Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q.1.1. Dokdiam Sdn Bhd is contemplating of buying a new heating machine Panaskan, for RM480000. The operating and maintenance costs will be RM65000 for

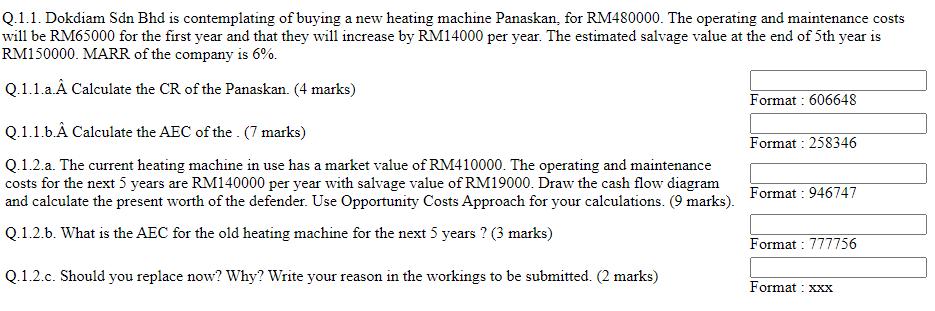

Q.1.1. Dokdiam Sdn Bhd is contemplating of buying a new heating machine Panaskan, for RM480000. The operating and maintenance costs will be RM65000 for the first year and that they will increase by RM14000 per year. The estimated salvage value at the end of 5th year is RM150000. MARR of the company is 6%. Q.1.1.a. Calculate the CR of the Panaskan. (4 marks) Format : 606648 Q.1.1.b. Calculate the AEC of the. (7 marks) Format : 258346 Q.1.2.a. The current heating machine in use has a market value of RM410000. The operating and maintenance costs for the next 5 years are RM140000 per year with salvage value of RM19000. Draw the cash flow diagram and calculate the present worth of the defender. Use Opportunity Costs Approach for your calculations. (9 marks). Format : 946747 Q.1.2.b. What is the AEC for the old heating machine for the next 5 years ? (3 marks) Format : 777756 Q.1.2.c. Should you replace now? Why? Write your reason in the workings to be submitted. (2 marks) Format : XXX

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started