Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q15 Navarro's Intra-Company Hedging. Navarro was a U.S.-based multinational company which manufactured and distributed specialty materials for sound-proofing construction. It had recently established a new

Q15

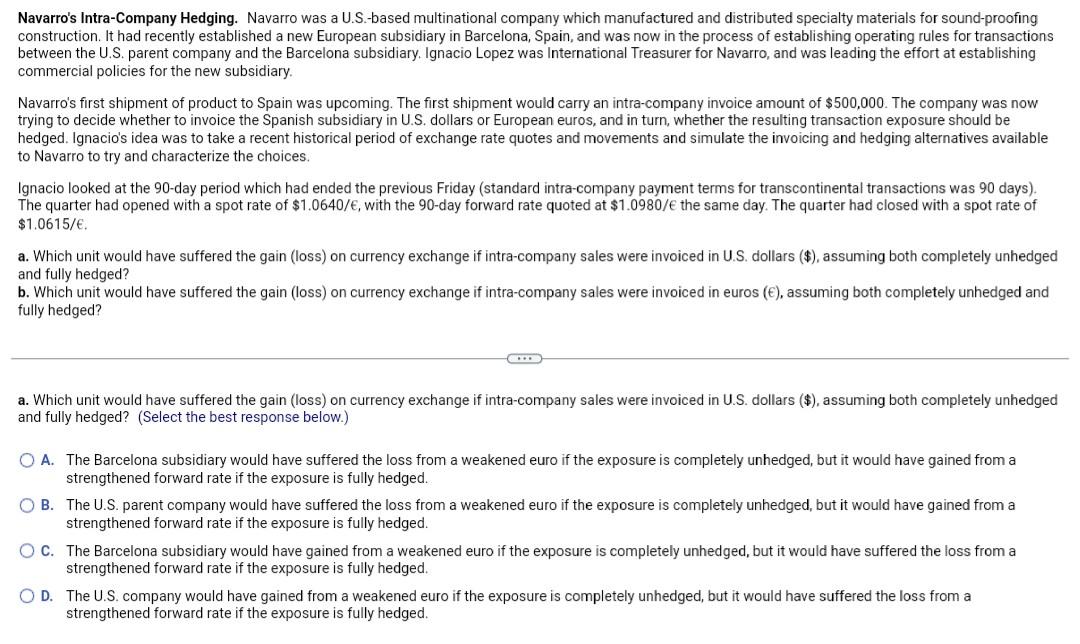

Navarro's Intra-Company Hedging. Navarro was a U.S.-based multinational company which manufactured and distributed specialty materials for sound-proofing construction. It had recently established a new European subsidiary in Barcelona, Spain, and was now in the process of establishing operating rules for transactions between the U.S. parent company and the Barcelona subsidiary. Ignacio Lopez was International Treasurer for Navarro, and was leading the effort at establishing commercial policies for the new subsidiary. Navarro's first shipment of product to Spain was upcoming. The first shipment would carry an intra-company invoice amount of $500,000. The company was now trying to decide whether to invoice the Spanish subsidiary in U.S. dollars or European euros, and in turn, whether the resulting transaction exposure should be hedged. Ignacio's idea was to take a recent historical period of exchange rate quotes and movements and simulate the invoicing and hedging alternatives available to Navarro to try and characterize the choices. Ignacio looked at the 90-day period which had ended the previous Friday (standard intra-company payment terms for transcontinental transactions was 90 days) The quarter had opened with a spot rate of $1.0640/, with the 90-day forward rate quoted at $1.0980/e the same day. The quarter had closed with a spot rate of $1.0615/. a. Which unit would have suffered the gain (loss) on currency exchange if intra-company sales were invoiced in U.S. dollars ($), assuming both completely unhedged and fully hedged? b. Which unit would have suffered the gain (loss) on currency exchange if intra-company sales were invoiced in euros (), assuming both completely unhedged and fully hedged? DO a. Which unit would have suffered the gain (loss) on currency exchange if intra-company sales were invoiced in U.S. dollars ($), assuming both completely unhedged and fully hedged? (Select the best response below.) O A. The Barcelona subsidiary would have suffered the loss from a weakened euro if the exposure is completely unhedged, but it would have gained from a strengthened forward rate if the exposure is fully hedged. OB. The U.S. parent company would have suffered the loss from a weakened euro if the exposure is completely unhedged, but it would have gained from a strengthened forward rate if the exposure is fully hedged. O C. The Barcelona subsidiary would have gained from a weakened euro if the exposure is completely unhedged, but it would have suffered the loss from a strengthened forward rate if the exposure is fully hedged. OD The U.S. company would have gained from a weakened euro if the exposure is completely unhedged, but it would have suffered the loss from a strengthened forward rate if the exposure is fully hedgedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started