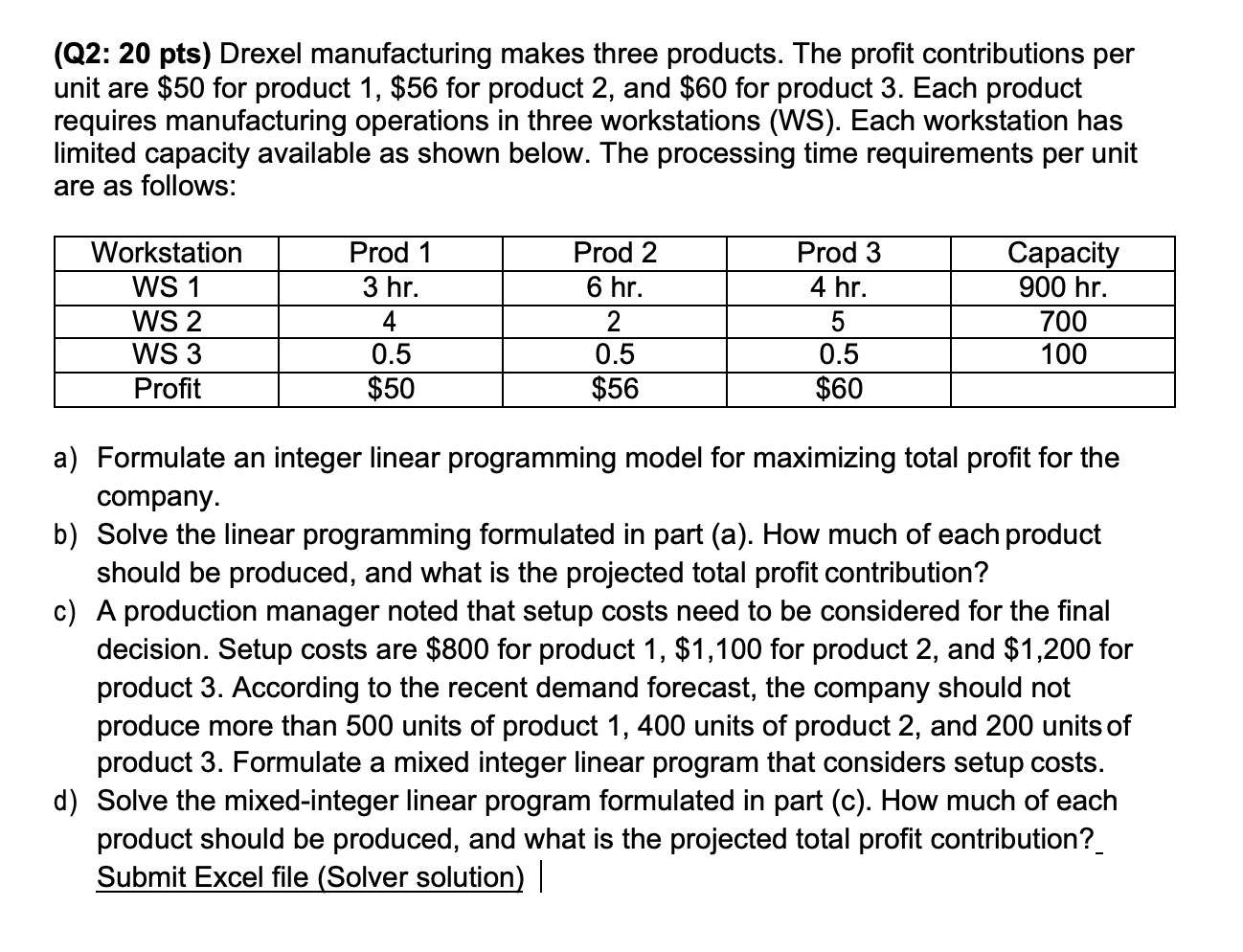

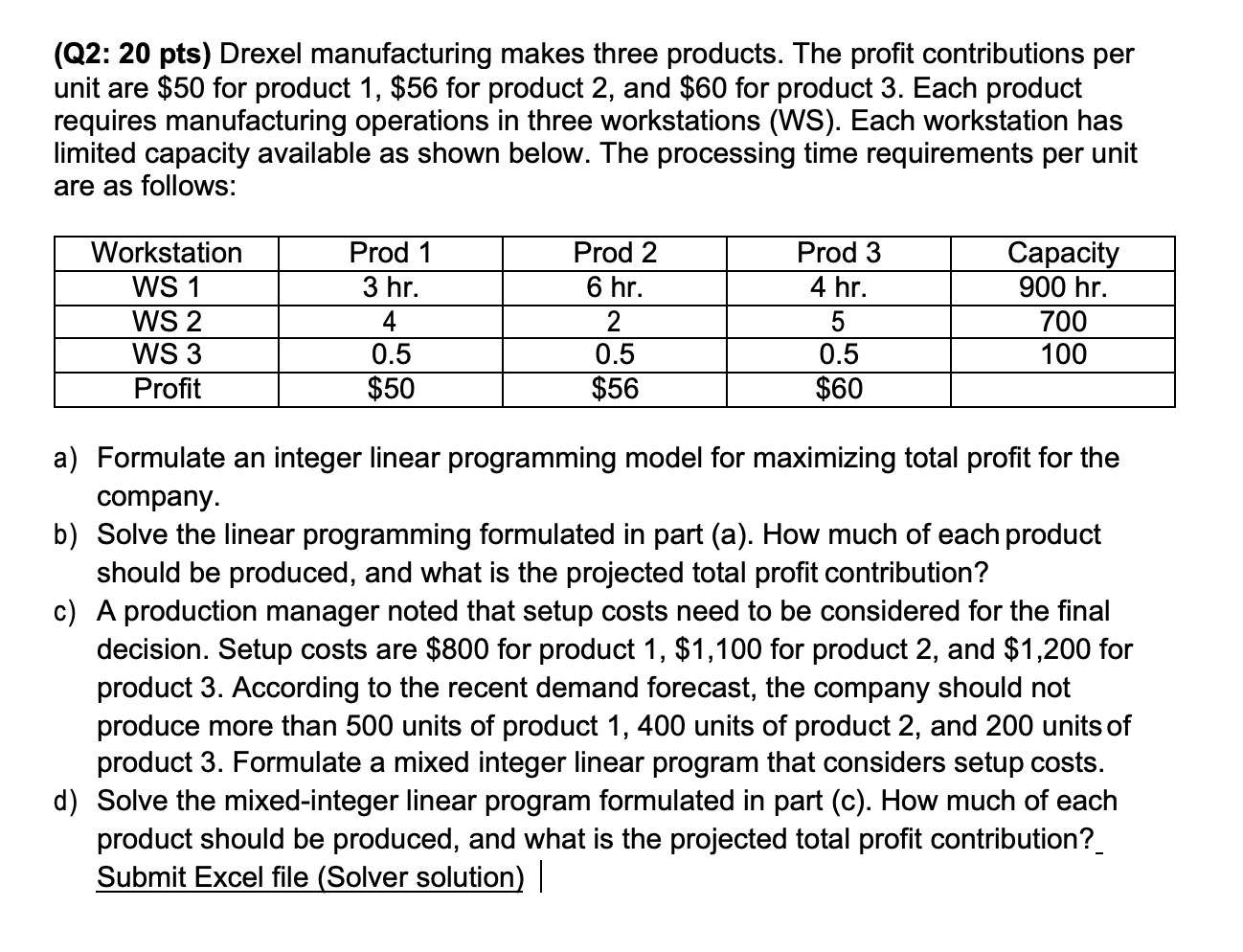

(Q2: 20 pts) Drexel manufacturing makes three products. The profit contributions per unit are $50 for product 1, $56 for product 2, and $60 for product 3. Each product requires manufacturing operations in three workstations (WS). Each workstation has limited capacity available as shown below. The processing time requirements per unit are as follows: Workstation WS 1 WS 2 WS 3 Profit Prod 1 3 hr. 4 0.5 $50 Prod 2 6 hr. 2 0.5 $56 Prod 3 4 hr. 5 0.5 $60 Capacity 900 hr. 700 100 a) Formulate an integer linear programming model for maximizing total profit for the company. b) Solve the linear programming formulated in part (a). How much of each product should be produced, and what is the projected total profit contribution? c) A production manager noted that setup costs need to be considered for the final decision. Setup costs are $800 for product 1, $1,100 for product 2, and $1,200 for product 3. According to the recent demand forecast, the company should not produce more than 500 units of product 1, 400 units of product 2, and 200 units of product 3. Formulate a mixed integer linear program that considers setup costs. d) Solve the mixed-integer linear program formulated in part (c). How much of each product should be produced, and what is the projected total profit contribution?. Submit Excel file (Solver solution) | (Q2: 20 pts) Drexel manufacturing makes three products. The profit contributions per unit are $50 for product 1, $56 for product 2, and $60 for product 3. Each product requires manufacturing operations in three workstations (WS). Each workstation has limited capacity available as shown below. The processing time requirements per unit are as follows: Workstation WS 1 WS 2 WS 3 Profit Prod 1 3 hr. 4 0.5 $50 Prod 2 6 hr. 2 0.5 $56 Prod 3 4 hr. 5 0.5 $60 Capacity 900 hr. 700 100 a) Formulate an integer linear programming model for maximizing total profit for the company. b) Solve the linear programming formulated in part (a). How much of each product should be produced, and what is the projected total profit contribution? c) A production manager noted that setup costs need to be considered for the final decision. Setup costs are $800 for product 1, $1,100 for product 2, and $1,200 for product 3. According to the recent demand forecast, the company should not produce more than 500 units of product 1, 400 units of product 2, and 200 units of product 3. Formulate a mixed integer linear program that considers setup costs. d) Solve the mixed-integer linear program formulated in part (c). How much of each product should be produced, and what is the projected total profit contribution?. Submit Excel file (Solver solution) |