Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q.1 What should be the major source of funds for a business? [2 Points] How would accounting information be used to make the decision about

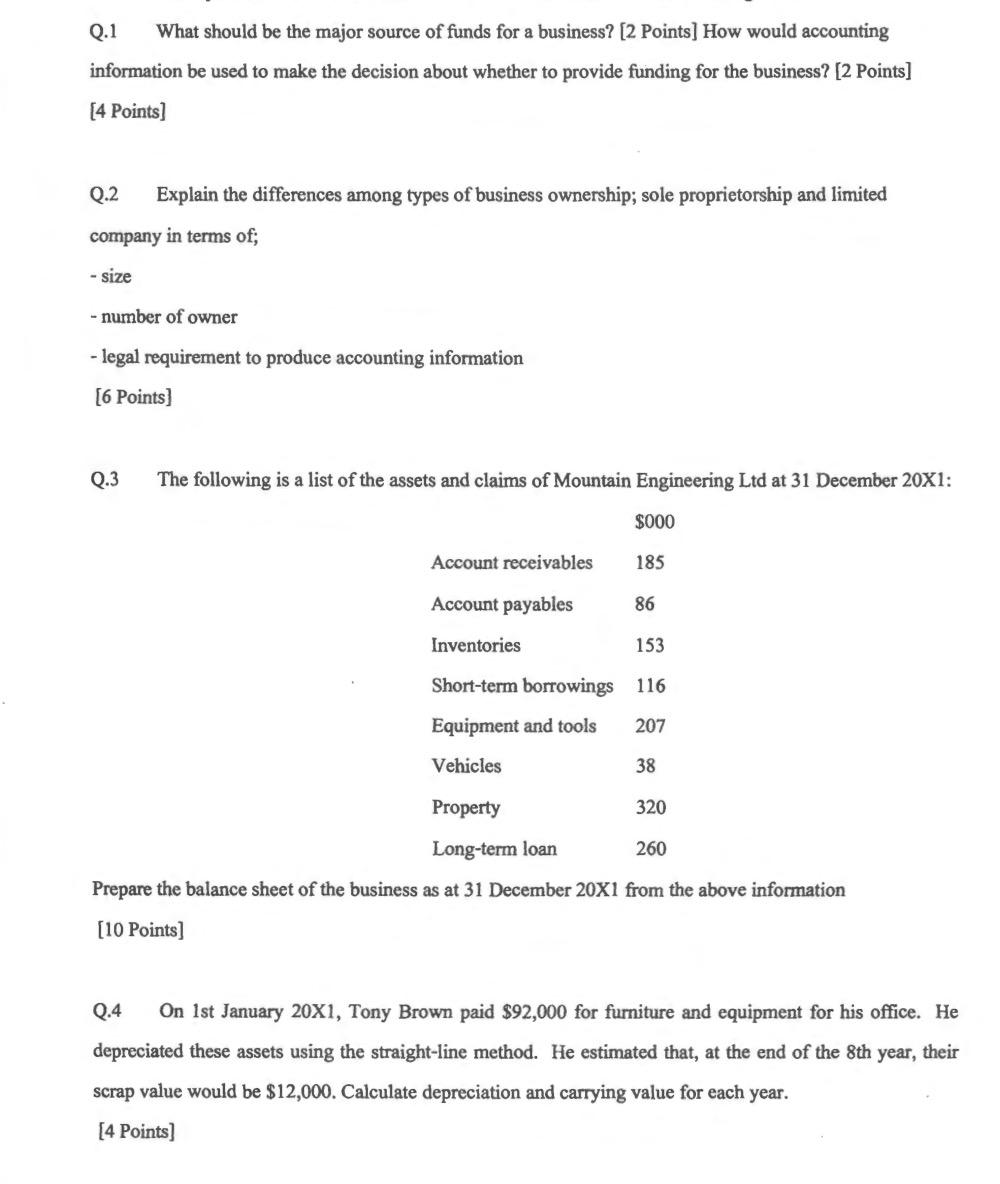

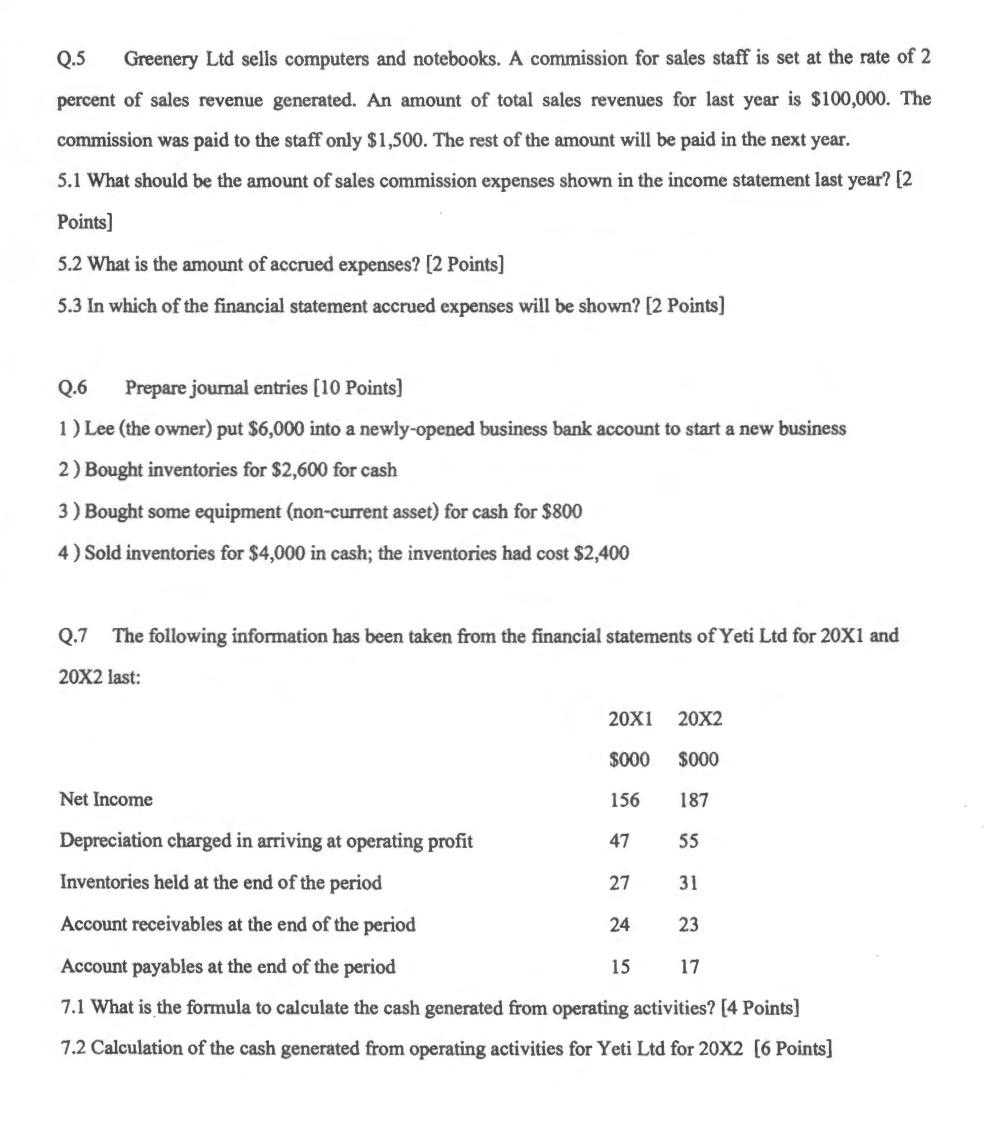

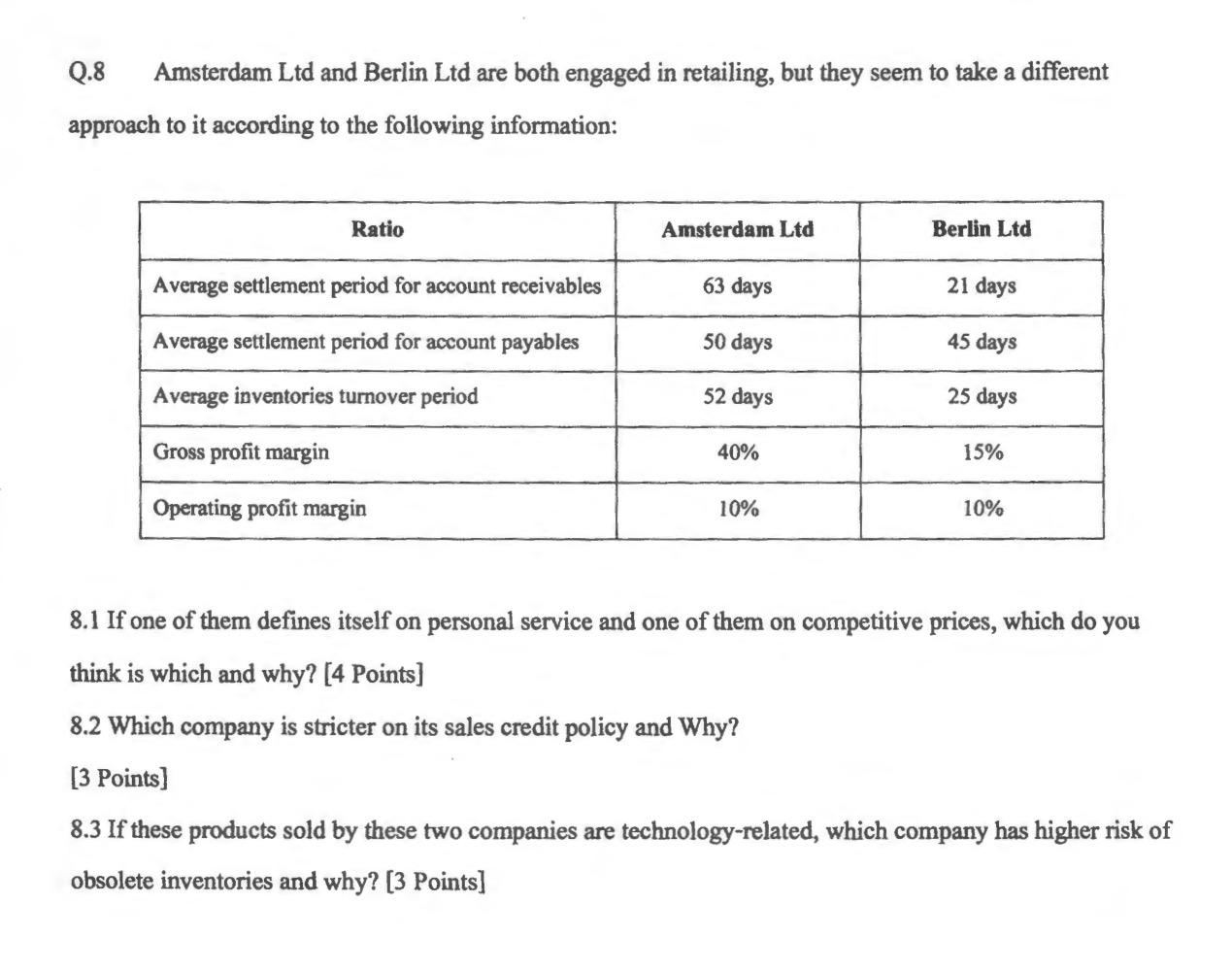

Q.1 What should be the major source of funds for a business? [2 Points] How would accounting information be used to make the decision about whether to provide funding for the business? [2 Points] [4 Points) Q.2 Explain the differences among types business ownership; sole proprietorship and limited company in terms of; - size - number of owner - legal requirement to produce accounting information [6 Points) Q.3 The following is a list of the assets and claims of Mountain Engineering Ltd at 31 December 20X1: $000 Account receivables 185 Account payables 86 Inventories 153 Short-term borrowings 116 Equipment and tools 207 Vehicles 38 Property 320 Long-term loan 260 Prepare the balance sheet of the business as at 31 December 20X1 from the above information (10 Points] Q.4 On 1st January 20X1, Tony Brown paid $92,000 for furniture and equipment for his office. He depreciated these assets using the straight-line method. He estimated that, at the end of the 8th year, their scrap value would be $12,000. Calculate depreciation and carrying value for each year. [4 Points) Q.5 Greenery Ltd sells computers and notebooks. A commission for sales staff is set at the rate of 2 percent of sales revenue generated. An amount of total sales revenues for last year is $100,000. The commission was paid to the staff only $1,500. The rest of the amount will be paid in the next year. 5.1 What should be the amount of sales commission expenses shown in the income statement last year? [2 Points] 5.2 What is the amount of accrued expenses? [2 Points] 5.3 In which of the financial statement accrued expenses will be shown? [2 Points] Q.6 Prepare journal entries (10 Points) 1) Lee (the owner) put $6,000 into a newly-opened business bank account to start a new business 2) Bought inventories for $2,600 for cash 3) Bought some equipment (non-current asset) for cash for $800 4) Sold inventories for $4,000 in cash; the inventories had cost $2,400 Q.7 The following information has been taken from the financial statements of Yeti Ltd for 20X1 and 20x2 last: 20X1 20X2 $000 $000 Net Income 156 187 Depreciation charged in arriving at operating profit 47 55 Inventories held at the end of the period 27 31 Account receivables at the end of the period 24 23 15 17 Account payables at the end of the period 7.1 What is the formula to calculate the cash generated from operating activities? [4 Points] 7.2 Calculation of the cash generated from operating activities for Yeti Ltd for 20X2 [6 Points] Q.8 Amsterdam Ltd and Berlin Ltd are both engaged in retailing, but they seem to take a different approach to it according to the following information: Ratio Amsterdam Ltd Berlin Ltd Average settlement period for account receivables 63 days 21 days Average settlement period for account payables 50 days 45 days Average inventories turnover period 52 days 25 days Gross profit margin 40% 15% Operating profit margin 10% 10% 8.1 If one of them defines itself on personal service and one of them on competitive prices, which do you think is which and why? [4 Points] 8.2 Which company is stricter on its sales credit policy and Why? [3 Points) 8.3 If these products sold by these two companies are technology-related, which company has higher risk of obsolete inventories and why? [3 Points]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started