Answered step by step

Verified Expert Solution

Question

1 Approved Answer

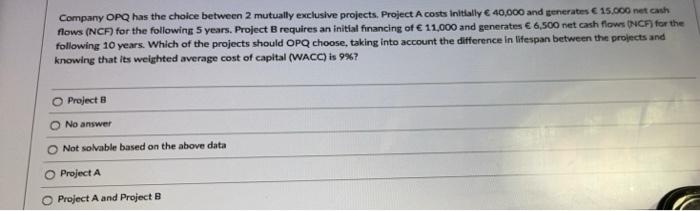

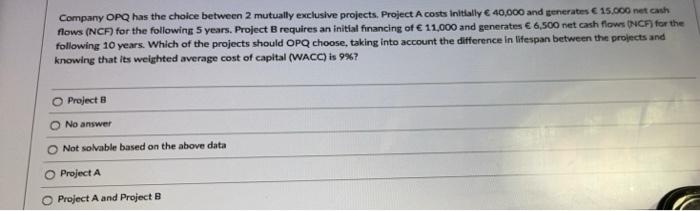

Q14 Company OPQ has the choice between 2 mutually exclusive projects. Project A costs initially 40,000 and generates 15.000 net cash flows (NCF) for the

Q14

Company OPQ has the choice between 2 mutually exclusive projects. Project A costs initially 40,000 and generates 15.000 net cash flows (NCF) for the following 5 years. Project B requires an initial financing of 11,000 and generates 6,500 net cash flows (NC) for the following 10 years. Which of the projects should OPQ choose, taking into account the difference in lifespan between the projects and knowing that its weighted average cost of capital (WACC) is 9%? Project B No answer Not solvable based on the above data Project A Project A and Project B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started