Answered step by step

Verified Expert Solution

Question

1 Approved Answer

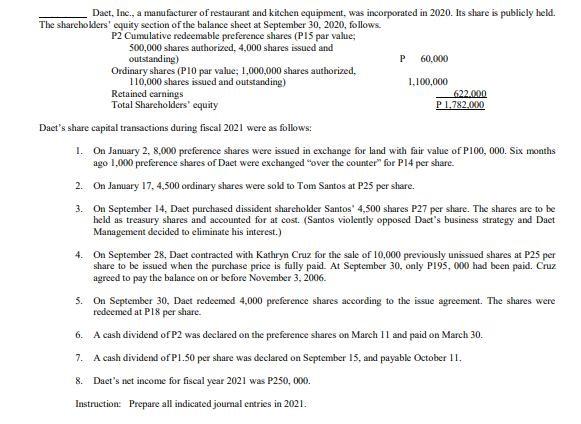

Dact, Inc., a manufacturer of restaurant and kitchen equipment, was incorporated in 2020. Its share is publicly held. The shareholders' equity section of the

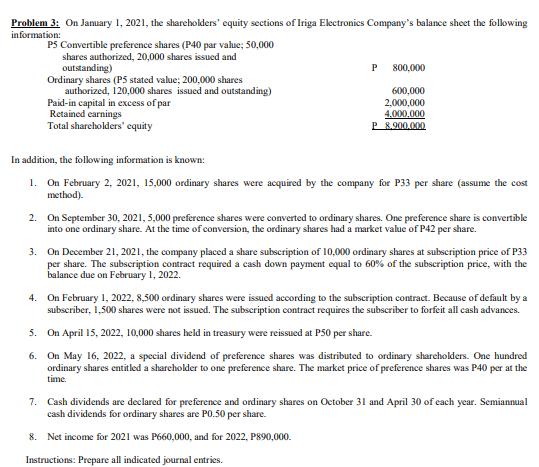

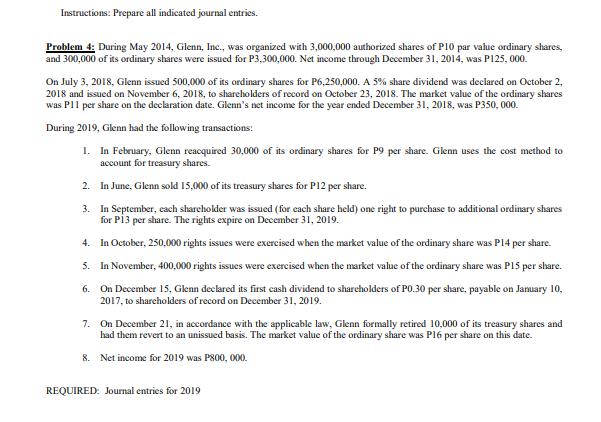

Dact, Inc., a manufacturer of restaurant and kitchen equipment, was incorporated in 2020. Its share is publicly held. The shareholders' equity section of the balance sheet at September 30, 2020, follows. P2 Cumulative redeemable preference shares (P15 par value; 500,000 shares authorized, 4,000 shares issued and outstanding) Ordinary shares (P10 par value; 1,000,000 shares authorized, 110,000 shares issued and outstanding) Retained earnings Total Shareholders' equity P 60,000 1,100,000 2. On January 17, 4,500 ordinary shares were sold to Tom Santos at P25 per share. 622.000 P1,782,000 Dact's share capital transactions during fiscal 2021 were as follows: 1. On January 2, 8,000 preference shares were issued in exchange for land with fair value of P100, 000. Six months ago 1,000 preference shares of Daet were exchanged "over the counter" for P14 per share. 3. On September 14, Daet purchased dissident shareholder Santos' 4,500 shares P27 per share. The shares are to be held as treasury shares and accounted for at cost. (Santos violently opposed Daet's business strategy and Dact Management decided to eliminate his interest.) 4. On September 28, Dact contracted with Kathryn Cruz for the sale of 10,000 previously unissued shares at P25 per share to be issued when the purchase price is fully paid. At September 30, only P195, 000 had been paid. Cruz agreed to pay the balance on or before November 3, 2006. 5. On September 30, Daet redeemed 4,000 preference shares according to the issue agreement. The shares were redeemed at P18 per share. 6. A cash dividend of P2 was declared on the preference shares on March 11 and paid on March 30. 7. A cash dividend of P1.50 per share was declared on September 15, and payable October 11. 8. Daet's net income for fiscal year 2021 was P250,000. Instruction: Prepare all indicated journal entries in 2021. Problem 3: On January 1, 2021, the shareholders' equity sections of Iriga Electronics Company's balance sheet the following information: PS Convertible preference shares (P40 par value; 50,000 shares authorized, 20,000 shares issued and outstanding) Ordinary shares (P5 stated value; 200,000 shares authorized, 120,000 shares issued and outstanding) Paid-in capital in excess of par Retained earnings Total shareholders' equity 800,000 600,000 2,000,000 4,000,000 P 8.900.000 P In addition, the following information is known: 1. On February 2, 2021, 15,000 ordinary shares were acquired by the company for P33 per share (assume the cost method). 2. On September 30, 2021, 5,000 preference shares were converted to ordinary shares. One preference share is convertible into one ordinary share. At the time of conversion, the ordinary shares had a market value of P42 per share. 3. On December 21, 2021, the company placed a share subscription of 10,000 ordinary shares at subscription price of P33 per share. The subscription contract required a cash down payment equal to 60% of the subscription price, with the balance due on February 1, 2022. 4. On February 1, 2022, 8,500 ordinary shares were issued according to the subscription contract. Because of default by a subscriber, 1,500 shares were not issued. The subscription contract requires the subscriber to forfeit all cash advances. 5. On April 15, 2022, 10,000 shares held in treasury were reissued at P50 per share. 6. On May 16, 2022, a special dividend of preference shares was distributed to ordinary shareholders. One hundred ordinary shares entitled a shareholder to one preference share. The market price of preference shares was P40 per at the time. 7. Cash dividends are declared for preference and ordinary shares on October 31 and April 30 of each year. Semiannual cash dividends for ordinary shares are P0.50 per share. 8. Net income for 2021 was P660,000, and for 2022, P890,000. Instructions: Prepare all indicated journal entries. Instructions: Prepare all indicated journal entries. Problem 4: During May 2014, Glenn, Inc., was organized with 3,000,000 authorized shares of P10 par value ordinary shares, and 300,000 of its ordinary shares were issued for P3,300,000. Net income through December 31, 2014, was P125,000. On July 3, 2018, Glenn issued 500,000 of its ordinary shares for P6,250,000. A 5% share dividend was declared on October 2, 2018 and issued on November 6, 2018, to shareholders of record on October 23, 2018. The market value of the ordinary shares was P11 per share on the declaration date. Glenn's net income for the year ended December 31, 2018, was P350,000. During 2019, Glenn had the following transactions: 1. In February, Glenn reacquired 30,000 of its ordinary shares for P9 per share. Glenn uses the cost method to account for treasury shares. 2. In June, Glenn sold 15,000 of its treasury shares for P12 per share. 3. In September, each shareholder was issued (for each share held) one right to purchase to additional ordinary shares for P13 per share. The rights expire on December 31, 2019. 4. In October, 250,000 rights issues were exercised when the market value of the ordinary share was P14 per share. 5. In November, 400,000 rights issues were exercised when the market value of the ordinary share was P15 per share. 6. On December 15, Glenn declared its first cash dividend to shareholders of P0.30 per share, payable on January 10, 2017, to shareholders of record on December 31, 2019. 7. On December 21, in accordance with the applicable law, Glenn formally retired 10,000 of its treasury shares and had them revert to an unissued basis. The market value of the ordinary share was P16 per share on this date. 8. Net income for 2019 was P800,000. REQUIRED: Journal entries for 2019

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

PROBLEM 2 Transaction 1 On February 2 2021 15000 ordinary shares were acquired by the company for P33 per share assume the cost method Date Account Debit Credit Feb 2 21 Treasury Shares P495000 Cash P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started