Answered step by step

Verified Expert Solution

Question

1 Approved Answer

q2 (a) A fund manager is considering constructing a portfolio on the following companies: Americano Ltd 10,000 shares Capucino Ltd 15,000 shares Francesco Ltd 12,000

q2

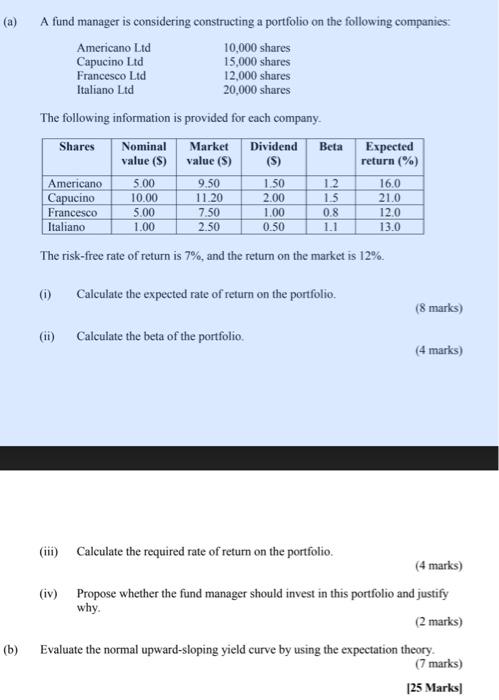

(a) A fund manager is considering constructing a portfolio on the following companies: Americano Ltd 10,000 shares Capucino Ltd 15,000 shares Francesco Ltd 12,000 shares Italiano Ltd 20,000 shares The following information is provided for each company. Shares Nominal Market Dividend Beta Expected value (S) value (5) (S) return (%) Americano 5.00 9.50 1.50 1.2 16.0 Capucino 10.00 11.20 2.00 1.5 21.0 Francesco 5.00 7.50 1.00 0.8 12.0 Italiano 1.00 2.50 0.50 11 13.0 The risk-free rate of return is 7%, and the return on the market is 12%. (1) Calculate the expected rate of return on the portfolio (8 marks) (ii) Calculate the beta of the portfolio (4 marks) (iii) Calculate the required rate of return on the portfolio. (4 marks) (iv) Propose whether the fund manager should invest in this portfolio and justify why. (2 marks) (b) Evaluate the normal upward-sloping yield curve by using the expectation theory (7 marks) [25 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started