Answered step by step

Verified Expert Solution

Question

1 Approved Answer

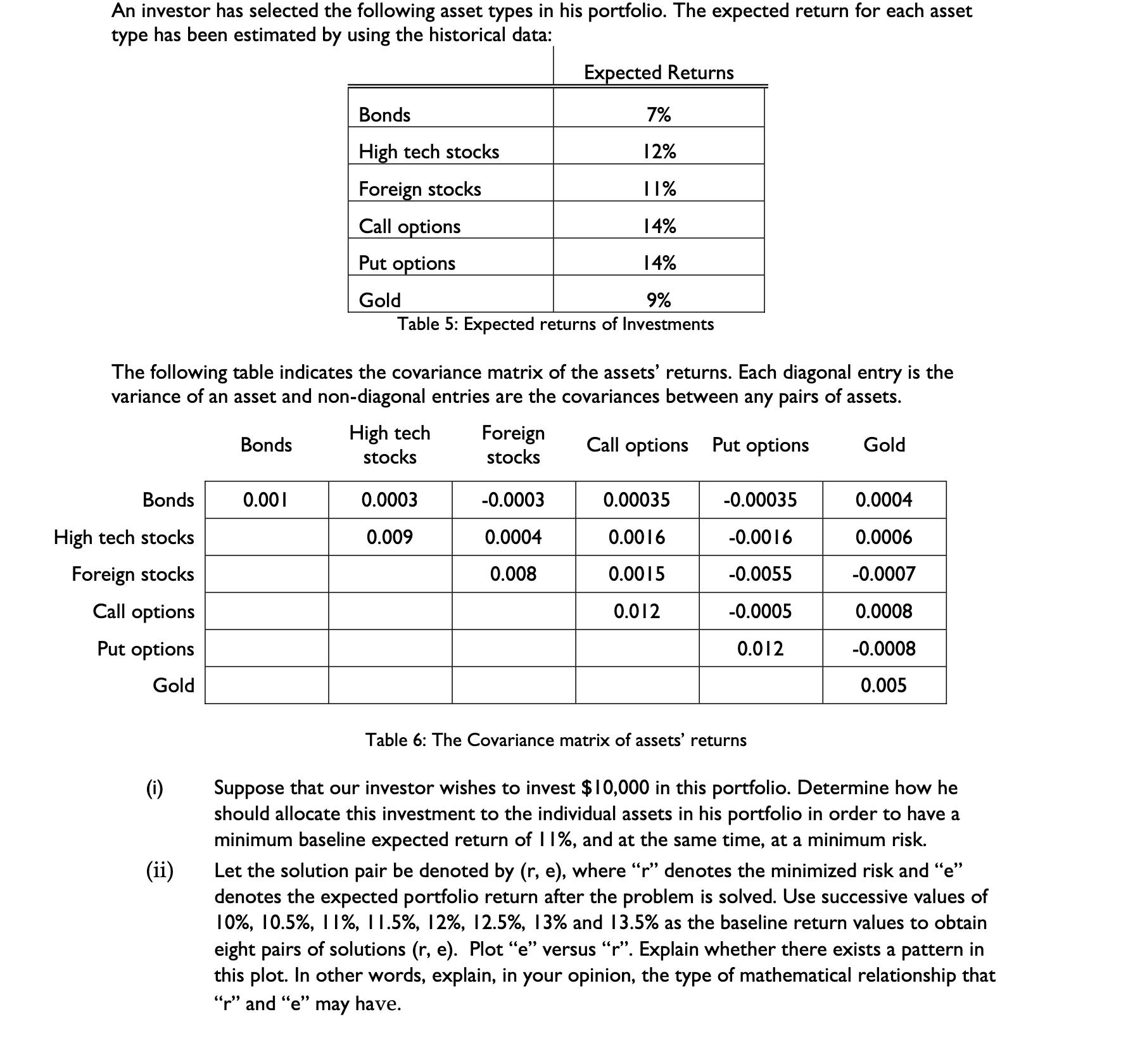

An investor has selected the following asset types in his portfolio. The expected return for each asset type has been estimated by using the

An investor has selected the following asset types in his portfolio. The expected return for each asset type has been estimated by using the historical data: Bonds High tech stocks Foreign stocks Call options Put options Gold (i) The following table indicates the covariance matrix of the assets' returns. Each diagonal entry is the variance of an asset and non-diagonal entries are the covariances between any pairs of assets. Call options Put options (ii) Bonds Bonds High tech stocks Foreign stocks Call options Put options Gold 0.001 7% 12% 11% 14% 14% 9% Table 5: Expected returns of Investments High tech stocks 0.0003 0.009 Expected Returns Foreign stocks -0.0003 0.0004 0.008 0.00035 0.0016 0.0015 0.012 -0.00035 -0.0016 -0.0055 -0.0005 0.012 Table 6: The Covariance matrix of assets' returns Gold 0.0004 0.0006 -0.0007 0.0008 -0.0008 0.005 Suppose that our investor wishes to invest $10,000 in this portfolio. Determine how he should allocate this investment the individual assets in his portfolio in order to have a minimum baseline expected return of 11%, and at the same time, at a minimum risk. Let the solution pair be denoted by (r, e), where "r" denotes the minimized risk and "e" denotes the expected portfolio return after the problem is solved. Use successive values of 10%, 10.5%, 11%, 11.5%, 12%, 12.5%, 13% and 13.5% as the baseline return values to obtain eight pairs of solutions (r, e). Plot "e" versus "r". Explain whether there exists a pattern in this plot. In other words, explain, in your opinion, the type of mathematical relationship that "r" and "e" may have.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Question The investment allocation to the individual assets in his portfolio to achieve a minimal baseline expected return of 11 while minimizing risk ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started