Question

Q2. A Less-than-truckload (LTL) company purchases a truck for $45,000 on April 21, 2014. It estimates that this truck will have a useful life

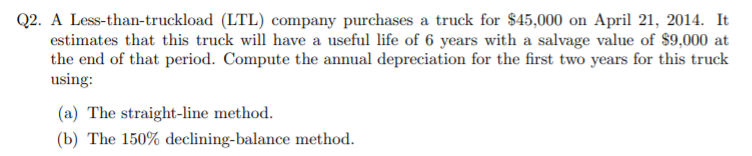

Q2. A Less-than-truckload (LTL) company purchases a truck for $45,000 on April 21, 2014. It estimates that this truck will have a useful life of 6 years with a salvage value of $9,000 at the end of that period. Compute the annual depreciation for the first two years for this truck using: (a) The straight-line method. (b) The 150% declining-balance method.

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Q2 a The straightline depreciation formula for an asset Annual Depreciation Expenses Cost of an Ass...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Management Accounting

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta

16th edition

978-0133058819, 9780133059748, 133058816, 133058786, 013305974X , 978-0133058789

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App