Answered step by step

Verified Expert Solution

Question

1 Approved Answer

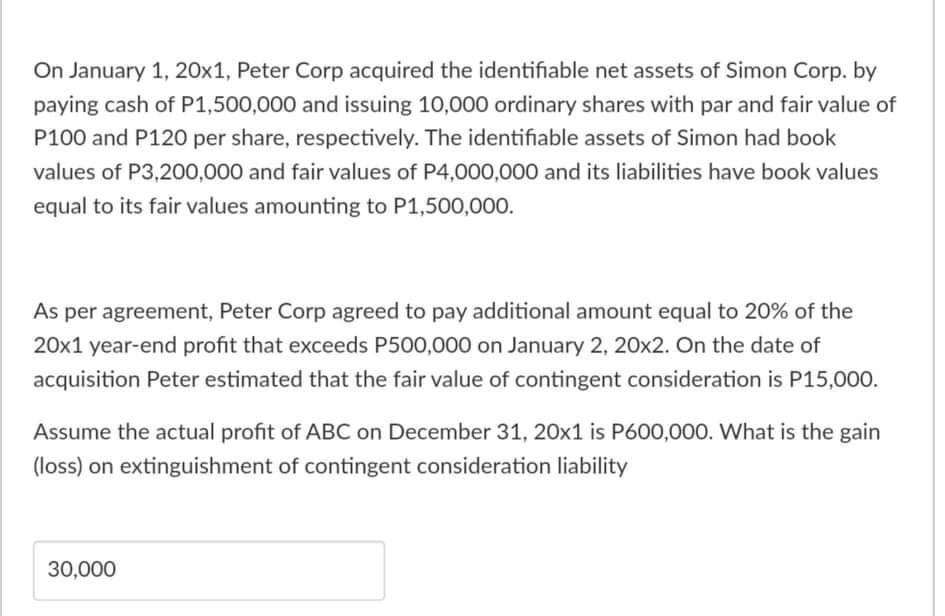

q12 On January 1, 20x1, Peter Corp acquired the identifiable net assets of Simon Corp. by paying cash of P1,500,000 and issuing 10,000 ordinary shares

q12

On January 1, 20x1, Peter Corp acquired the identifiable net assets of Simon Corp. by paying cash of P1,500,000 and issuing 10,000 ordinary shares with par and fair value of P100 and P120 per share, respectively. The identifiable assets of Simon had book values of P3,200,000 and fair values of P4,000,000 and its liabilities have book values equal to its fair values amounting to P1,500,000. As per agreement, Peter Corp agreed to pay additional amount equal to 20% of the 20x1 year-end profit that exceeds P500,000 on January 2, 20x2. On the date of acquisition Peter estimated that the fair value of contingent consideration is P15,000. Assume the actual profit of ABC on December 31, 20x1 is P600,000. What is the gain (loss) on extinguishment of contingent consideration liability 30,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started