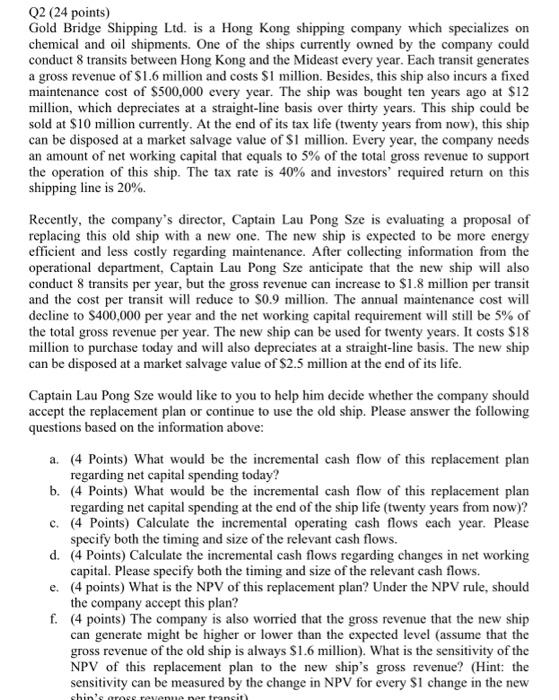

Q2 (24 points) Gold Bridge Shipping Ltd. is a Hong Kong shipping company which specializes on chemical and oil shipments. One of the ships currently owned by the company could conduct 8 transits between Hong Kong and the Mideast every year. Each transit generates a gross revenue of $1.6 million and costs $1 million. Besides, this ship also incurs a fixed maintenance cost of $500,000 every year. The ship was bought ten years ago at $12 million, which depreciates at a straight-line basis over thirty years. This ship could be sold at $10 million currently. At the end of its tax life (twenty years from now), this ship can be disposed at a market salvage value of $1 million. Every year, the company needs an amount of net working capital that equals to 5% of the total gross revenue to support the operation of this ship. The tax rate is 40% and investors' required return on this shipping line is 20%. Recently, the company's director, Captain Lau Pong Sze is evaluating a proposal of replacing this old ship with a new one. The new ship is expected to be more energy efficient and less costly regarding maintenance. After collecting information from the operational department, Captain Lau Pong Sze anticipate that the new ship will also conduct 8 transits per year, but the gross revenue can increase to $1.8 million per transit and the cost per transit will reduce to $0.9 million. The annual maintenance cost will decline to $400,000 per year and the networking capital requirement will still be 5% of the total gross revenue per year. The new ship can be used for twenty years. It costs $18 million to purchase today and will also depreciates at a straight-line basis. The new ship can be disposed at a market salvage value of $2.5 million at the end of its life. Captain Lau Pong Sze would like to you to help him decide whether the company should accept the replacement plan or continue to use the old ship. Please answer the following questions based on the information above: a. (4 Points) What would be the incremental cash flow of this replacement plan regarding net capital spending today? b. (4 Points) What would be the incremental cash flow of this replacement plan regarding net capital spending at the end of the ship life (twenty years from now)? c. (4 Points) Calculate the incremental operating cash flows each year. Please specify both the timing and size of the relevant cash flows. d. (4 Points) Calculate the incremental cash flows regarding changes in net working capital. Please specify both the timing and size of the relevant cash flows. e. (4 points) What is the NPV of this replacement plan? Under the NPV rule, should the company accept this plan? f. (4 points) The company is also worried that the gross revenue that the new ship can generate might be higher or lower than the expected level (assume that the gross revenue of the old ship is always $1.6 million). What is the sensitivity of the NPV of this replacement plan to the new ship's gross revenue? (Hint: the sensitivity can be measured by the change in NPV for every $1 change in the new shin'e rose rexene per transit Q2 (24 points) Gold Bridge Shipping Ltd. is a Hong Kong shipping company which specializes on chemical and oil shipments. One of the ships currently owned by the company could conduct 8 transits between Hong Kong and the Mideast every year. Each transit generates a gross revenue of $1.6 million and costs $1 million. Besides, this ship also incurs a fixed maintenance cost of $500,000 every year. The ship was bought ten years ago at $12 million, which depreciates at a straight-line basis over thirty years. This ship could be sold at $10 million currently. At the end of its tax life (twenty years from now), this ship can be disposed at a market salvage value of $1 million. Every year, the company needs an amount of net working capital that equals to 5% of the total gross revenue to support the operation of this ship. The tax rate is 40% and investors' required return on this shipping line is 20%. Recently, the company's director, Captain Lau Pong Sze is evaluating a proposal of replacing this old ship with a new one. The new ship is expected to be more energy efficient and less costly regarding maintenance. After collecting information from the operational department, Captain Lau Pong Sze anticipate that the new ship will also conduct 8 transits per year, but the gross revenue can increase to $1.8 million per transit and the cost per transit will reduce to $0.9 million. The annual maintenance cost will decline to $400,000 per year and the networking capital requirement will still be 5% of the total gross revenue per year. The new ship can be used for twenty years. It costs $18 million to purchase today and will also depreciates at a straight-line basis. The new ship can be disposed at a market salvage value of $2.5 million at the end of its life. Captain Lau Pong Sze would like to you to help him decide whether the company should accept the replacement plan or continue to use the old ship. Please answer the following questions based on the information above: a. (4 Points) What would be the incremental cash flow of this replacement plan regarding net capital spending today? b. (4 Points) What would be the incremental cash flow of this replacement plan regarding net capital spending at the end of the ship life (twenty years from now)? c. (4 Points) Calculate the incremental operating cash flows each year. Please specify both the timing and size of the relevant cash flows. d. (4 Points) Calculate the incremental cash flows regarding changes in net working capital. Please specify both the timing and size of the relevant cash flows. e. (4 points) What is the NPV of this replacement plan? Under the NPV rule, should the company accept this plan? f. (4 points) The company is also worried that the gross revenue that the new ship can generate might be higher or lower than the expected level (assume that the gross revenue of the old ship is always $1.6 million). What is the sensitivity of the NPV of this replacement plan to the new ship's gross revenue? (Hint: the sensitivity can be measured by the change in NPV for every $1 change in the new shin'e rose rexene per transit