Answered step by step

Verified Expert Solution

Question

1 Approved Answer

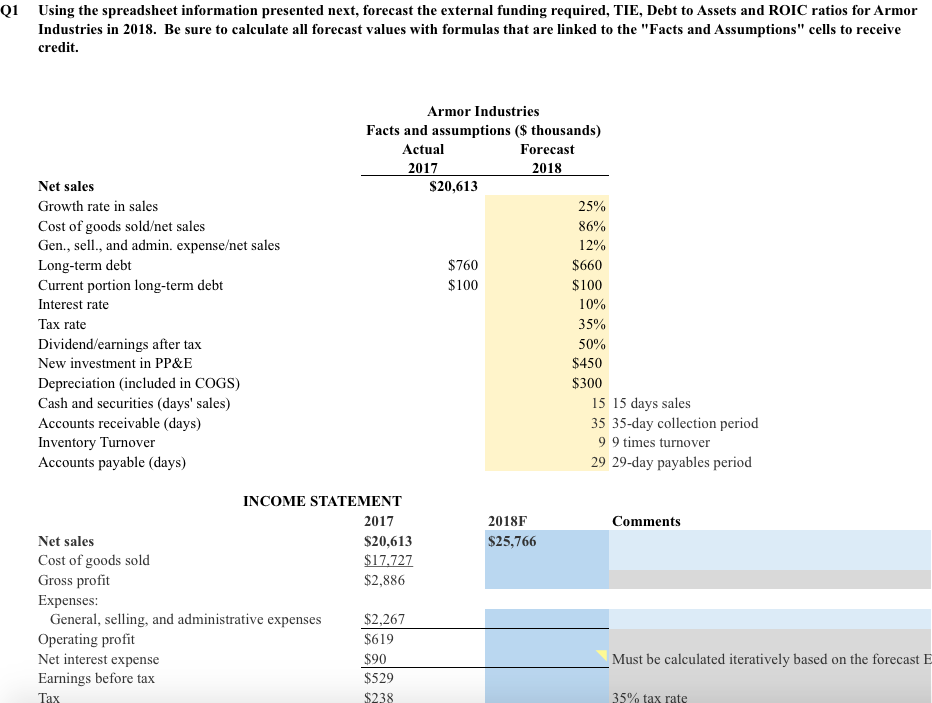

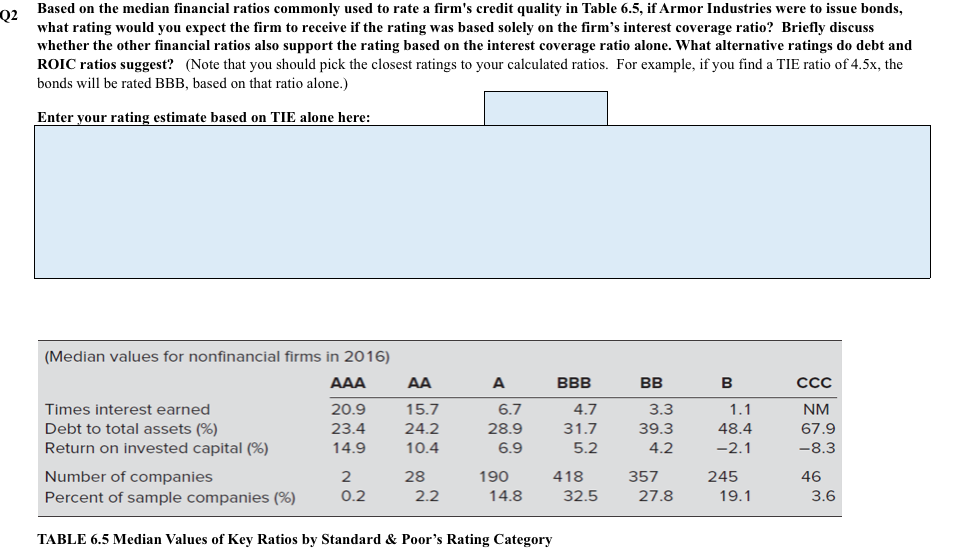

Q1 Using the spreadsheet information presented next, forecast the external funding required, TIE, Debt to Assets and ROIC ratios for Armor Industries in 2018.

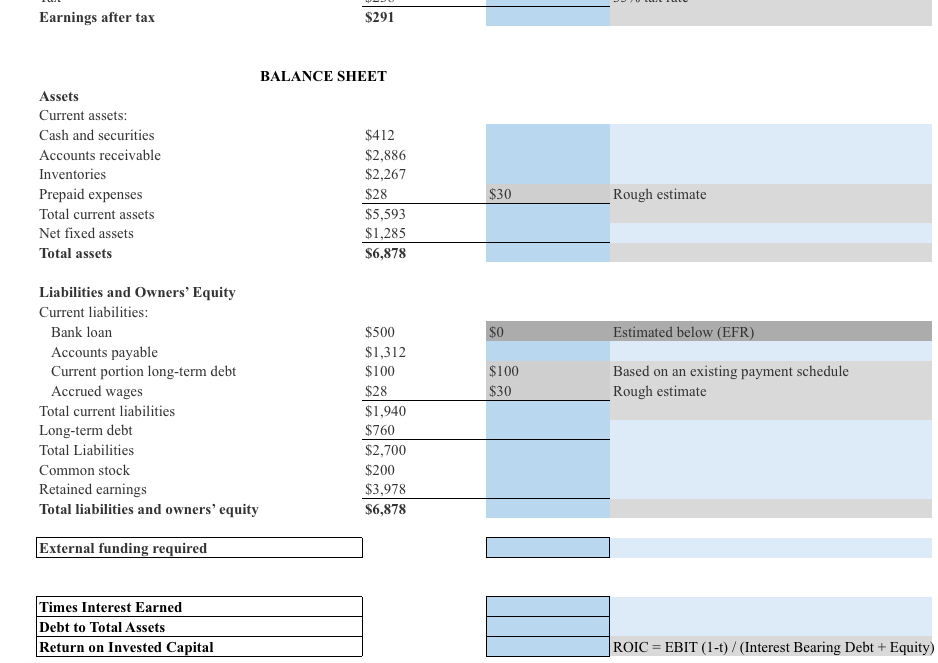

Q1 Using the spreadsheet information presented next, forecast the external funding required, TIE, Debt to Assets and ROIC ratios for Armor Industries in 2018. Be sure to calculate all forecast values with formulas that are linked to the "Facts and Assumptions" cells to receive credit. Armor Industries Facts and assumptions ($ thousands) Actual 2017 Forecast 2018 Net sales Growth rate in sales Cost of goods sold/net sales $20,613 25% 86% Gen., sell., and admin. expense/net sales 12% Long-term debt $760 $660 Current portion long-term debt $100 $100 Interest rate 10% Tax rate Dividend/earnings after tax New investment in PP&E Depreciation (included in COGS) Cash and securities (days' sales) Accounts receivable (days) Inventory Turnover Accounts payable (days) 35% 50% $450 $300 15 15 days sales 35 35-day collection period 99 times turnover 29 29-day payables period INCOME STATEMENT 2017 2018F Comments Net sales $20,613 $25,766 Cost of goods sold $17,727 Gross profit Expenses: General, selling, and administrative expenses $2,886 $2,267 Operating profit Net interest expense Earnings before tax Tax $619 $90 $529 $238 35% tax rate Must be calculated iteratively based on the forecast E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started