Question

Q10. You are provided with the following forecast cash flow information for an investment project that your company is considering: Year 1 2 3

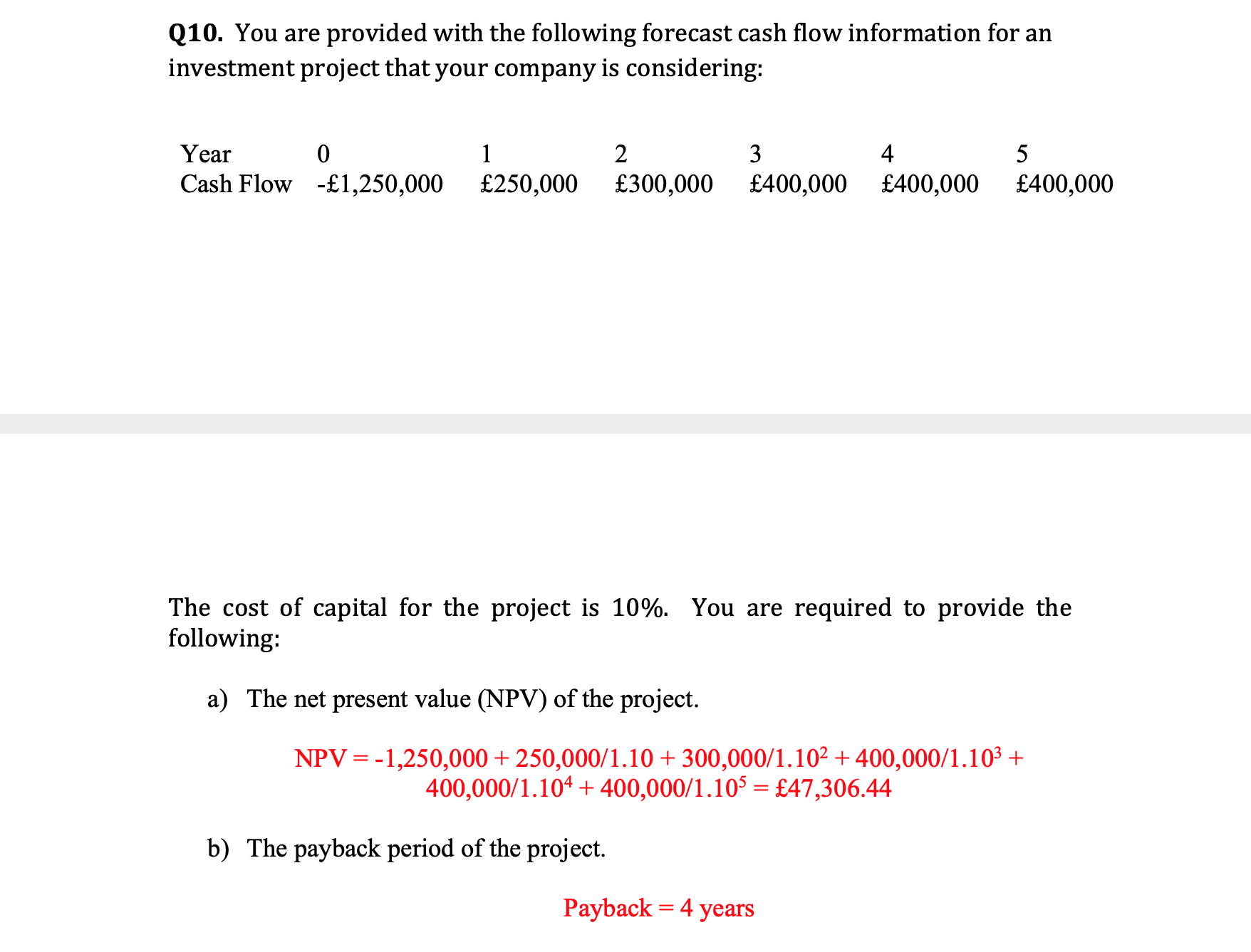

Q10. You are provided with the following forecast cash flow information for an investment project that your company is considering: Year 1 2 3 4 5 Cash Flow -1,250,000 250,000 300,000 400,000 400,000 400,000 0 The cost of capital for the project is 10%. You are required to provide the following: a) The net present value (NPV) of the project. NPV = -1,250,000+250,000/1.10 + 300,000/1.10 +400,000/1.10 + 400,000/1.104 + 400,000/1.105 = 47,306.44 b) The payback period of the project. Payback = 4 years

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

c The profitability index of the project Profitability Index Present Value of Cash Flows Initial Inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting The Cornerstone Of Business Decision Making

Authors: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

8th Edition

0357715349, 978-0357715345

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App