Answered step by step

Verified Expert Solution

Question

1 Approved Answer

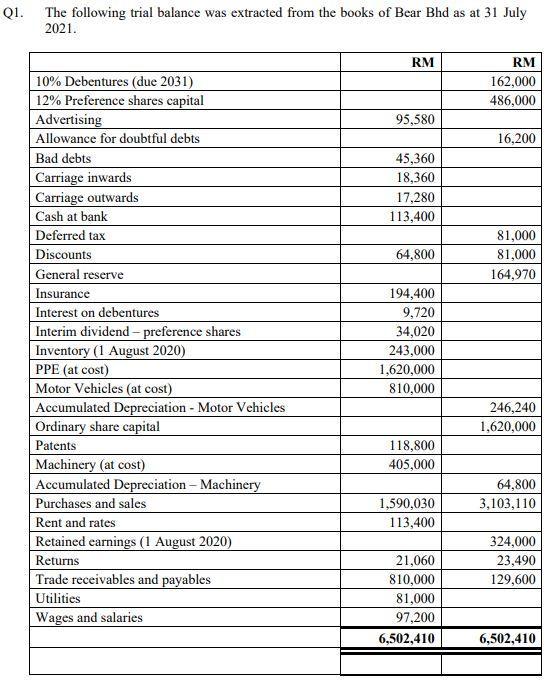

Q1. The following trial balance was extracted from the books of Bear Bhd as at 31 July 2021. 10% Debentures (due 2031) 12% Preference

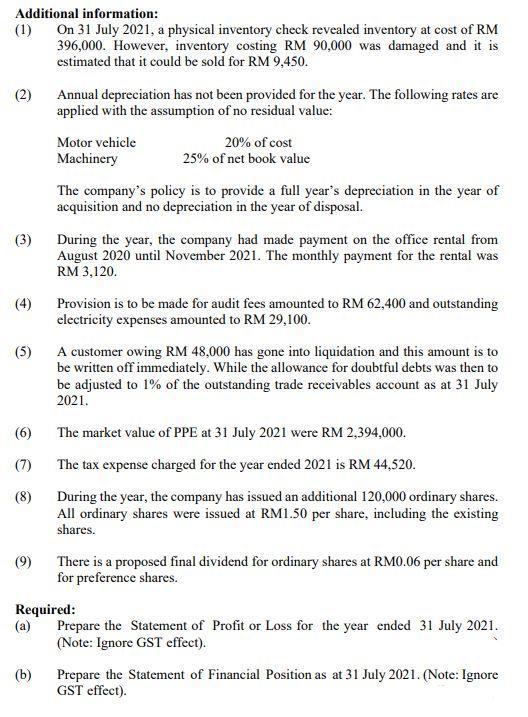

Q1. The following trial balance was extracted from the books of Bear Bhd as at 31 July 2021. 10% Debentures (due 2031) 12% Preference shares capital Advertising Allowance for doubtful debts Bad debts Carriage inwards Carriage outwards Cash at bank Deferred tax Discounts General reserve Insurance Interest on debentures Interim dividend - preference shares Inventory (1 August 2020) PPE (at cost) Motor Vehicles (at cost) Accumulated Depreciation - Motor Vehicles Ordinary share capital Patents Machinery (at cost) Accumulated Depreciation - Machinery Purchases and sales Rent and rates Retained earnings (1 August 2020) Returns Trade receivables and payables Utilities Wages and salaries RM 95,580 45,360 18,360 17,280 113,400 64,800 194,400 9,720 34,020 243,000 1,620,000 810,000 118,800 405,000 1,590,030 113,400 21,060 810,000 81,000 97,200 6,502,410 RM 162,000 486,000 16,200 81,000 81,000 164,970 246,240 1,620,000 64,800 3,103,110 324,000 23,490 129,600 6,502,410 Additional information: (1) On 31 July 2021, a physical inventory check revealed inventory at cost of RM 396,000. However, inventory costing RM 90,000 was damaged and it is estimated that it could be sold for RM 9,450. (2) (3) (4) (6) (7) (8) (9) Annual depreciation has not been provided for the year. The following rates are applied with the assumption of no residual value: Motor vehicle Machinery (b) 20% of cost 25% of net book value The company's policy is to provide a full year's depreciation in the year of acquisition and no depreciation in the year of disposal. (5) A customer owing RM 48,000 has gone into liquidation and this amount is to be written off immediately. While the allowance for doubtful debts was then to be adjusted to 1% of the outstanding trade receivables account as at 31 July 2021. During the year, the company had made payment on the office rental from August 2020 until November 2021. The monthly payment for the rental was RM 3,120. Provision is to be made for audit fees amounted to RM 62,400 and outstanding electricity expenses amounted to RM 29,100. The market value of PPE at 31 July 2021 were RM 2,394,000. The tax expense charged for the year ended 2021 is RM 44,520. During the year, the company has issued an additional 120,000 ordinary shares. All ordinary shares were issued at RM1.50 per share, including the existing shares. Required: (a) There is a proposed final dividend for ordinary shares at RM0.06 per share and for preference shares. Prepare the Statement of Profit or Loss for the year ended 31 July 2021. (Note: Ignore GST effect). Prepare the Statement of Financial Position as at 31 July 2021. (Note: Ignore GST effect).

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Statement of Profit or Loss for the year ended 31 July 2021 Particulars Calculation Amount in RM S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started