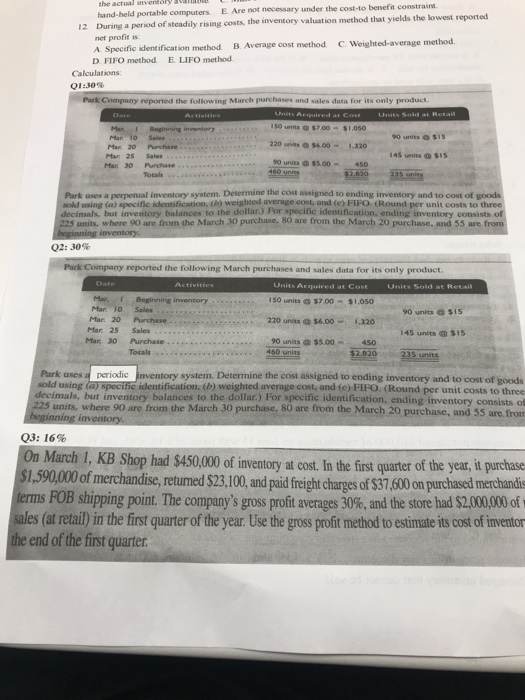

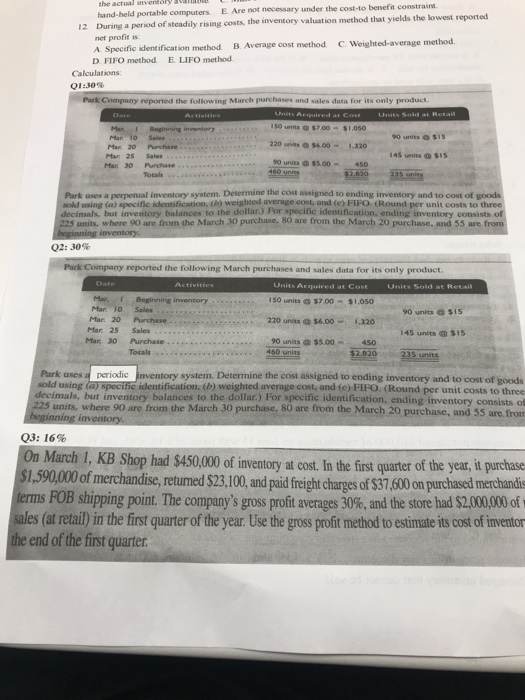

the actual inventory hand-held portable computers E Are not necessary under the cost to benefit constraint 12. During a period of steadily rising costs, the inventory valuation method that yields the lowest reported net profit is A Specific identification method B. Average cost method C Weighted-average method D. FIFO method E. LIFO method Calculations: 01:05 Park Company reported the following March purchases and sales data for its only product. Us Aceda Can Soldat Retail 150 units @ $7.00 - $1.050 Mar 10 Sales 90 units SIS Mar 20 Purchase ...... 220 56.00 - .320 Mar 25 Sales .......... 145 units S15 Mar 30 Purchase 90 units @ $5.00 - 450 235 units Park uses a Testual inventory system. Determine the cost assigned to ending inventory and to cost of goods sold using a specific identification, (b) weighted average cost, and (e) FIFO. (Round per unit costs to three decimals, but inventory balances to the dollar) For specific identification, ending inventory consists of 225 units, where 90 are from the March 30 purchase, 80 are from the March 20 purchase and 55 are from beginning inventory Q2: 30% Date Park Company reported the following March purchases and sales data for its only product. Units Acquired at Cost Units Sold at Retail Mar Beginning inventory 150 units @ $7.00 - $1,050 Mar To Sales 90 units @ $15 Mar. 20 Purchase 220 unit 56.00 1.320 Mar 25 Sales 145 units @ $15 Mar 30 Purchase ..... . .. 90 units @ $5.00 450 Totals 460 units $2.820 Park uses periodic Inventory system. Determine the cost assigned to ending inventory and to cost of rods sold using a specific identification. (b) weighted average cost, and (c) FIFO. (Round per unit costs to three decimals, but inventory balances to the dollar) For specte identiniention, ending inventory consists on 225 units, where 90 are from the March 30 purchase, 80 are from the March 20 purchase, and 55 are from beginning inventory. Q3: 16% On March 1, KB Shop had $450,000 of inventory at cost. In the first quarter of the year, it purchase $1,590,000 of merchandise, retumed $23,100, and paid freight charges of $37,600 on purchased merchandis terms FOB shipping point. The company's gross profit averages 30%, and the store had $2,000,000 of sales (at retail) in the first quarter of the year. Use the gross profit method to estimate its cost of inventor the end of the first quarter