Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q1-) What is the NPV with the simple project without any options. Draw the Decision Tree. Will you invest? Q2-) Assume you have ONLY

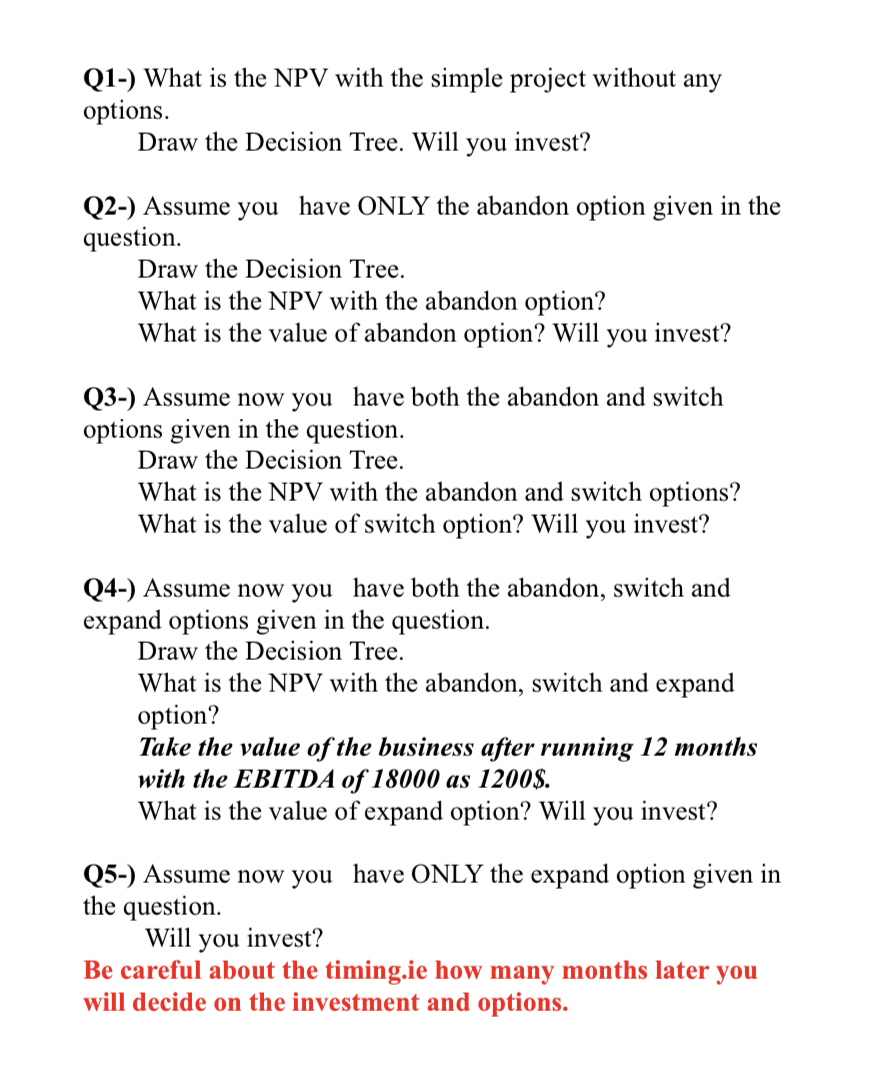

Q1-) What is the NPV with the simple project without any options. Draw the Decision Tree. Will you invest? Q2-) Assume you have ONLY the abandon option given in the question. Draw the Decision Tree. What is the NPV with the abandon option? What is the value of abandon option? Will you invest? Q3-) Assume now you have both the abandon and switch options given in the question. Draw the Decision Tree. What is the NPV with the abandon and switch options? What is the value of switch option? Will you invest? Q4-) Assume now you have both the abandon, switch and expand options given in the question. Draw the Decision Tree. What is the NPV with the abandon, switch and expand option? Take the value of the business after running 12 months with the EBITDA of 18000 as 1200$. What is the value of expand option? Will you invest? Q5-) Assume now you have ONLY the expand option given in the question. Will you invest? Be careful about the timing.ie how many months later you will decide on the investment and options.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started