Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1 To build a portfolio will exactly replicate the payoff to the call option, you need to purchase _______shares 0.50 2. 0.233 3. 0.333 4.

Q1

To build a portfolio will exactly replicate the payoff to the call option, you need to purchase _______shares

- 0.50

2. 0.233

3. 0.333

4. 3

5. 0.633

Q2

To build a portfolio will exactly replicate the payoff to the call option, you need to

- borrow 19.05

2. lend 18.05

3. borrow 20

4. buy 19.05 bonds

5. buy 20 bonds

6. borrow 18.5

Q 3

Call option' price is

- 16.4

2. 20.4

3. 3.5

4. 10.9

5. 14.3

6. 12.5

7. 0

8. 15.3

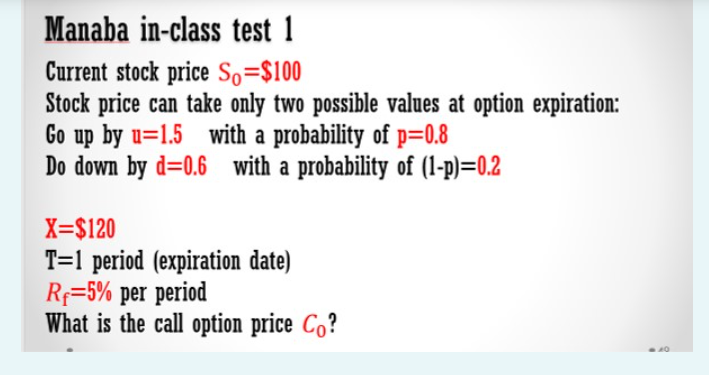

Manaba in-class test 1 Current stock price S0=$100 Stock price can take only two possible values at option expiration: Go up by u=1.5 with a probability of p=0.8 Do down by d=0.6 with a probability of (1p)=0.2 X=$120 T=1 period (expiration date) Rf=5% per period What is the call option price C0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started