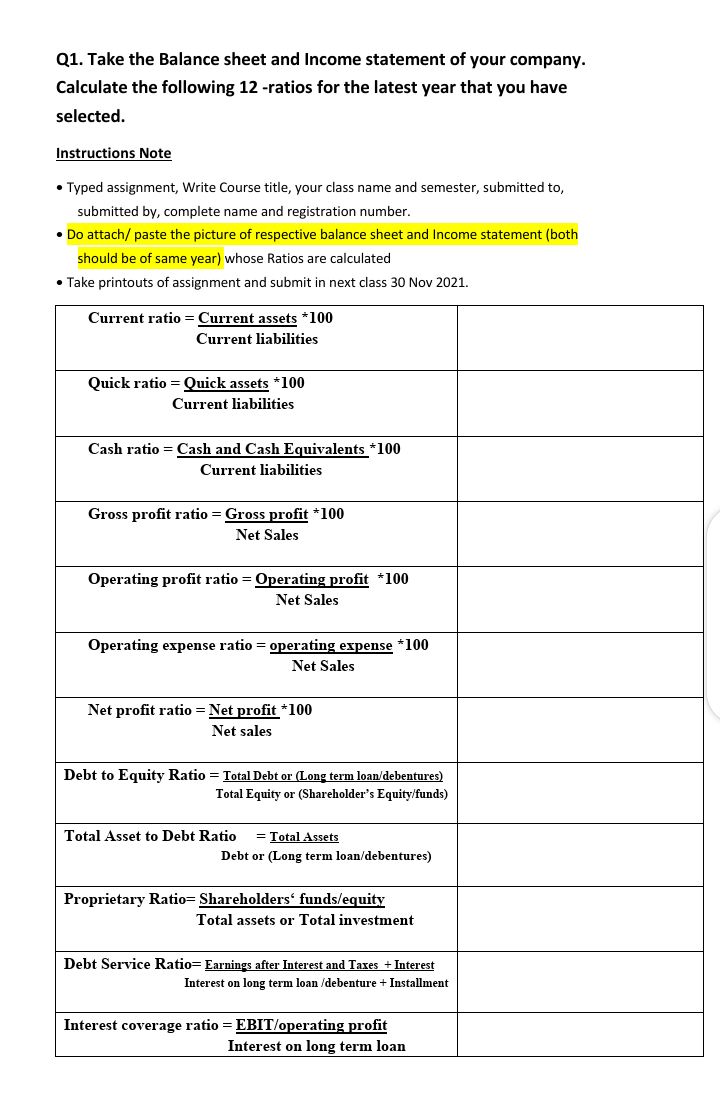

Q1. Take the Balance sheet and Income statement of your company. Calculate the following 12 -ratios for the latest year that you have selected. Instructions

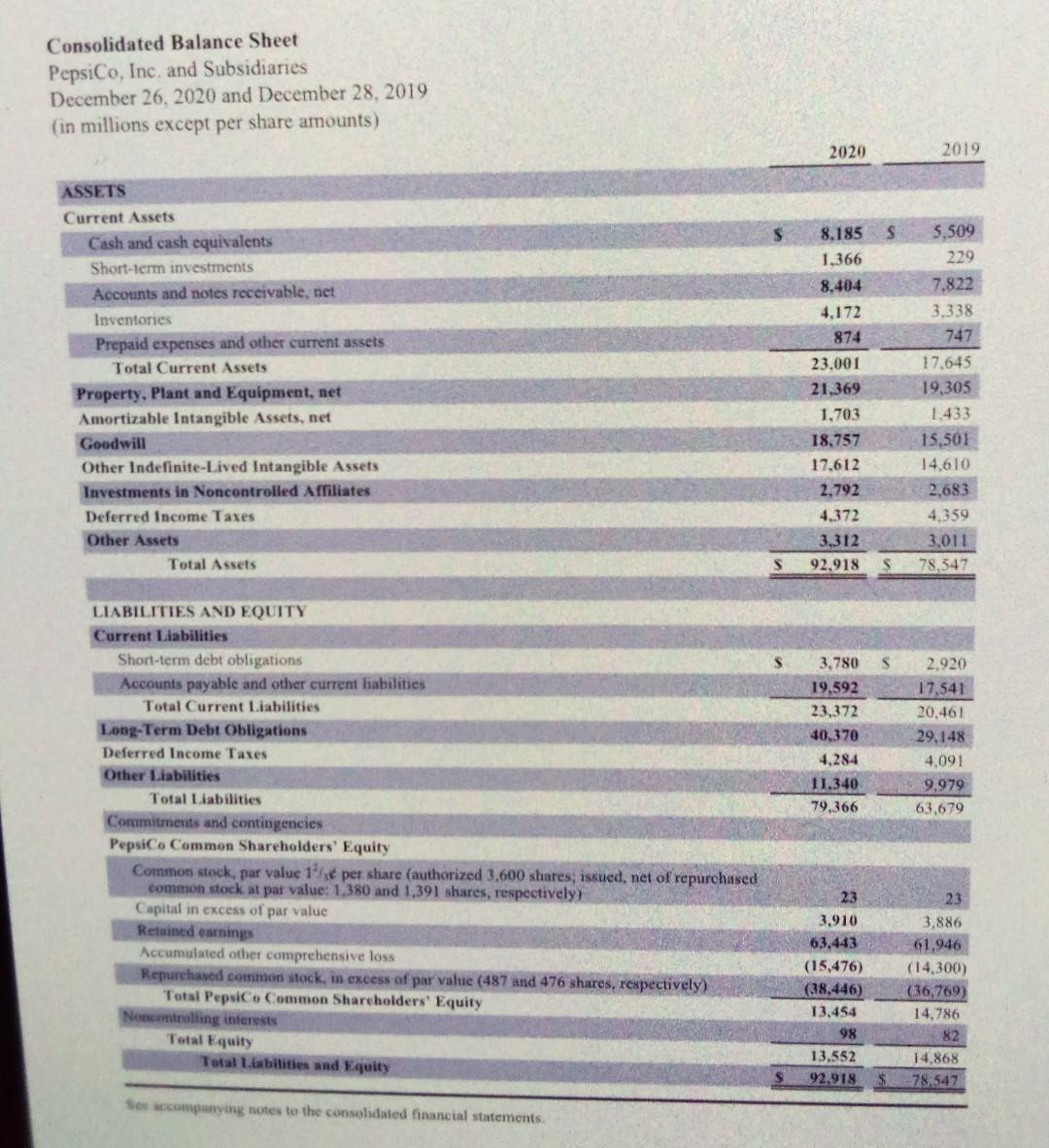

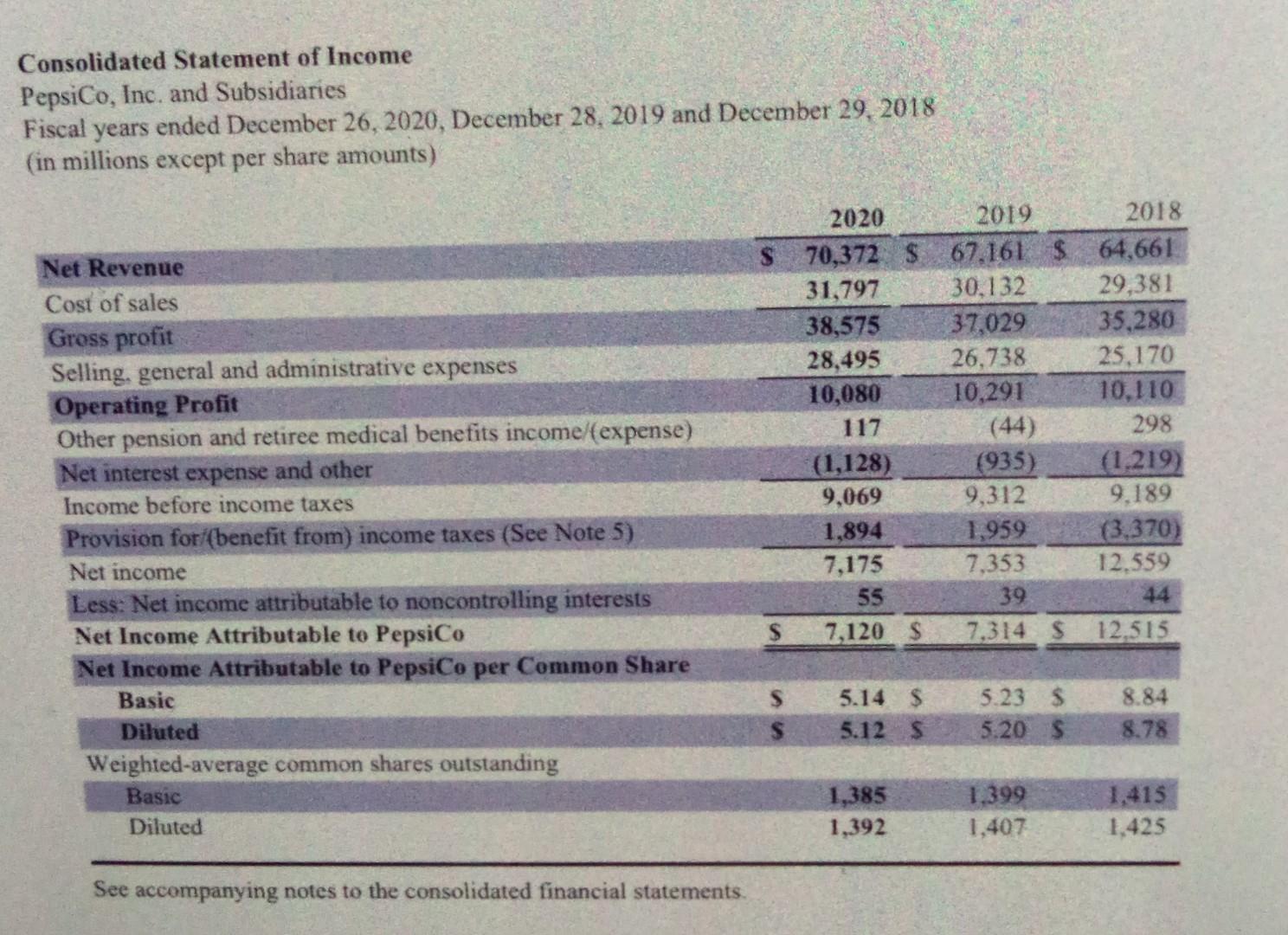

Q1. Take the Balance sheet and Income statement of your company. Calculate the following 12 -ratios for the latest year that you have selected. Instructions Note Typed assignment, Write Course title, your class name and semester, submitted to, submitted by, complete name and registration number. Do attach/ paste the picture of respective balance sheet and Income statement (both should be of same year) whose Ratios are calculated Take printouts of assignment and submit in next class 30 Nov 2021. Current ratio = Current assets * 100 Current liabilities Quick ratio = Quick assets *100 Current liabilities Cash ratio = Cash and Cash Equivalents *100 Current liabilities Gross profit ratio = Gross profit *100 Net Sales Operating profit ratio = Operating profit *100 Net Sales Operating expense ratio = operating expense *100 Net Sales Net profit ratio = Net profit *100 Net sales Debt to Equity Ratio = Total Debt or (Long term loan/debentures) Total Equity or (Shareholder's Equity/funds) Total Asset to Debt Ratio = Total Assets Debt or (Long term loan/debentures) Proprietary Ratio=Shareholders' funds/equity Total assets or Total investment Debt Service Ratio=Earnings after Interest and Taxes + Interest Interest on long term loan /debenture + Installment Interest coverage ratio = EBIT/operating profit Interest on long term loan Consolidated Balance Sheet PepsiCo, Inc. and Subsidiaries December 26, 2020 and December 28, 2019 (in millions except per share amounts) 2020 2019 S 8.185 1,366 8.404 4,172 874 ASSETS Current Assets Cash and cash equivalents Short-term investments Accounts and notes receivable, net Inventories Prepaid expenses and other current assets Total Current Assets Property, Plant and Equipment, net Amortizable Intangible Assets, net Goodwill Other Indefinite-Lived Intangible Assets Investments in Noncontrolled Affiliates Deferred Income Taxes Other Assets Total Assets 23.001 21,369 1.703 18,757 17.612 2,792 4.372 3,312 92,918 5.509 229 7.822 3.338 747 17,645 19,305 1.433 15,501 14.610 2,683 4,359 3,011 78,347 s $ S 3.780 S 19,592 23,372 40,370 2.920 17,541 20,461 29.148 4,091 9.979 63.679 4,284 11.340 79,366 LIABILITIES AND EQUITY Current Liabilities Short-term debt obligations Accounts payable and other current liabilities Total Current Liabilities Long-Term Debt Obligations Deferred Income Taxes Other Liabilities Total Liabilities Commitments and contingencies PepsiCo Common Shareholders' Equity Common stock, par value 1e per share (authorized 3,600 shares; issued, net of repurchased common stock at par value: 1.380 and 1,391 shares, respectively) Capital in excess of par value Retained earning Accumulated other comprehensive loss Repurchased common stock, in excess of par value (487 and 476 shares, respectively) Total PepsiCo Common Shareholders' Equity Non milling interests Total Equity Total Liabilities and Equity 23 3,910 63.443 (15,476) (38,446) 13,454 98 13,552 92,918 23 3,886 61.946 (14,300) (36,769) 14,786 82 14.868 78 547 S Ses accompanying notes to the consolidated financial statements. Consolidated Statement of Income PepsiCo, Inc. and Subsidiaries Fiscal years ended December 26, 2020, December 28, 2019 and December 29, 2018 (in millions except per share amounts) Net Revenue Cost of sales Gross profit Selling, general and administrative expenses Operating Profit Other pension and retiree medical benefits income/expense) Net interest expense and other Income before income taxes Provision for(benefit from) income taxes (See Note 5) Net income Less: Net income attributable to noncontrolling interests Net Income Attributable to PepsiCo Net Income Attributable to PepsiCo per Common Share Basic Diluted Weighted-average common shares outstanding Basic Diluted 2020 2019 $ 70,372 $ 67,161 $ 31,797 30,132 38,575 37,029 28,495 26,738 10,080 10,291 117 (44) (1,128) (935) 9,069 9,312 1,894 1,959 7,175 7.353 55 39 $ 7,120 $ 7.314 $ 2018 64,661 29,381 35,280 25,170 10.110 298 (1.219) 9.189 (3.370) 12.559 44 12,515 S 5.14 $ 5.12 S 5.23 $ 5.20 S 8.84 8.78 1,385 1,392 1.399 1,407 1,415 1,425 See accompanying notes to the consolidated financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started