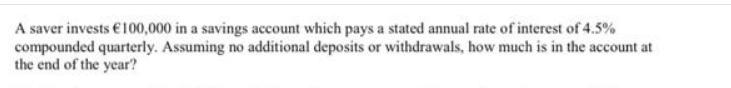

A saver invests 100,000 in a savings account which pays a stated annual rate of interest of 4.5% compounded quarterly. Assuming no additional deposits

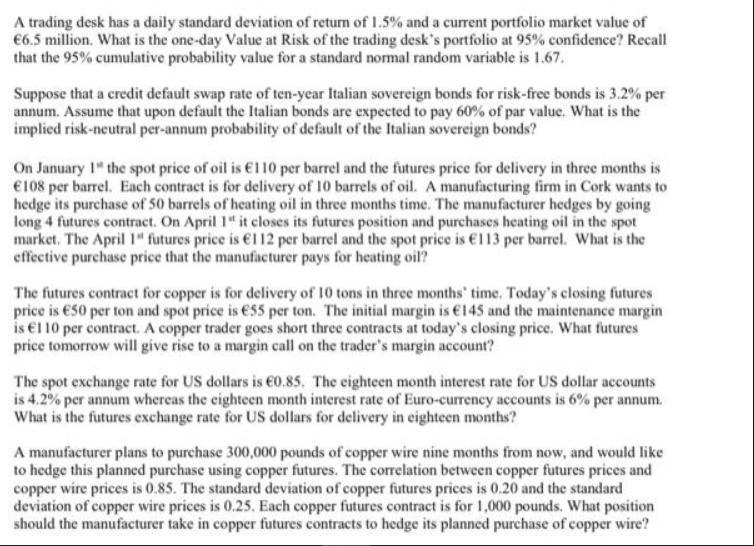

A saver invests 100,000 in a savings account which pays a stated annual rate of interest of 4.5% compounded quarterly. Assuming no additional deposits or withdrawals, how much is in the account at the end of the year? A trading desk has a daily standard deviation of return of 1.5% and a current portfolio market value of 6.5 million. What is the one-day Value at Risk of the trading desk's portfolio at 95% confidence? Recall that the 95% cumulative probability value for a standard normal random variable is 1.67. Suppose that a credit default swap rate of ten-year Italian sovereign bonds for risk-free bonds is 3.2% per annum. Assume that upon default the Italian bonds are expected to pay 60% of par value. What is the implied risk-neutral per-annum probability of default of the Italian sovereign bonds? On January 1" the spot price of oil is 110 per barrel and the futures price for delivery in three months is 108 per barrel. Each contract is for delivery of 10 barrels of oil. A manufacturing firm in Cork wants to hedge its purchase of 50 barrels of heating oil in three months time. The manufacturer hedges by going long 4 futures contract. On April 1" it closes its futures position and purchases heating oil in the spot market. The April 1" futures price is 112 per barrel and the spot price is 113 per barrel. What is the effective purchase price that the manufacturer pays for heating oil? The futures contract for copper is for delivery of 10 tons in three months' time. Today's closing futures price is 50 per ton and spot price is 55 per ton. The initial margin is 145 and the maintenance margin is 110 per contract. A copper trader goes short three contracts at today's closing price. What futures price tomorrow will give rise to a margin call on the trader's margin account? The spot exchange rate for US dollars is 0.85. The eighteen month interest rate for US dollar accounts is 4.2% per annum whereas the eighteen month interest rate of Euro-currency accounts is 6% per annum. What is the futures exchange rate for US dollars for delivery in eighteen months? A manufacturer plans to purchase 300,000 pounds of copper wire nine months from now, and would like to hedge this planned purchase using copper futures. The correlation between copper futures prices and copper wire prices is 0.85. The standard deviation of copper futures prices is 0.20 and the standard deviation of copper wire prices is 0.25. Each copper futures contract is for 1,000 pounds. What position should the manufacturer take in copper futures contracts to hedge its planned purchase of copper wire? A saver invests 100,000 in a savings account which pays a stated annual rate of interest of 4.5% compounded quarterly. Assuming no additional deposits or withdrawals, how much is in the account at the end of the year? A trading desk has a daily standard deviation of return of 1.5% and a current portfolio market value of 6.5 million. What is the one-day Value at Risk of the trading desk's portfolio at 95% confidence? Recall that the 95% cumulative probability value for a standard normal random variable is 1.67. Suppose that a credit default swap rate of ten-year Italian sovereign bonds for risk-free bonds is 3.2% per annum. Assume that upon default the Italian bonds are expected to pay 60% of par value. What is the implied risk-neutral per-annum probability of default of the Italian sovereign bonds? On January 1" the spot price of oil is 110 per barrel and the futures price for delivery in three months is 108 per barrel. Each contract is for delivery of 10 barrels of oil. A manufacturing firm in Cork wants to hedge its purchase of 50 barrels of heating oil in three months time. The manufacturer hedges by going long 4 futures contract. On April 1" it closes its futures position and purchases heating oil in the spot market. The April 1" futures price is 112 per barrel and the spot price is 113 per barrel. What is the effective purchase price that the manufacturer pays for heating oil? The futures contract for copper is for delivery of 10 tons in three months' time. Today's closing futures price is 50 per ton and spot price is 55 per ton. The initial margin is 145 and the maintenance margin is 110 per contract. A copper trader goes short three contracts at today's closing price. What futures price tomorrow will give rise to a margin call on the trader's margin account? The spot exchange rate for US dollars is 0.85. The eighteen month interest rate for US dollar accounts is 4.2% per annum whereas the eighteen month interest rate of Euro-currency accounts is 6% per annum. What is the futures exchange rate for US dollars for delivery in eighteen months? A manufacturer plans to purchase 300,000 pounds of copper wire nine months from now, and would like to hedge this planned purchase using copper futures. The correlation between copper futures prices and copper wire prices is 0.85. The standard deviation of copper futures prices is 0.20 and the standard deviation of copper wire prices is 0.25. Each copper futures contract is for 1,000 pounds. What position should the manufacturer take in copper futures contracts to hedge its planned purchase of copper wire?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Value at Risk VaR Given the standard deviation of return 15 the portfolio market value 65 million and the 95 cumulative probability value for a stan...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started