Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q#1 The following information is for Harris Inc., first year of operations. The amounts are in millions of dollars. Accounting income for current year

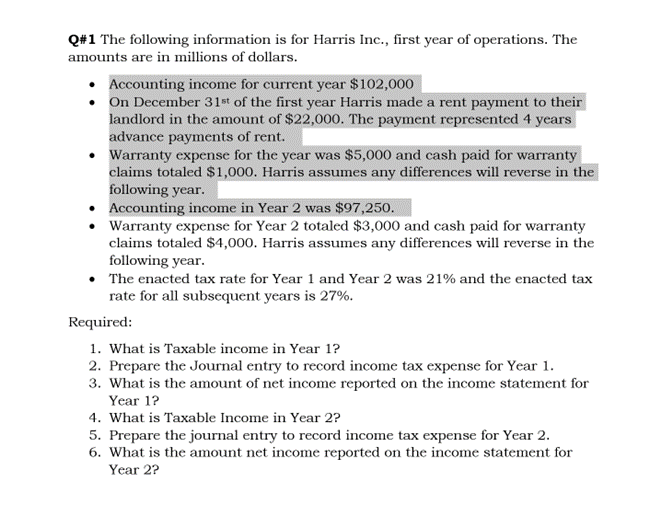

Q#1 The following information is for Harris Inc., first year of operations. The amounts are in millions of dollars. Accounting income for current year $102,000 On December 31st of the first year Harris made a rent payment to their landlord in the amount of $22,000. The payment represented 4 years advance payments of rent. Warranty expense for the year was $5,000 and cash paid for warranty claims totaled $1,000. Harris assumes any differences will reverse in the following year. Accounting income in Year 2 was $97,250. Warranty expense for Year 2 totaled $3,000 and cash paid for warranty claims totaled $4,000. Harris assumes any differences will reverse in the following year. The enacted tax rate for Year 1 and Year 2 was 21% and the enacted tax rate for all subsequent years is 27%. Required: 1. What is Taxable income in Year 1? 2. Prepare the Journal entry to record income tax expense for Year 1. 3. What is the amount of net income reported on the income statement for Year 1? 4. What is Taxable Income in Year 2? 5. Prepare the journal entry to record income tax expense for Year 2. 6. What is the amount net income reported on the income statement for Year 2?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate Taxable income in Year 1 we need to adjust the Accounting income for certain items Ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started