Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q11 Q11 Please only final answer Fill the table Candlyicious, a candy show in Dubai expects the following sales and material payments for the period

Q11

Q11

Please only final answer Fill the table

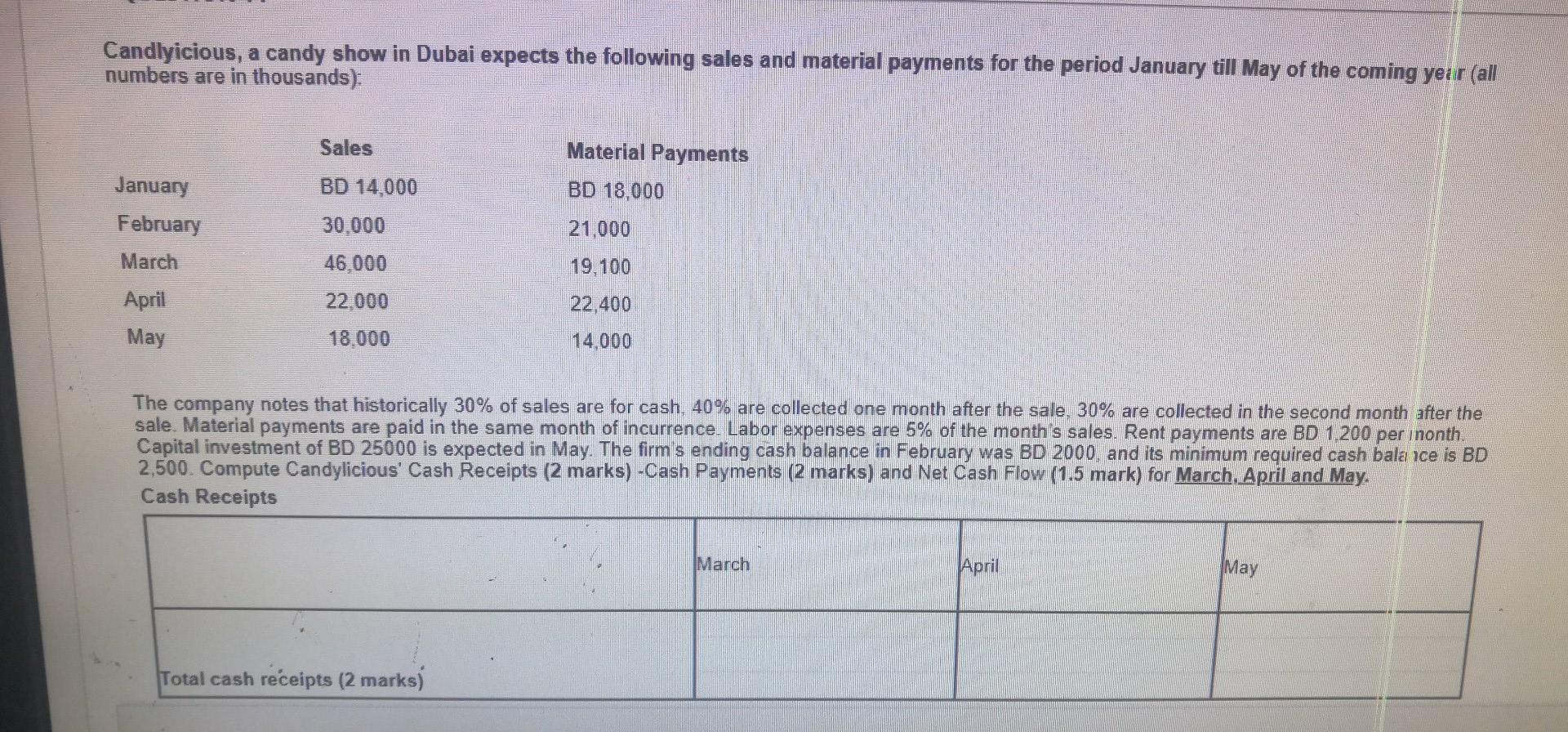

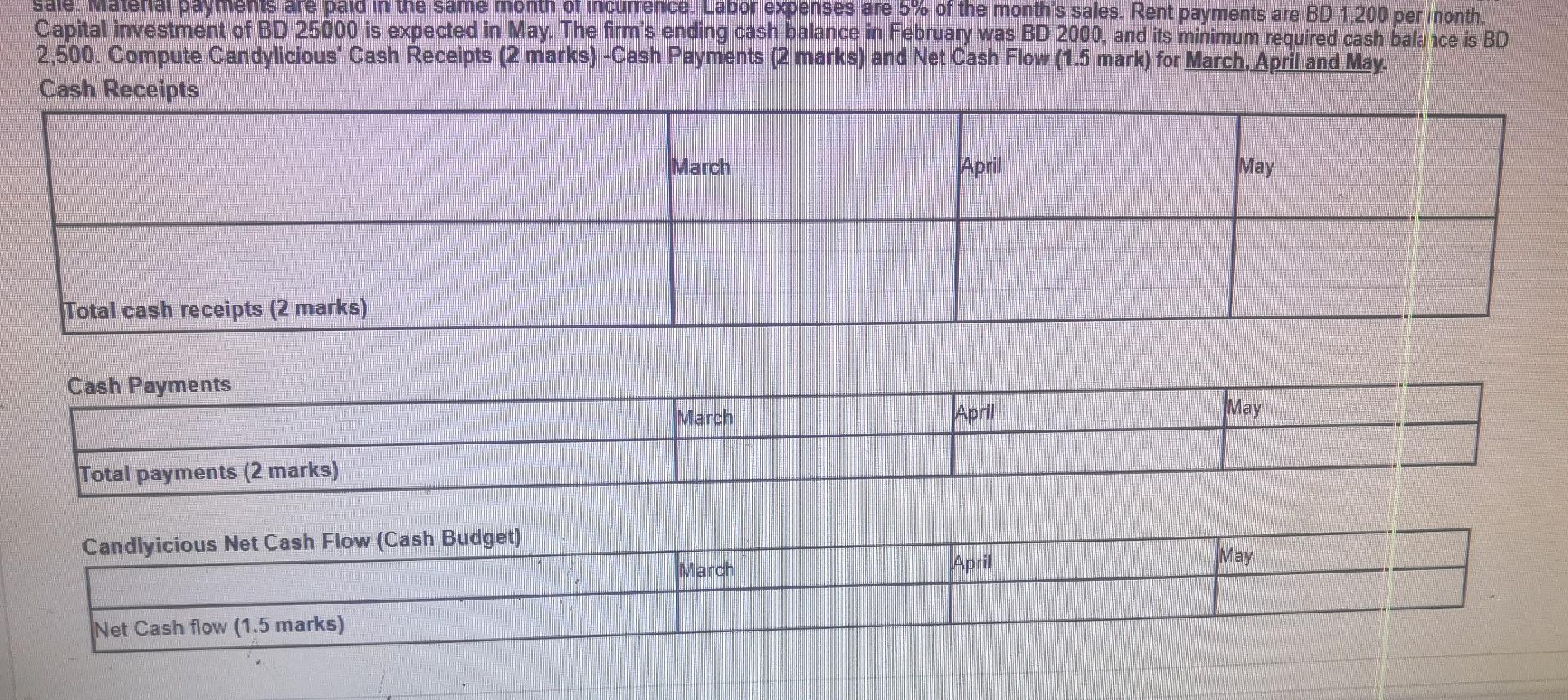

Candlyicious, a candy show in Dubai expects the following sales and material payments for the period January till May of the coming year (all numbers are in thousands): Sales Material Payments January BD 14,000 BD 18,000 February 30,000 21,000 March 46,000 19,100 April 22,000 22,400 14,000 May 18,000 The company notes that historically 30% of sales are for cash, 40% are collected one month after the sale, 30% are collected in the second month after the sale. Material payments are paid in the same month of incurrence. Labor expenses are 5% of the month's sales. Rent payments are BD 1.200 per month. Capital investment of BD 25000 is expected in May. The firm's ending cash balance in February was BD 2000, and its minimum required cash balance is BD 2,500. Compute Candylicious' Cash Receipts (2 marks) -Cash Payments (2 marks) and Net Cash Flow (1.5 mark) for March, April and May. Cash Receipts March April May Total cash receipts (2 marks) sale. Mater payments are paid in the same month of incurrence. Labor expenses are 5% of the month's sales. Rent payments are BD 1,200 per month. Capital investment of BD 25000 is expected in May. The firm's ending cash balance in February was BD 2000, and its minimum required cash balance is BD 2,500. Compute Candylicious' Cash Receipts (2 marks) -Cash Payments (2 marks) and Net Cash Flow (1.5 mark) for March, April and May. Cash Receipts March April May Total cash receipts (2 marks) Cash Payments March Total payments (2 marks) Candlyicious Net Cash Flow (Cash Budget) March Net Cash flow (1.5 marks) April April May MayStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started