Question

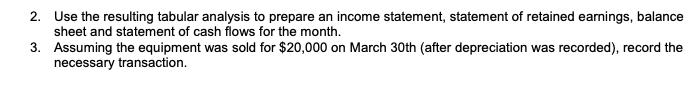

Q1: What was the company's net income for march? Q2: What were the company's cash flows for operating activities for march? Use a positive number

Q1: What was the company's net income for march?

Q2: What were the company's cash flows for operating activities for march? Use a positive number to indicate an overall (i.e. net) inflow or a negative number to indicate an overall outflow.

Q3: What were the company's cash flows for financing activities for march? Use a positive number to indicate an overall (i.e. net) inflow or a negative number to indicate an overall outflow.

Q4: What was the company's cash balance at the end of march?

Q5: What was the company's accounts receivable balance at the end of march?

Q6: What was the company's pre-paid expenses balance at the end of march?

Q7: What was the company's supplies balance at the end of march?

Q8: What was the company's equipment balance at the end of march ?

Q9: What was the company's accumulated depreciation balance at the end of march?

Q10: What was the company's accounts payable at the end of march?

Q11: What was the company's notes payable balance at the end of march?

Q12: What was the company's unearned revenue balance at the end of March?

Q13: What was the gain or loss on the sale of the equipment? Use a positive number to indicate a gain or a negative number to indicate loss.

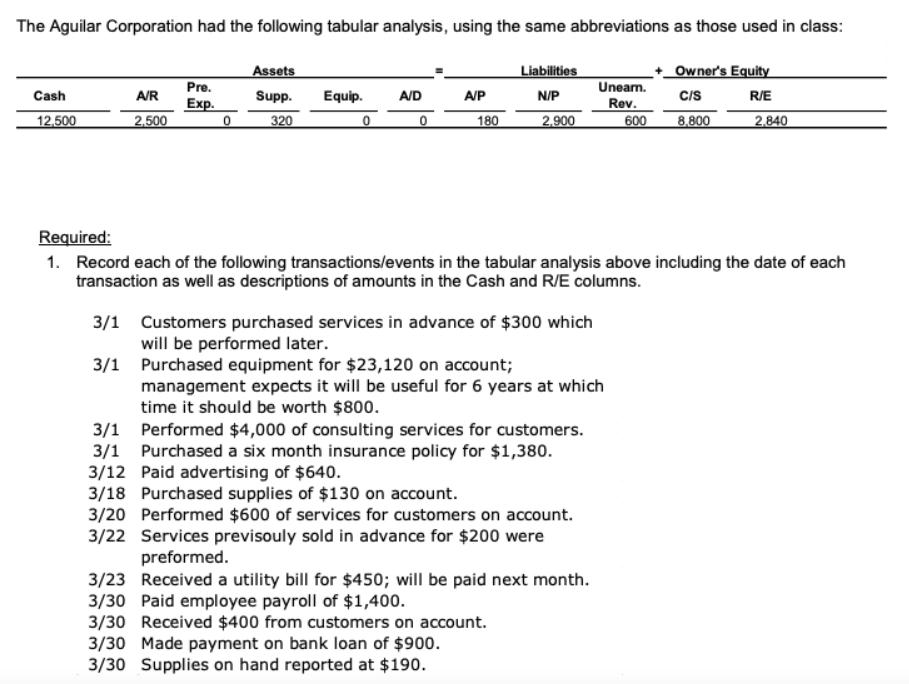

The Aguilar Corporation had the following tabular analysis, using the same abbreviations as those used in class: Liabilities N/P 2,900 Owner's Equity C/S R/E 8,800 Cash 12,500 A/R 2,500 Pre. Exp. 0 Assets Supp. 320 Equip. 0 A/D 0 A/P 180 3/1 Customers purchased services in advance of $300 which will be performed later. 3/1 Required: 1. Record each of the following transactions/events in the tabular analysis above including the date of each transaction as well as descriptions of amounts in the Cash and R/E columns. Purchased equipment for $23,120 on account; management expects it will be useful for 6 years at which time it should be worth $800. 3/1 Performed $4,000 of consulting services for customers. 3/1 Purchased a six month insurance policy for $1,380. Paid advertising of $640. 3/12 3/18 3/20 3/22 Purchased supplies of $130 on account. Performed $600 of services for customers on account. Services previsouly sold in advance for $200 were preformed. Unearn. Rev. 600 3/23 Received a utility bill for $450; will be paid next month. 3/30 Paid employee payroll of $1,400. 3/30 Received $400 from customers on account. 3/30 Made payment on bank loan of $900. 3/30 Supplies on hand reported at $190. 2,840

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided information here is the updated tabular analysis with the recorded transactions Date AR Pre Exp Supp Equip AD AP NP Unearn Rev CS RE Cash Description 2500 12500 320 0 0 0 0 2900 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started