Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Q.1-Please answer the following: A. Risk Averse Behavior suggests that the required return is : An increasing function of risk A decreasing function of risk

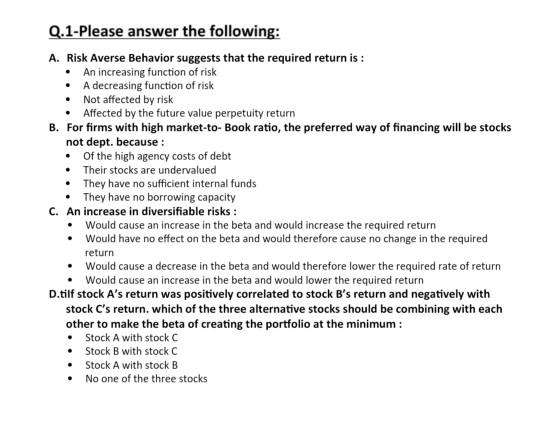

Q.1-Please answer the following: A. Risk Averse Behavior suggests that the required return is : An increasing function of risk A decreasing function of risk Not affected by risk Affected by the future value perpetuity return B. For firms with high market-to-Book ratio, the preferred way of financing will be stocks not dept. because : Of the high agency costs of debt Their stocks are undervalued They have no sufficient internal funds They have no borrowing capacity C. An increase in diversifiable risks: Would cause an increase in the beta and would increase the required return Would have no effect on the beta and would therefore cause no change in the required return Would cause a decrease in the beta and would therefore lower the required rate of return Would cause an increase in the beta and would lower the required return D.tilf stock A's return was positively correlated to stock B's return and negatively with stock C's return, which of the three alternative stocks should be combining with each other to make the beta of creating the portfolio at the minimum : Stock A with stock Stock B with stock C Stock A with stock B No one of the three stocks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started