Answered step by step

Verified Expert Solution

Question

1 Approved Answer

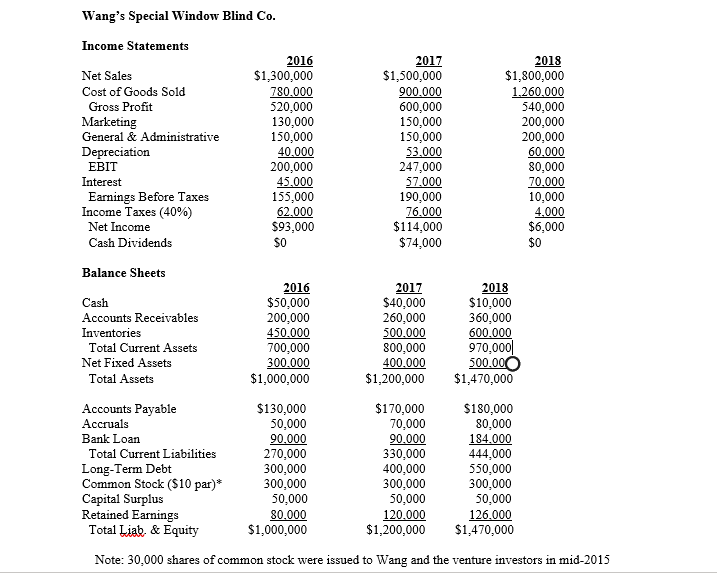

Q1. Wang was particularly concerned by the drop in cash from $50,000 in 2016 to $10,000 in 2018. Calculate the average current ratio, the quick

Q1. Wang was particularly concerned by the drop in cash from $50,000 in 2016 to $10,000 in 2018.

Calculate the average current ratio, the quick ratio, and the networking capital to total assets ratio

for 2016-2017 and 2017-2018.What has happened to the liquidity position?

Wang grew up in Shanghai, China and received a college degree from a vocational and technical institute in Shanghai. After working at a major window blind manufacturer in Shanghai 10 years, Wang realized that what he really wanted to do was to start and operate his own business. He took a vacation and traveled several countries including the U.S. Then, he was sure that he wanted to be an entrepreneur in the United States. Wang moved to the U.S. in early 2015. With $140,000 of his personal assets, and $210,000 from venture investors, he began operations in mid-2015 making special bamboo window 12 blinds. Following are the three years of income statements and balance sheets for his venture. Wang has felt that in order to maintain a competitive advantage that he would need to continue to expand sales. After first concentrating on selling bamboo blinds in the east coast in 2016 and 2017, he decided to enter the west coast market. He experienced an increase in expenses associated with identifying, contacting. and selling to customers in California, Oregon, and Washington. Since his net income dropped a lot in 2018, he hired you to know what is going on his venture. *Use averages of the prior and current year ratio calculations involving asset items.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started