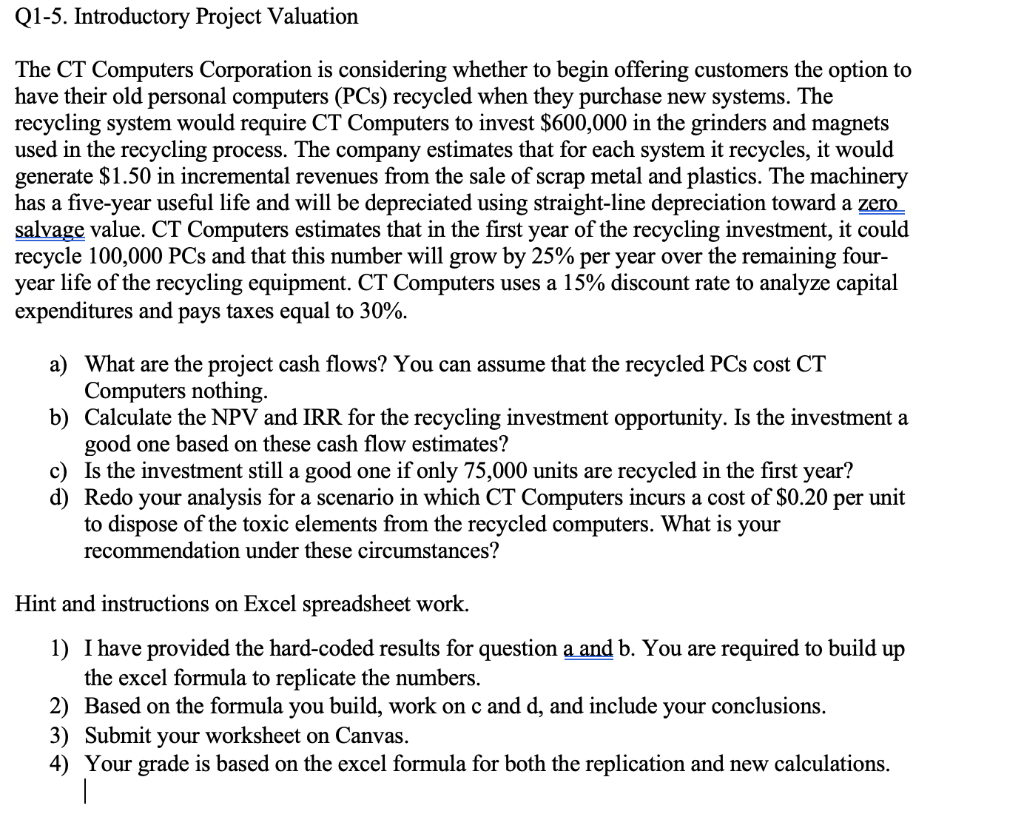

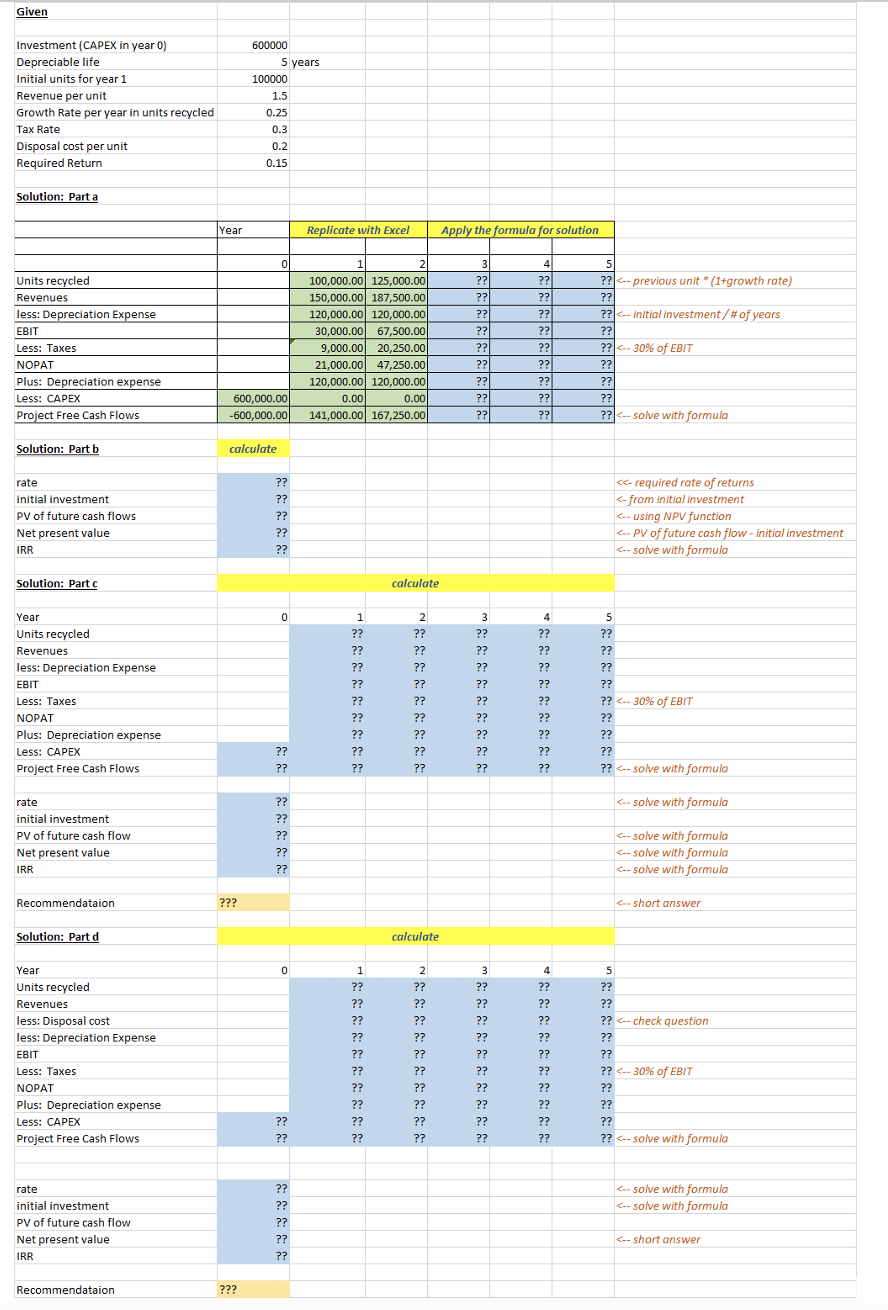

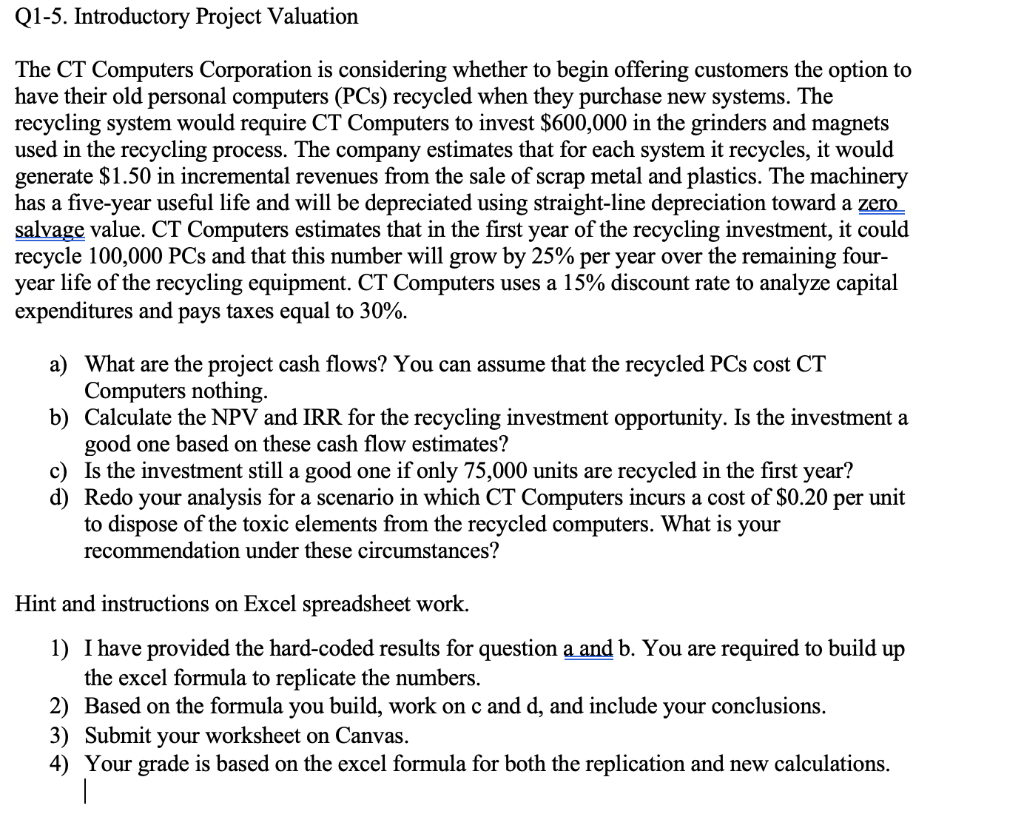

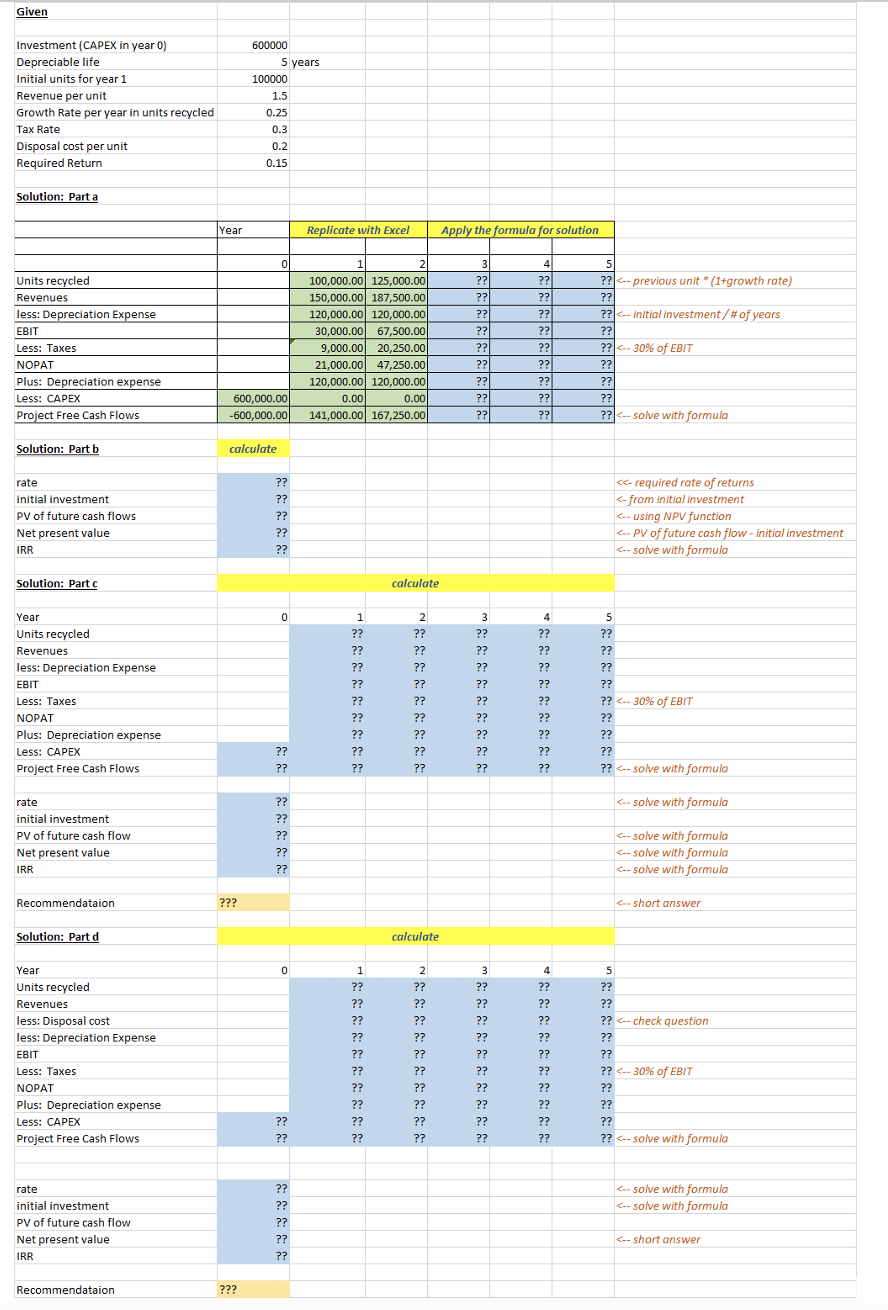

Q1-5. Introductory Project Valuation The CT Computers Corporation is considering whether to begin offering customers the option to have their old personal computers (PCs) recycled when they purchase new systems. The recycling system would require CT Computers to invest $600,000 in the grinders and magnets used in the recycling process. The company estimates that for each system it recycles, it would generate $1.50 in incremental revenues from the sale of scrap metal and plastics. The machinery has a five-year useful life and will be depreciated using straight-line depreciation toward a zero salvage value. CT Computers estimates that in the first year of the recycling investment, it could recycle 100,000 PCs and that this number will grow by 25% per year over the remaining four- year life of the recycling equipment. CT Computers uses a 15% discount rate to analyze capital expenditures and pays taxes equal to 30%. a) What are the project cash flows? You can assume that the recycled PCs cost CT Computers nothing. b) Calculate the NPV and IRR for the recycling investment opportunity. Is the investment a good one based on these cash flow estimates? c) Is the investment still a good one if only 75,000 units are recycled in the first year? d) Redo your analysis for a scenario in which CT Computers incurs a cost of $0.20 per unit to dispose of the toxic elements from the recycled computers. What is your recommendation under these circumstances? Hint and instructions on Excel spreadsheet work. 1) I have provided the hard-coded results for question a and b. You are required to build up the excel formula to replicate the numbers. 2) Based on the formula you build, work on c and d, and include your conclusions. 3) Submit your worksheet on Canvas. 4) Your grade is based on the excel formula for both the replication and new calculations. | Given Investment (CAPEX in year 0) Depreciable life Initial units for year 1 Revenue per unit Growth Rate per year in units recycled Tax Rate Disposal cost per unit Required Return 600000 5 years 100000 1.5 0.25 0.3 0.2 0.15 Solution: Parta Year Replicate with Excel Apply the formula for solution 0 4 Units recycled Revenues less: Depreciation Expense EBIT Less: Taxes NOPAT Plus: Depreciation expense Less: CAPEX Project Free Cash Flows 1 21 100,000.00 125,000.00 150,000.00 187,500.00 120,000.00 120,000.00 30,000.00 67,500.00 9,000.00 20,250.00 21,000.00 47,250.00 120,000.00 120,000.00 0.00 0.00 141,000.00 167,250.00 3 ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? ?? 51 ?? - previous unit *(1+growth rate) ?? ??