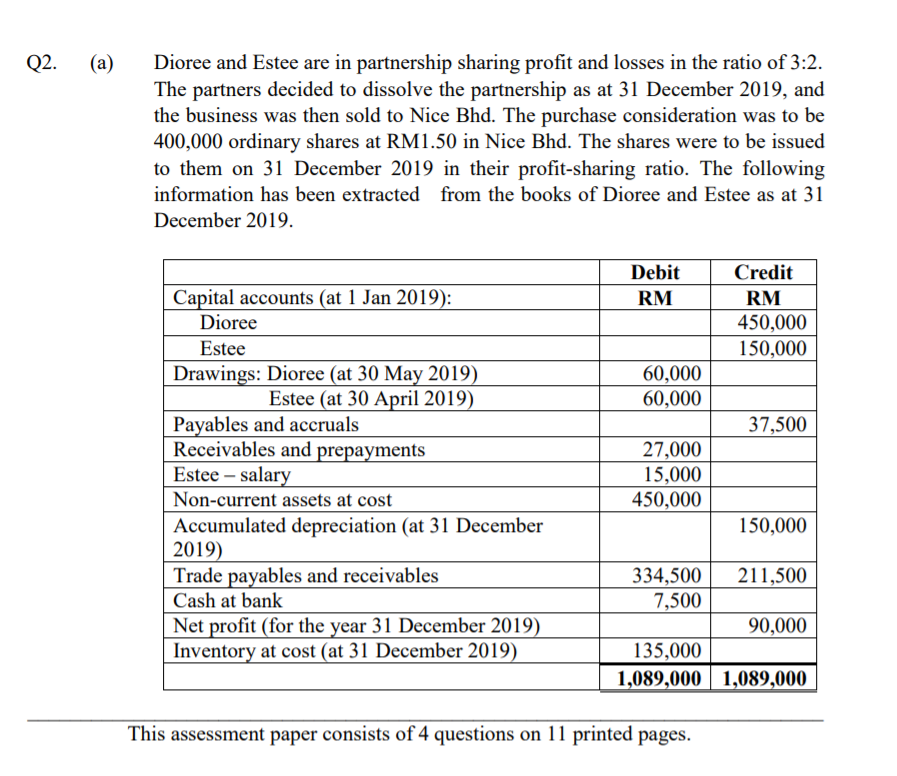

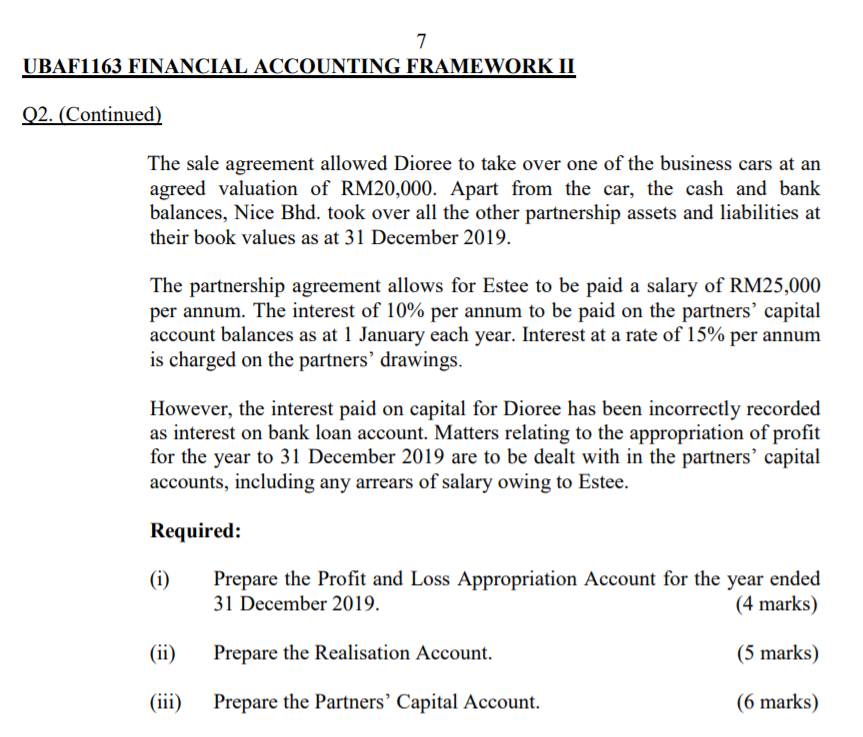

Q2. (a) Dioree and Estee are in partnership sharing profit and losses in the ratio of 3:2. The partners decided to dissolve the partnership as at 31 December 2019, and the business was then sold to Nice Bhd. The purchase consideration was to be 400,000 ordinary shares at RM1.50 in Nice Bhd. The shares were to be issued to them on 31 December 2019 in their profit-sharing ratio. The following information has been extracted from the books of Dioree and Estee as at 31 December 2019. Debit RM Credit RM 450,000 150,000 60,000 60,000 37,500 Capital accounts (at 1 Jan 2019): Dioree Estee Drawings: Dioree (at 30 May 2019) Estee (at 30 April 2019) Payables and accruals Receivables and prepayments Estee - salary Non-current assets at cost Accumulated depreciation (at 31 December 2019) Trade payables and receivables Cash at bank Net profit (for the year 31 December 2019) Inventory at cost (at 31 December 2019) 27,000 15,000 450,000 150,000 334,500 211,500 7,500 90,000 135,000 1,089,000 1,089,000 This assessment paper consists of 4 questions on 11 printed pages. 7 UBAF1163 FINANCIAL ACCOUNTING FRAMEWORK II Q2. (Continued) The sale agreement allowed Dioree to take over one of the business cars at an agreed valuation of RM20,000. Apart from the car, the cash and bank balances, Nice Bhd. took over all the other partnership assets and liabilities at their book values as at 31 December 2019. The partnership agreement allows for Estee to be paid a salary of RM25,000 per annum. The interest of 10% per annum to be paid on the partners' capital account balances as at 1 January each year. Interest at a rate of 15% per annum is charged on the partners drawings. However, the interest paid on capital for Dioree has been incorrectly recorded as interest on bank loan account. Matters relating to the appropriation of profit for the year to 31 December 2019 are to be dealt with in the partners' capital accounts, including any arrears of salary owing to Estee. Required: (i) Prepare the Profit and Loss Appropriation Account for the year ended 31 December 2019. (4 marks) (ii) Prepare the Realisation Account. (5 marks) (iii) Prepare the Partners' Capital Account. (6 marks)